SI Research: Is HupSteel A Deep Value Stock In Play?

Market value of a stock is simply the price we see the shares transacting at. Intrinsic value, on the other hand, is usually hidden and harder to determine, and is what value investors out there are trying to find.

While complicated models to forecast intrinsic value are usually used by finance professionals, retail investors can turn to simpler methods, which help give a gauge of a stock’s value. Here, we revisit a concept known as conservative net asset value (CNAV), which values stocks by stripping out the most liquid assets (like cash) and assets most likely to hold their value (like properties and leasehold land).

Using the CNAV method, we identify steel products and services provider HupSteel and take a closer look to see if it is indeed an undervalued stock.

CNAV Calculation

With reference to HupSteel’s balance sheet based on the annual report for the financial year ended 30 June 2015 (FY15), we pull out the relevant figures. Taking a conservative approach, we strip out only cash and equivalents, investment properties, as well as leasehold land and buildings. Summing up the three items, we obtain a total conservative asset value of $164.9 million.

Next, we deduct total liabilities – almost negligible at $7.4 million – from the total conservative asset value to get CNAV of $157.5 million.

Subsequently, we divide the CNAV by total number of shares outstanding (adjusted for stock consolidation) to get CNAV per share of $1.28.

Source: Company FY15 Annual Report

Stacking it against the stock’s close price of $0.58 as at 23 August, HupSteel’s shares appear to be trading at a whopping 54.7 percent discount!

However, before we get too excited, let us take a deeper examination of the firm.

Falling Operating Performance And Dividends A Drag On Share Price?

The group derives the main bulk of its revenue from the steel products trading segment, providing products like steel pipes, fittings and other structural steel.

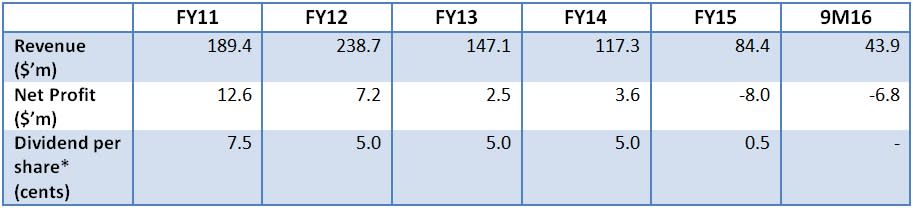

Looking at the past five years financial performance, it is clear that both top and bottom lines are in a downtrend. In particular, HupSteel sank into the red in FY15 and remained in losses in 9M16.

Source: Company Annual Reports, *: Adjusted for 1:5 stock consolidation that took place 5 Jan-16

The group attributed the poorer results to stiff competition in the industry and weaker demand for steel products. Notably, for the recent two full-year period, the company’s performance was also impacted by the drop in crude oil prices, given that more than 50 percent of revenue is derived from the marine and oil & gas industries (FY15: 63 percent, FY14: 69 percent).

Consequently, HupSteel cut its dividend per share in tandem with the weaker net profit recorded. In particular, dividend per share was slashed 90 percent in FY15 to $0.005 per share.

Tracing back, we see that the group’s share price was around $0.90 before it started to decline when it issued a profit warning for FY15 (fell 10.5 percent in the week following the announcement). Subsequently, share price continued to fall as the group posted dismal financial results in the first three quarters of FY16, further compounded by the stock rout at the start of 2016.

With the group seeing that the challenging business environment is likely to persist, it is unlikely for us to see a positive catalyst from earnings performance.

Other Metrics To Consider When Using CNAV

Generally, when using CNAV to identify undervalued stocks, there are three other criterions to look out for, namely profitability, operational efficiency and balance sheet strength.

For profitability, it is pretty direct and we look at earnings of the company. With falling revenue and the fact that the group is in the red, HupSteel clearly fails this criterion.

Next, for operational efficiency, we mainly look at the cash flows of the company, and want to see that it is able to generate positive operating cash flows (or positive free cash flows to be even more conservative). Despite generating losses in FY15, HupSteel was still able to register positive operating cash flow for the period. In fact, operating cash flow and free cash flow was positive in four of past five financial years from FY11 to FY15.

Lastly, we focus on balance sheet strength and we generally look at gearing level and check that the company is not taking on too much debt. HupSteel fares highly in this respect, given that its total liabilities stood at only $4.6 million as of 31 March (debt is almost negligible), dwarfed by cash and equivalents amounting to $54.4 million.

SI Research Takeaway

Overall, with a market capitalisation of just $71.5 million as of 23 August, HupSteel is a small cap that could be easily overlooked by any investors especially with its lacklustre operational performance in recent years.

While we are skeptical on whether the group can execute a successful business turnaround plan, we do find value deeply entrenched in the stock. The spread between the CNAV of $1.28 and the share price of $0.58 serves as a huge buffer even if we were to discount the CNAV value aggressively.

In conclusion, HupSteel presents an interesting case of deep value play for investors. That said, as with other value stocks, there is no guarantee that the intrinsic value of HupSteel will be unlocked given the lack of a catalyst. Additionally, we note that the firm is a family-owned business with the founding Lim family holding more than 50 percent stake in the firm, with no signs that they are looking to unlock the group’s value for shareholders.

Yahoo Finance

Yahoo Finance