SI Research: Is Frasers Centrepoint Trust Still Attractive?

S-REITs, in general, has so far made a strong showing which came on the back of growing investor interest that arose from the uncertain outlook of US-China trade war. As we re-enter the phase of escalating tensions and rising tariffs, investors may once again look to S-REITs in hunt for higher yields and stability.

Frasers Centrepoint Trust (FCT) has been one of the better performing real estate investment trusts (REIT) in the local sphere of S-REITs since the start of the year. Excluding distributions, the REIT has already posted a return of 13.4 percent, as its unit price rose from $2.17 from the beginning of the year to $2.46 as at the end of May. Can FCT sustain its performance going into 2H19? How attractive is FCT given its already impressive unit price performance this year?

A Unique Proposition

FCT offers a unique portfolio amongst other local retail REITs the likes of Mapletree Commercial Trust, Starhill Global REIT and CapitaLand Mall Trust. FCT does not own properties in “prime” areas in Singapore but is instead solely focused on operating malls situated in the residential heartlands.

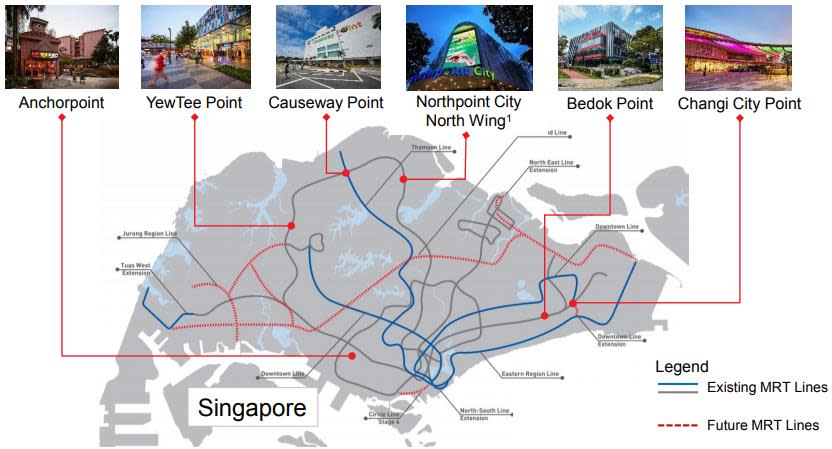

Currently, the REIT owns six suburban malls in its portfolio: Causeway Point, Northpoint City North Wing, Changi City Point, Bedok Point, Yew Tee Point and Anchorpoint. As these malls are located in the residential heartlands, both consumers and retail investors should be highly familiar to them.

With downside risks tending to tilt towards the upscale retail segment, FCT’s malls are more resilient given that residential heartlands have much smaller retail mall floor space per capita compared to prime areas. As a result of this strategy, FCT’s malls virtually face little to no competition in their proximity all while having the upside of strong residential catchment.

FCT Portfolio: Good Connectivity To Public Transport

Source: FCT’s 2Q19 Presentation

Impeccable Track Record

A look at FCT’s distribution history and investors should be convinced of the REIT’s quality. Since its listing in 2006, FCT has never failed to raise distributions. Over the years, distribution per unit (DPU) has risen from 6.55 Singapore cents in FY07 to 12.015 Singapore cents in FY18. The annual DPU represented a compound annual growth rate of 5.7 percent over a period of eleven years.

The track record of growing DPU continued into the current financial year. In the latest 1H19, FCT declared DPU of 6.157 Singapore cents compared to 6.10 Singapore cents in 1H18.

Growth was mainly achieved from positive rental reversions. Over the first six months, the REIT saw an average increase of 5.4 percent in rentals from renewal and replacement leases over expiring leases. Correspondingly, this led to a 3.6-percent increase in its net property income to $71.8 million in 1H19.

Boosting Growth

Backing FCT is its strong sponsor Frasers Property, which itself is one of the largest property conglomerates in Southeast Asia and also listed on the Singapore Exchange. To sustain FCT’s strong track record for growth, the quality sponsor has periodically injected assets into the REIT’s portfolio.

Following its 1H19 earnings announcement, FCT recently announced that it would acquire a 33.3-percent stake in Waterway Point from its Sponsor in a $440.6 million deal. Situated right next to the Punggol MRT station, Waterway Point is the only full-fledged mall in the Punggol housing estate.

With a net lettable area of 371,200 square feet, the mall has a committed occupancy of 98.1 percent as at 31 March 2019. The acquisition is expected to be DPU-accretive, with an entry yield of 4.7 percent on a 100 percent basis of the agreed property value of $1.3 billion.

Keeping Gearing In Check

To fund the purchase, FCT has commenced its equity fundraising, with aggregate gross proceeds expected to be no more than $437.4 million. This will come in the form of a private placement and a preferential offering.

As at the time of writing, the private placement had just been completed. Of the $369.6 million in gross proceeds, $188.7 million was used to pare down the bridging loans taken up in connection to the acquisition of interest in PGIM Real Estate AsiaRetail Fund in February and March. The remaining proceeds will be raised via the preferential offering which had just been launched.

Post-acquisition of Waterway Point’s stake, FCT’s total debt is forecasted to hit $1.2 billion. This includes the pro rata share of bank loan amounting to $191 million. Taking that into consideration, FCT projects that the REIT’s gearing will be about 33 percent following the acquisition. At this level, well below the gearing threshold of 45 percent, FCT still maintains about $400 million of debt headroom for future deals. A potential acquisition target in the pipeline from its sponsor is Northpoint City South Wing.

High Portfolio Occupancy

Source: FCT’s 2Q19 Presentation

Frothy Valuation

The pro forma effects on FCT’s net asset value (NAV) per unit would not be significant. Post-acquisition, NAV per unit is expected to be maintained at around $2.10 per unit. Based on the current unit price of $2.46, FCT is changing hands at about a 17-percent premium to its book value.

Meanwhile, we try to come up with an indicative DPU to see what yield investors would be getting at the current unit price. Based on 1H19 DPU of 6.157 Singapore cents, we assume the ballpark figure for the annualised FY19-DPU to be around 12.3 Singapore cents. This would translate to an indicative yield of just about 5 percent.

Peer Comparison

Taking a look at other local retail REITs, we found that most – with the exception of Starhill Global REIT – are trading at a premium to their respective book value just like FCT. Meanwhile, FCT’s yield is also comparable to its peers. This led us to believe that the impressive unit price performance was not limited to FCT but to the basket of local retail REITs.

Conclusion

While we really like FCT’s unique investment proposition, the current pricey valuation and low yield make the REIT much less appealing.

As the broader market is declining to lower levels, a correction for the unattractive valuation amongst local retail S-REITs could be due. Meanwhile, other subsectors such as in the industrial and office space may have more downside protection given that they are seeing strengthening fundamentals. The hospitality subsector is also bottoming-out, making it a more favourable place to look at for yield-hungry investors.

Yahoo Finance

Yahoo Finance