SI Research: Hi-P International – Capitalising On A Global Tech Boom

Throughout much of this year, the manufacturing sector was a major growth driver for Singapore’s economy. According to the latest data from the Economic Development Board, manufacturing output rose for the tenth straight month in May, though growth was markedly slower at only five percent.

Albeit the low growth numbers registered by the manufacturing sector as a whole, electronics manufacturing singlehandedly lifted the overall statistic by growing 35.1 percent since May last year, primarily driven by a 48.3 percent growth in production of semiconductors. Cumulatively, the electronics cluster chalked up a double-digit growth of 36.9 percent from January to May 2017.

Despite the staggering growth rates of electronics manufacturing output in Singapore, valuations of such local-listed companies are still somewhat undemanding and also lagging behind the US Tech sector. As such, we take a look at local-listed Hi-P International (Hi-P), which offers the potential to capitalise on the global tech boom.

The Business

Hi-P is a leading contract manufacturer listed on the Mainboard of the Singapore Exchange. The company provides vertically-integrated electronics manufacturing services that embraces the entire value chain from product development and component manufacturing to product assembly and surface finishing. In a brief, Hi-P helps to manufacture the wireless components, computer peripherals and consumer electronics for its customers.

The company operates 14 manufacturing plants strategically located in Singapore, China, Poland and Thailand while its marketing and engineering centers are situated in China, Taiwan, US and Singapore.

Improving Profitability And Financial Strength

(Source: Shares Investment)

For the past five financial years from FY12 to FY16, Hi-P’s top line and bottom line generally trended upwards. The company fell into a massive net loss of $45.4 million in FY15 as its Russian client, Yota Devices, failed to take delivery and make payment for finished goods that Hi-P had produced. Nonetheless, the company has since moved on and performance has recovered.

In its latest 1Q17 financial results, Hi-P generated revenue of $244.2 million, a decline of 11.4 percent compared to a year ago. Despite that, the company rebounded from a net loss of $12.4 million in 1Q16 to a net profit of $8.4 million.

The improvement in profitability, albeit a fall in revenue, came on the back of operational and manufacturing refinement which gave rise to better product mix and lower inventory provision and scrap expenses. Ultimately, the improved efficiencies helped boost gross profit margin by 7.6 percentage points to 13.7 percent.

The company’s financial health has also improved as it continued to pare down on its debt. For Hi-P, total debt peaked in 3Q15 at $352.7 million but has since dropped to $68 million in 1Q17. Meanwhile, during the same period, cash assets grew from $86.2 million to $180 million, more than enough for Hi-P to cover its debt obligations and giving it a net cash position of $112 million.

Consequent to the strengthened balance sheet, total debt-to-equity has fallen from 36.2 percent to just 10.5 percent, giving the company ample financial headroom to take on more debt for capitalising on any growth opportunities.

Ramp Up In New Tech Product Launches

Tech geeks will be seeing a plethora of exciting tech products releases such as Apple’s highly anticipated iPhone 8, Google’s Pixel 2 and China’s Xiaomi Mi 6 in 2H17. This should give electronic manufacturing a boost in the short-term. Apart from smartphones, other smart devices that seek to extend connectivity to everything else (Internet of Things) are also highly demanded and this trend will lead to new partnerships between electronic manufacturers and tech companies for product development.

According to “Worldwide Electronics Manufacturing Services Market 2016”, total electronics assembly value is expected to grow from US$1.3 trillion to US$1.6 trillion by 2020 while electronic manufacturing services itself will grow from a market value of US$430 billion to US$580 billion, over the same period.

In addition, we also see that big tech firms are starting to encroach into one another’s turf in their bid to expand revenue streams. Over the long-term, keener competition amongst the big-tech firms will increase demand for electronic manufacturing services. Given the strong industry tailwind, Hi-P should see higher utilisation of its production capacity and hence investors should keep watch of Hi-P’s earnings momentum going forward.

Undemanding Valuation

Since the beginning of the year, shares of Hi-P have rallied from $0.52 per share to $0.91 per share as at 3 July 2017. Despite the 75-percent upside registered, the gain may not be over-extended since the shares only rebounded when the company turned around in 1H16. The current valuation also does not appear expensive.

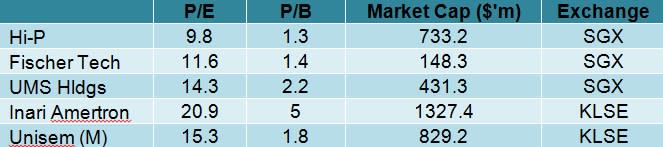

At the current share price, Hi-P is changing hands at a price-to-earnings (P/E) of 9.8 times and price-to-book (P/B) of 1.3 times. How does Hi-P weigh against some of its local and regional listed peers?

Comparatively, we observe that local-listed electronic manufacturers generally trail those listed in the region, whether in terms of P/E or P/B. For Hi-P, its current trading multiples also appear the lowest amongst the selected peers.

In conclusion, we opine that shares of Hi-P have most room to run when there is expansion in electronics manufacturing. Furthermore, given that it is trading at the lowest multiples amongst the peers, investors will also have some margin of safety.

(As at 03 July 2017)

Yahoo Finance

Yahoo Finance