SI Research: Courts Asia – A Bargain Opportunity?

Courts Asia (Courts), is a leading electrical, consumer electronics and furniture retailer in Southeast Asia. Having established a strong brand name in Singapore, the group has also expanded across the causeway and entered into the Indonesian market in 2014.

After adding seven new stores in Malaysia and three new stores in Indonesia over the past year, Courts now operates over 90 stores across three markets, spanning over 1.7 million square feet of retail space.

Since our previous coverage in June 2016, Courts’ shares have advanced $0.075, or approximately 20.8 percent, to $0.435 as at 3 July 2017. At the current price, Courts’ shares are changing hands approximately 43.5 percent below its initial public offering price of $0.77.

With FY17 net profit surging 247.6 percent, could there be more upside potential for Courts this year?

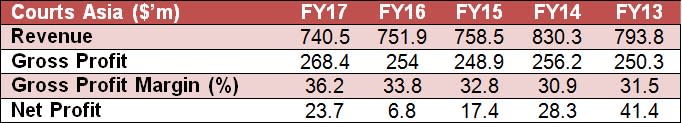

Financial Performance

(Source: Shares Investment)

Courts’ financial performance would not impress many at first glance as the group’s most recent financial results for FY17 pales in comparison to that of FY13. Notwithstanding that Courts had adopted a new FRS 115 accounting standard, which resulted in a restatement of FY16 results, FY17 registered the lowest revenue of the five financial years while net profit was over 40 percent below that of FY13.

However, it is notable that the group’s gross profit margin has been on an upward trend, improving by 2.4 percentage points to 36.2 percent over the past year, also marking the highest point in five years. The higher gross profit margin was a result of the group focus on driving cost and margin management, which led to higher earned service charge income and higher merchandise margins.

More New Households In Singapore

Earlier this year, the government announced an increase in housing grants for young couples buying a resale Housing and Development Board flat for the first time. The move, which helps to keep Singapore a great place for families, could encourage earlier creation of new households as resale transactions can be completed within three to four months as opposed to the more common Build-to-Order route which requires several years.

As Court’s operations in Singapore contributes over 65 percent of total revenue, the latest development can be viewed positively for the group as more households would lead to increased demand for the retailer.

Although Courts faces strong competition from other one-stop retailers such as Best Denki and Harvey Norman, as well as countless smaller sized retailers, we believe that Courts holds an advantage due to its megastores which provide a superior variety of products as well as a greater convenience of one-stop shopping.

Still A Potential Privatisation Play

Previously, we identified Courts as a potential privatisation candidate due to the group’s low float, a single shareholder with a significantly large ownership as well as the active share buyback mandate.

Courts’ current float of 20.7 percent is down by two percent from a year ago, while the largest shareholder, Singapore Retail Group’s (SRG) percentage of shareholdings has increased by 0.9 percent to 74.4 percent.

Under the group’s latest share buyback mandate, which was renewed on 27 July 2016, Courts has since bought back a total of 3.6 million shares or 0.7 percent of the total outstanding shares. As compared to the total percentage of 3.9 percent bought back under the previous share buyback mandate, the current level falls far behind. However, it is notable that Courts’ share buyback volume last year picked up strongly after the release of its FY16 results.

Assuming that the share buyback mandate reaches the maximum limit, with room for another 9.3 percent or approximately 48.1 million shares, the percentage holdings of SRG could potentially increase to approximately 82 percent, making it easier for a privatisation bid.

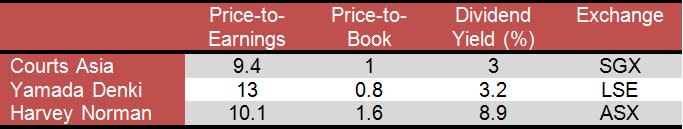

Peer Comparisons

(As at 3 July 2017)

Amongst the three companies, Courts is currently valued at the lowest price-to-earnings (P/E) ratio of 9.4 times, slightly below that of Australian-based Harvey Norman, while almost 30 percent lower than Yamada Denki, the parent company of Best Denki.

In terms of price-to-book (P/B) value, Courts remains at the middle level while Harvey Norman’s P/B is double that of Yamada Denki.

However, Courts’ dividend yield is the lowest at three percent, almost a third of Harvey Norman, partly due to the Australian-based retailer’s shares plunging over the past six months driving up dividend yields.

Given Courts’ current valuations against the two foreign competitors, which also operate businesses in Singapore and the region, we believe that Courts’ current share price present an attractive opportunity for more share buybacks which could in turn make it easier for the largest shareholder to make a buyout offer.

Yahoo Finance

Yahoo Finance