SI Research: Centurion Corporation – Bright Prospect Ahead

Recently, Singapore’s sovereign wealth fund GIC reported a 20-year annualised real rate of return of 3.7 percent above global inflation on its portfolio for the period ended 31 March 2017, which dipped slightly from the four percent return last year.

Along with the released statement came some comments that the fund is prepared to take underperformance against relative benchmarks owing to current period of heightened uncertainty and low returns. Nonetheless, a key part of GIC’s investment in such a challenging environment would be to ensure that its portfolio remains robust with diversification across asset classes, regions, return drivers and risk thresholds.

Adding on to that, Lim Chow Kiat, GIC’s chief executive officer, pointed out that they see growth and opportunities investing into infrastructure as well as student-housing market. Now that caught our attention. According to data from Real Capital Analytics cited by Bloomberg showed, GIC and Mapletree Investments have pushed acquisitions in student housing to a record US$16.2 billion last year. This year, GIC together with the Canada Pension Plan Investment Board and The Scion Group jointly acquired three US student-housing portfolios for about US$1.6 billion.

With “smart money” illuminating the way and taking the lead, should we as smart investors follow suit? This issue, let us take a closer look at Centurion Corporation (Centurion), and explore what this leading provider of quality accommodation in Asia has got to offer us.

Company Profile

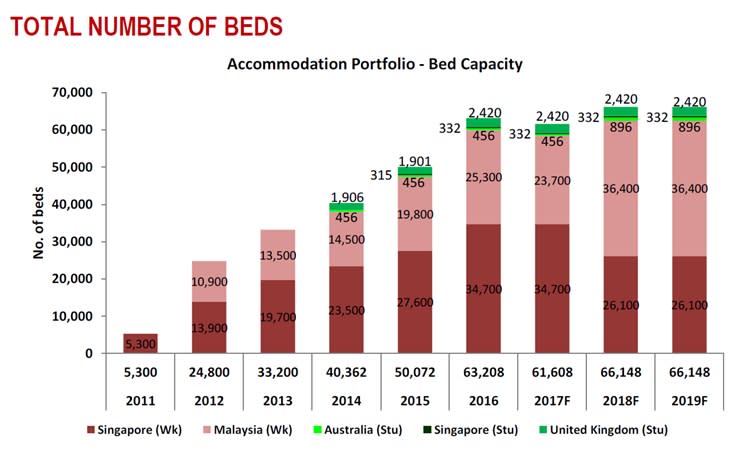

Starting out as an audio cassette tape manufacturer in 1981, Centurion (formerly known as SM Summit Holdings) has successfully diversified into the accommodation business to capture growth opportunities in this niche market following a reverse acquisition in 2011. Today, the group owns, develops and manages quality workers accommodation assets under the Westlite brand and student accommodation assets under the Dwell brand. As at March 2017, Centurion has a portfolio of 11 workers accommodation and 10 student accommodation in operation totaling 61,608 beds in Singapore, Malaysia, Australia and the United Kingdom (UK).

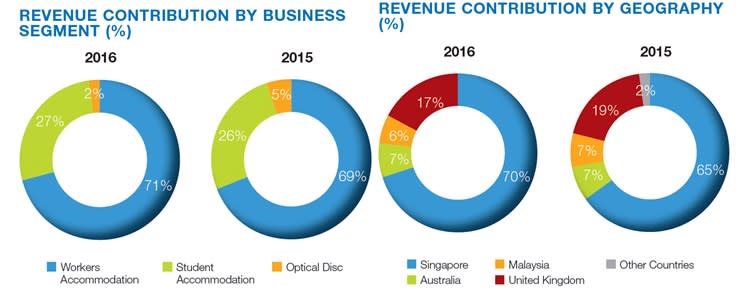

According to Centurion’s FY16 annual report, the group’s core businesses in worker accommodation and student accommodation accounted for 71 percent and 27 percent of its FY16 revenue respectively. Geographically, the main bulk of the revenue was derived from Singapore at 70 percent followed by United Kingdom contributing 17 percent, while the rest is made up of Australia and Malaysia with each constituting seven and six percent respectively.

