SI Research: Far East Hospitality Trust – Priced For Safety

The first quarter of 2019 has been kind to investors. At its highest, the local benchmark Straits Times Index returned a positive 7 percent, from the beginning of the year to late February. However, as March draws to an end, the broader market started to sell-off once again and we see a higher probability of downward pressure going into 2Q19.

Led by declines in the US, the latest sell-off was sparked off when the Federal Reserve paused interest rate hikes for the rest of 2019. Instead of cheering to the news, US investors fear that the Fed’s dovish turn was a result of an impending slowdown in the US economy. As US investors piled on US treasuries, the yield curve finally inverted for the first time since the last crisis of 2007, on 22 March 2019.

Historically, the yield curve has been a valuable tool for indicating recessions. Though it is neither definitive nor causal, it does signal weakness in investors’ confidence which, compounded with an already slowing global economy, could lead to an eventual self-fulfilling prophecy.

On the local front, with the first quarter earnings season rounding up, released results felt lacking in quality as a whole. Meanwhile, a benign interest rate environment has benefited the REIT sector which has outperformed the STI in 1Q19. However, latest quarter earnings on the whole were boosted by one-off divestment gains in the sector. That said, going into 2Q19, heightened volatility would continue to push investors into S-REITs due to consistent cashflow from distributions.

That said, after a good run for S-REITs in 1Q19, we expect the focus to return to value and investors would rotate into more attractively-priced counters. Under the current circumstances, we see Far East Hospitality Trust (FEHT) as a quality trust that may fit the criteria.

About FEHT

FEHT is pure-play Singapore hospitality trust comprising 13 mid-to-upscale hotels and serviced residences. The entire portfolio boasts of a valuation of $2.6 billion as at FY18.

Unique to FEHT, the trust holds some of Singapore’s more iconic hospitality assets such as Rendezvous Hotel at Bugis, Village Hotel Albert Court, and Orchard Rendezvous Hotel located along the pristine shopping district of Orchard Road. Newer additions include Oasia Hotel Downtown at Tanjong Pagar and Oasia Hotel Novena. FEHT also owns a 30-percent stake in the upcoming joint three-hotel development in Sentosa: Village Hotel Sentosa, The Outpost Hotel and The Barracks Hotel.

Under its serviced residences portfolio, FEHT has four serviced residence assets namely, Village Residence Clarke Quay, Village Residence Hougang, Village Residence Robertson Quay and Regency House. By segments, serviced residences accounted for 19.4 percent of revenue while the hotel portfolio accounted for the remaining 80.6 percent in FY18.

Improving Fundamentals

Share price of FEHT has been under pressure for a protracted period from 2015 to 2018. In 2018, a moderation in expectations of Singapore’s hospitality market led to a correction of FEHT, putting another speed bump to its patchy recovery. In addition, the cut in the minimum rental period for private homes from six to three months in mid-2017 has continued to be an overhang for FEHT service residences portfolio.

However, looking at FEHT’s latest results, we see evidence of improving fundamentals that indicate that recovery is intact nonetheless. For FY18, FEHT recorded gross revenue of $113.7 million and net property income of $102.8 million, representing growth of 9.5 percent and 10.3 percent respectively. The increase was driven by higher master lease rental owing to the uptick in demand, as well as the addition of Oasia Hotel Downtown in 2Q18.

Breaking down the segmental results, FEHT’s hotel portfolio saw improvement in occupancy of 1.5 percentage points to 89.1 percent while average daily rate increased 4.4 percent to $162 in FY18. Consequently, revenue per available room (RevPAR) jumped 6.2 percent to $144 compared to FY17. On a quarterly basis, 4Q18 RevPAR rose even faster by 7.5 percent to $142 compared to a year ago. Overall, the hotel portfolio generated revenue of $91.6 million, an increase of about 12.9 percent.

On its serviced residences segment, revenue of $22 million represented a marginal decrease of 2.7 percent in FY18. However, slight improvements can be seen as RevPAR showed a marginal increase of 0.9 percent to $177, driven by improvement in occupancy by 4.1 percentage points to 84.1 percent, in spite of a four percent decrease in average daily rate to $210. The latest quarter of 4Q18 also showed a more optimistic picture as occupancy rose 6.1 percentage points to 84.3 percent while average daily rate showed a marginal decline of 0.4 percent to $212. As a result, RevPAR in the serviced residences segment actually jumped 7.5 percent to $179 in 4Q18 as compared to last year.

Overall, total return jumped from $14.3 million in FY17 to $90.7 million in

FY18 mainly due to fair value changes in investment properties. Net income before tax and fair value changes was $61.4 million, representing a 1.6 percent increase.

Growth To Shift Up A Notch

As FEHT completed major asset enhancements on its assets in the past two years, there should not be any significant capital expenditure going into FY19. At the same time, with major renovations and rebranding efforts already completed, the post-enhanced assets would boost contributions to underpin growth for FEHT.

In addition to that, the joint hotel development with its sponsor in Sentosa is slated to begin operations in April 2019, coinciding with FEHT’s second quarter. Based on preliminary searches on its hotel booking sites, staying at the Sentosa hotels would cost around $230 to $250 per night. Compared to higher-priced accommodation options in Sentosa, the properties would fill the less fulfilled midscale segment, giving travellers good value for their money.

The ramp-up of operations at Sentosa would start to meaningfully impact FEHT’s bottom line from FY19 onwards. As the properties scale up, FEHT also has the Rights of First Refusal to acquire more stakes in the Sentosa properties in the pipeline in the medium term.

However, FEHT ended FY18 with aggregate leverage of 40.1 percent to assets, following the debt-funded acquisition of Oasia Hotel Downtown. With its stretched balance sheet, FEHT does not have significant debt headroom to take on larger acquisitions for now.

Priced For Safety

Source: Shares Investment

Another indication of better prospect, FEHT has raised 4Q18 distribution per unit (DPU) by 3.1 percent to 1.00 Singapore cents. This represented an improvement in DPU for the fourth consecutive quarter, bringing FY18 DPU to 4.00 Singapore cents, supporting our belief that FEHT would see higher contributions from its hotel portfolio and a potential recovery for its serviced residences.

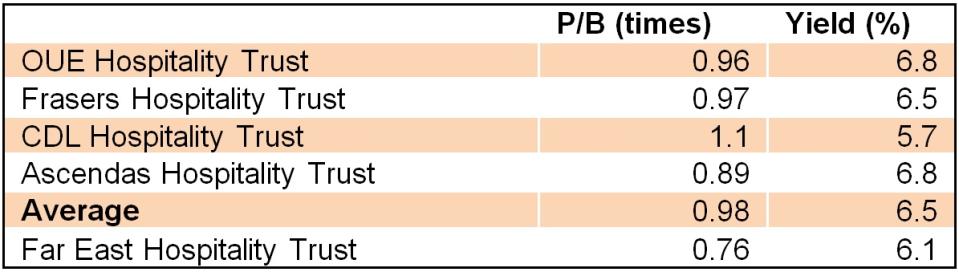

However, while assets under management (AUM) grew 10.6 percent to $2.6 billion, FEHT’s share price has yet to catch up, leading to significantly cheaper valuation relative to its peers.

At the current price of $0.67 per unit, FEHT is trading at a price-to-book value (P/B) of just 0.76 times while offering a distribution yield of 6.1 percent. Comparatively, other local-listed peers are all trading at higher P/B multiples despite their yields not being meaningfully more attractive. At a discount of 24 percent to book value, we also like FEHT as it provides ample margin of safety.

Yahoo Finance

Yahoo Finance