SI Research: Is China Everbright Water A Good Stock To Buy?

Water is indispensable to all living things. It is one of the few major building blocks for life to exist. While water cover more than 70 percent of Earth’s surface, the oceans make up approximately 97 percent with large glaciers consisting of another two percent, leaving a meagre one percent of freshwater for all sustenance.

Needless to say, the country that is likely to consume the most water would be the world’s most populous country, China – home to 1.4 billion making up 18.4 percent of the world population. However, the country only has access to about seven percent of freshwater supplies, according to the United Nations.

In addition, China is the world’s top polluter where the years of breakneck growth have caused large amount of pollutants to be emitted, befouling its air, water and soil. The pollution has further limited the amount of water available for use and that makes clean water an even more scarce resource in China!

Chinese President Xi Jinping pledged to build a “moderately prosperous society” by 2020 and combating pollution is one of the three critical battles to achieving this goal. This led us to take a look at China Everbright Water (CEW), a Singapore-listed environmental protection company which focuses on water and environment management in China.

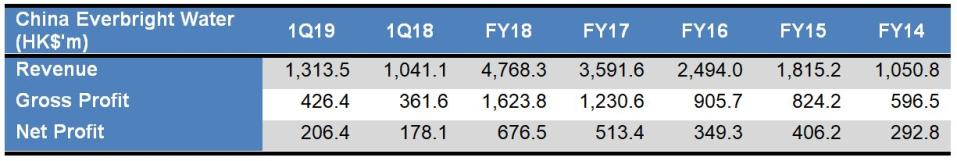

Financial Performance

2016 marked the start of China’s thirteenth Five-Year Plan. The plan, which calls for environmental protection and more clean energy, seeks to promote a cleaner and greener economy. The favourable environmental protection policies have led to much benefit for CEW.

Source: Shares Investment

In the last five years, revenue rose at a compound annual growth rate (CAGR) of 46 percent, from HK$1.1 billion in FY14 to HK$4.8 billion in FY18. Gross profit also grew 28.5 percent from HK$596.5 million to HK$1.6 billion in the same period. Correspondingly, net profit rose at CAGR 23.3 percent to HK$676.5 million in FY18. The improvements in financial performance were consistently positive over the years.

In the latest earnings release, CEW’s 1Q19’s net profit improved 15.9 percent to HK$206.4 million on the back of higher construction revenue which arose from the construction of several water environment treatment projects and water supply projects as well as the expansion and upgrading of several wastewater treatment plants.

Nevertheless, finance costs jumped 40.4 percent to HK$90.8 million following the issuance of the second tranche of RMB-denominated corporate bonds of RMB800 million in August 2018 and the third tranche of RMB-denominated corporate bonds of RMB700 million in January 2019.

The earnings picture going forward looks good, with the absence of legal and professional fees from its dual listing on The Stock Exchange of Hong Kong (HKEX) and lower effective interest rate after refinancing from corporate bonds which have lower coupon rate less than four percent.

Balance Sheets

As at 31 March 2019, CEW has a cash pile of HK$2.2 billion and a total debt of HK$8.5 billion. This translates to a net debt of HK$6.3 billion. One of the major concerns with the expanding group was its substantial increase in debt. Despite the capital-intensive nature of the business, the group maintains a total debt-to-equity ratio at just 1.0 times. Complementing the stable debt-to-equity ratio, the group’s current ratio is at a comfortable level of 1.4 times indicating a state of healthy financial well-being.

On top of that, return on equity (ROE) improved from 6.8 percent in 1Q18 to 8.3 percent in 1Q19. In FY18, ROE stood at 8.5 percent, an improvement from 4.6 percent in FY14 with the lowest recorded ROE in the past five financial years. Since ROE increases with higher leverage, this signals that the group is deploying its leveraged capital efficiently.

Peer Comparison

(As at 30 May 2019)

At the time of writing, CEW’s shares last changed hands at $0.37 per share, putting the valuation of the group’s shares at a trailing 12 months (TTM) price-to-earnings (P/E) ratio of 8.0 times. In addition, based on the group’s current book value per share of HK$3.17 ($0.56), CEW’s shares are trading at a 34 percent discount to book value.

Compared to its peers, CEW is trading at a slightly higher TTM P/E and price-to-book-value (P/B), but offers a superior ROE. Furthermore, CEW’s slightly higher valuation is also supported by higher growth in both the top line and bottom line. However, CEW delivered an inferior dividend yield of 2.7 percent.

Future Prospects

In 1Q19, CEW secured a wastewater treatment (WWT) plant operation and management (O&M) project and a sludge treatment project. The O&M project in Zhenjiang will unify the operations management of water plant in Zhengrunzhou which is in line with its asset-light strategy. In addition, CEW commenced construction on 14 projects and one project commenced operation during 1Q19. On top of that, a total of seven WWT have received approval for tariff hikes from 21 percent to 56 percent.

CEW subsequently won four more new projects in April and May 2019 commanding a total investment of Rmb2.8 billion ($554.5 million) and contributing an additional daily designated water treatment capacity of 802,000 m3. While most of the newly secured contracts commanded an investment in the millions, the most significant contract win was secured by a consortium led by CEW and an investor representative designated by the People’s Government of Tongxiang City with a total investment of about Rmb 1.3 billion ($250 million). CEW will hold a 79.9 percent equity stake in the project company and it has a concession period of 20 years including the construction period.

The project is CEW’s first in Zhejiang province, also the first project of the company venturing into the business area of drinking water sources wetland projection. This marks a breakthrough in the Eastern China and potentially paving the way for further business expansion in the region.

Yahoo Finance

Yahoo Finance