Source: Company Annual Reports

Strong Financial Results

Centurion’s financial results were nothing short of impressive. Over the last five years, the group’s revenue grew consistently at a compounded annual growth rate (CAGR) of 24.5 percent to $120.3 million in FY16, driven by the continual expansion of its workers and student accommodation businesses as well as an increasing portfolio size. Correspondingly, net profit from core business operations climbed at a CAGR of 30.5 percent to $38.6 million in FY16.

Source: Company Annual Reports

Centurion’s latest quarter results continued to display stable revenue and profit increments. For 1Q17, the group reported revenue of $36 million, which rose 25.6 percent. The double-digit growth was largely attributed to better performance of the group’s worker accommodation assets in Singapore, in particular the newer Westlite Woodlands and ASPRI-Westlite Papan. Most notably, revenue from the group’s student accommodation business was also significant with contributions from four newly acquired student accommodation assets in the UK. As a result, net profit jumped 14.5 percent to $10.7 million.

Strong Demand In Singapore

Despite the softer economy in FY16, all five worker accommodation assets which Centurion operates in Singapore enjoyed close to full occupancy rates during the year. Being one of the largest purpose-built workers accommodation (PBWA) owner-operators in Singapore and Malaysia, its established position in the sector allowed Centurion to ride along the tailwinds brought about by some of the favourable government policies. For instance, non-Malaysian manufacturing workers will no longer be allowed to rent out entire HDB flats with effect from 1 January 2017, making PBWA an alternative option for accommodation. Meanwhile, factory-converted dormitories are also facing increasingly stringent guidelines by the authorities.

With the Building and Construction Authority projecting the value of construction contracts to be awarded in 2017 to reach between $28 billion and $35 billion higher than preliminary estimate, which in turn translates to higher demand for foreign workers in Singapore. Over the short term, this bodes well for the sustainability of demand for worker accommodation contributing to Centurion’s performances.

Acquisitions To Drive Growth

Student accommodation has always been one of Centurion’s best performing and resilient segments even during global economic downturn, underpinned by the popularity of UK and Australia among international students seeking tertiary education with their number of top ranking universities, coupled with shortage of quality and well-managed purpose-built student accommodation (PBSA) in the regions.

According to a Jones Lang LaSalle report published in November 2016, student accommodation database in Melbourne, Australia, reported a total of 234,844 full time students matched with an existing supply of only 19,188 beds.

Considering the healthy demand and undersupply of PBSA beds in Melbourne, Centurion has finalized its plans to develop a new accommodation block in RMIT Village which could increase an additional 160 beds. Meanwhile on 30 March 2017, the group has also entered into an agreement to acquire a development site in Adelaide for a 280-bed student accommodation expected to be completed in 2018. Given its proximity to major universities in Adelaide and limited pipeline of PBSA beds in that area, Centurion is confident of the future performance of its second asset in Australia.

Likewise, performances of Centurion’s eight PBSA assets in the UK are equally lustrous alongside their Australia’s counterparts. According to the Universities and Colleges Admissions Services, the 2016/2017 academic year saw an increase of 7,000 acceptances into UK universities from the previous year. As a result, the group’s student accommodation assets continued to perform well with an overall occupancy rate of approximately 96 percent.

Source: Company’s Factsheet

Valuation

As at 19 July 2017, Centurion is transacting at a market price of $0.50 per share, which represents a rather inexpensive valuation of price-to-earnings ratio at 12.3 times and a price-to-book ratio at 0.9 times. With a dividend payout of $0.02 in FY16, current price offers a decent yield of around four percent. Although the shares just had a run-up from $0.31 since December last year and is currently trading near its 52-week high, we reckon that there could be potential for further upside given its expanding portfolio as well as a stable business in a resilient sector.

Yahoo Finance

Yahoo Finance