SI Research: BreadTalk Group – At Risk Of Getting Mouldy

If you were born and “bread” in Singapore, you must know that the good ol’ traditional national breakfast is “kopi-gao” (rich coffee) and “kaya-loti” (bread with coconut jam) served with silky soft-boiled “kweh-neng” (egg). Singaporean travellers hankering for a taste of home while they are overseas could now have more choices, with many home-grown brands opening outlets in places like Shanghai, Indonesia, Thailand and even the Middle East.

BreadTalk is perhaps one of Singapore’s most recognisable companies despite its relatively small market capitalisation of $574.5 million. This homegrown brand operates iconic restaurant and bakery brands such as its namesake BreadTalk, ToastBox and Din Tai Fung.

As a brief introduction, BreadTalk has four main divisions, namely Bakery, Food Atrium, Restaurant and 4orth. Currently, BreadTalk has 842 stores in Asia and the Middle East after closing down 29 underperforming outlets in the past six months. Its Bakery division is literally its bread and butter, accounting for 47.1 percent of the total revenue. The Restaurant and Food Atrium division makes up the remaining 25.1 percent and 25.9 percent respectively. For now, 4orth (its remaining side ventures) make up a mere 1.9 percent of total revenue.

In the latest quarter, BreadTalk delivered a mixed earnings performance. We dive deeper to see if BreadTalk could rekindle better performances in coming quarters.

Results Overview

In 1H18, revenue nudged up 0.7 percent to $297.4 million from a year ago. This is an improvement compared with a 2.9 percent fall in revenue from 1H16 to 1H17. The growth in revenue throughout 1H18 can be attributed to higher contributions from Food Atrium and Restaurant divisions, dragged down by lower contributions from the Bakery division due to closure of franchisees in China.

Notably, despite closing three outlets, BreadTalk’s Food Atrium operations reported the most improvement with earnings before interest, taxes, depreciation and amortisation (EBITDA) jumping 20 percent to $13 million while EBITDA margin grew from 14.7 percent to 17 percent, largely driven by strong same store sales growth momentum across the entire portfolio, particularly in China. Moreover, Food Atrium registered a record low vacant rate of 1.5 percent in the latest quarter.

While Food Atrium was the star in the latest 1H18 earnings announcement, growth in 2H18 should be bolstered by the Restaurant operations as the group recently added three more restaurant outlets.

Margin Woes

Over the past few years, BreadTalk consistently operated with a respectable gross profit margin in the mid-50 percent range. However, its EBITDA margin tells a different story. In 1H18, BreadTalk’s EBITDA margin continued to contract to 11.6 percent – the lowest level in five years.

The contraction in EBITDA margin was due to weaknesses in profitability at the Shanghai direct operated stores and higher-than-expected pre-opening expenses at the new outlets from the franchise business. Correspondingly, the group’s net profit fell from $13 million to $3.6 million due to the absence of recognition of $9.3 million in net capital gain from divestment of TripleOne Somerset.

Excluding the one-off divestment gain, core food and beverage (F&B) business net profit has improved 38.9 percent to $5.4 million and core F&B net margin grew from 1.3 percent to 1.8 percent.

Meanwhile, associates and joint ventures contributed a combined loss of $0.5 million as compared to a profit of $0.2 million due largely to weaker performances from Jumbo China, Carl’s Jr Shanghai and BreadTalk Minor Thailand.

Going forward, we believe the potential cost pressures such as overhead expenses and higher startup costs for Din Tai Fung London will limit the upside for earnings growth as well as margins into FY19.

New F&B Concepts But Rising Leverage Concerns

After several years of major rationalisation exercises, BreadTalk is now back on its expansion phase and is looking to open Song Fa Bah Kut Teh eateries in Shenzhen and Guangzhou, a Wu Pao Chun bakery in China, Nayuki and Tai Gai in Singapore and Thailand as well as Din Tai Fung in London. Moreover, management also cited that BreadTalk may sign two new F&B concepts in this year.

The new F&B concepts should help improve margins in the long run, but we are remaining cautious owing to higher capital expenditure and higher overhead costs such as marketing and branding in the near term. Notwithstanding that, execution risks remain in BreadTalk’s oversea ventures.

Along with the execution risks of recent ventures, BreadTalk saw a substantial increase in debt. During the first half of the year, total borrowings increased from 183.3 million in FY17 to $257.6 million and net debt (after deducting cash) grew from $41.2 million to $51 million. As a result of that, BreadTalk’s debt interest obligation rose substantially as interest expense surged 95.3 percent to $4.9 million.

Back in FY13 when BreadTalk was also in a phase of aggressive expansion, its total debt-to-equity ratio was 179.6 percent. After paring borrowings in the past few years, BreadTalk’s recent borrowings have brought its debt-to-equity ratio back to a high level at 145.4 percent. Meanwhile, current ratio is now standing at 0.9 times, raising potential liquidity concerns. As such, the aggressive expansion – by relying heavily on borrowings – makes BreadTalk a risky venture for investors.

Peer Comparison

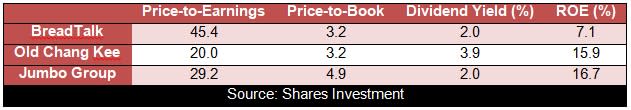

Based on the trailing twelve months earnings-per-share of $0.02, and the current closing price of $1.02, BreadTalk is trading at a steep valuation of 45.4 times as compared to 22.4 times a year ago. Compared to its F&B peers like Old Chang Kee and Jumbo, BreadTalk appears too expensive for our taste. Moreover, BreadTalk delivered an inferior return-on-equity (ROE) of 7.1 percent, well below its peers.

Yahoo Finance

Yahoo Finance