SI Research: COSCO Shipping International – Transforming For The Future

Although technological advancement has affected many businesses over the past decade leading to the rise and fall of many companies, the business of moving large amounts of goods from one location to another has remained relatively unchanged.

Despite the availability of air freight, over 90 percent of world trade continues to be carried by sea due to the lower freight costs. While the shipping industry is a resilient one, it is in itself a highly competitive industry. With over 50,000 merchant ships trading internationally, shipping companies are often embroiled in price wars and they fight for a greater market share.

The performance of COSCO Shipping International (Singapore)’s (COSCO) share price over the past few years have not been too impressive. On an overall downward trend for the past five years, the group’s shares are currently trading at $0.365 per share, down by about 37 percent from its 52-week high.

The Business

COSCO is a subsidiary of a Chinese state-owned shipping and logistics services supplier company, China Ocean Shipping (Group) Company, one of the largest shipping companies in the world.

Originally engaged in the business of dry bulk shipping, ship repair and marine engineering, the group’s vision is to become a leading integrated logistics management service provider in Southeast Asia. As part of the group’s plan to expand its logistics network, COSCO completed the acquisition of Cogent Holdings (Cogent) for $490 million in March 2018.

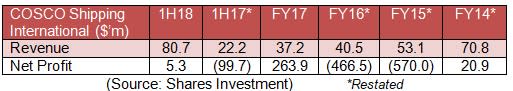

Improved Financial Performance

COSCO suffered massive losses amounting to over a billion dollars in FY15 and FY16. The losses were mainly due to the depressed state of crude oil prices which resulted in an adverse impact on the global offshore marine industry. In addition, the slump in the shipbuilding market negatively impacted the group’s shipyards, while the aggressive price war in the shipping industry placed significant pressures to the group’s dry bulk fleet operations.

The worst is likely over for COSCO following the disposal of its loss-making shipyard business. Having disposed of 51 percent equity interest in COSCO Shipyard Group, 50 percent equity interest in COSCO (Nantong) Shipyard and 39.1 percent equity interest in COSCO (Dalian) Shipyard the group’s funds received a much needed boost of Rmb1.4 billion.

For 1H18, the improved performance was largely due to the newly acquired logistics businesses, which contributed revenue of $64.4 million. Meanwhile, the group managed to turnaround with a net profit of $5.3 million in the absence of loss from discontinued operations amounting to $157.3 million in 1H17.

Going forward, it is likely that Cogent would be the key growth catalyst as the group’s fleet has been reduced to three bulk carriers with a total tonnage of 163,000 tons.

Cogent Holdings

With a broad based clientele, ranging from local small and medium-sized enterprises to multinational companies, Cogent operated through four main business segments – warehousing and property management services (WPM), automotive logistic management services (ALM), transportation management services and container depot management services.

Cogent owns one of Singapore’s largest one-stop integrated centres and the world’s first and only rooftop container depot, Cogent One-Stop Logistics Hub (C1.LH). C1.LH is a patented design that allows for the consolidation of warehousing and container depot management in a single location, maximising the use of land space while providing cost savings.

The patent for C1.LH innovative design in countries including but not limited to the United States, Europe, China, Hong Kong, Japan and Singapore, provides opportunities for strategic expansion overseas.

Avoiding Turbulent Waters

We view COSCO’s move towards building its Southeast Asia logistics network while scaling down on the shipping business positively.

Although the international dry bulk shipping market displayed a sign of improvement in the second quarter of 2018, we remain cautious on this sector due to the ongoing trade war between China and the United States (US).

Currently, the US has imposed tariffs on US$50 billion of Chinese goods, prompting China to retaliate in kind. On top of that, US President Donald Trump is prepared to impose tariffs on another US$200 billion worth of Chinese imports, which will significantly escalate the already high trade tensions.

Peer Comparison

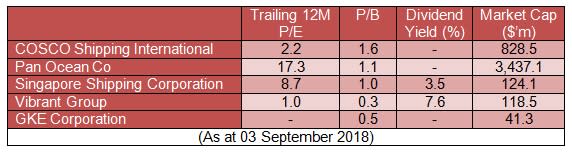

Comparing the valuations of COSCO against some of its peers would show that the group’s valuations are rather attractive. However, it is notable that the lower trailing 12 months price-to-earnings (TTM P/E) is partly due to profit from discontinued operations.

Having said that, Vibrant Group, which is valued at the lowest TTM P/E of one time, had also recognised a significant amount of negative goodwill arising from the acquisition of a subsidiary.

Currently, one missing factor that would shift COSCO to a more favourable position with investors would be a stable dividend payout. The group had indicated that there would be no dividend payout for FY17 as it was evaluating various strategic moves for its business. In the future, we believe that COSCO could benefit from the region’s growing logistics industry as well as potential opportunities that may arise as China’s One Belt, One Road Vision brings China and Southeast Asia closer.

Yahoo Finance

Yahoo Finance