SI Research: 5 Factors That Sweeten JB Foods

In February this year, Shares Investment featured JB Foods as a strong business that would remain unfazed in the age of technological disruptions. JB Foods’ shares were then trading at around $0.53, after applying the adjustment factor for the rights issue. The group’s shares have since steadily advanced over 10 percent to $0.585 as at 17 September 2018.

Shareholders that remained steadfast for the past year have more reason to celebrate as their total returns more than doubled. However, as many investors tend to be wary about stocks that have registered a significant increase in price, this is the point where the upward momentum stalls. Conversely, we believe that run is not quite over for JB Foods.

The Business

JB Foods has a long and established history of almost 40 years, since starting out as a processor of wet cocoa beans to dry cocoa beans in the 1980s.

The group is mainly engaged in the production and sale of cocoa ingredient products such as butter, powder, liquor and cakes, all of which are carried out at the group’s processing plant at the Port of Tanjung Pelepas, a free trade zone in Johor, Malaysia, as well as the Maspion Industrial Estates in Gresik, Indonesia. In total, the group’s facilities have an annual production capacity of 145,000 metric tonnes of cocoa bean equivalent.

Solid Turnaround

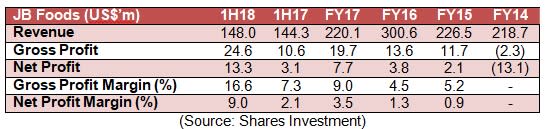

JB Foods’ loss-making years are almost out of sight as the group continues to deliver strong growth in earnings. Currently, the group is on track to a very promising FY18 as its latest 1H18 results exceeded expectations with a solid 331.6 percent increase in net profit.

Despite only registering a marginal 2.6 percent increase in revenue for 1H18, gross profit margin improved by 9.3 percentage points to 16.6 percent driven by an increase in shipment volume and improvements in processing margin.

As cost of sales results in a significant impact on the group’s earnings, the price movement of cocoa is a strong indicator of future earnings.

Favourable Cocoa Prices

Cocoa prices remain favorable as cocoa futures on the Intercontinental Exchange closed at US$2,219 on 14 September 2018. The current price level is significantly lower than the prices seen from 2014 to 2016, which were mostly above the US$3,000 mark.

In addition, data released by the International Cocoa Organization showed that the supply surplus for the current year is expected to reach 31,000 tonnes. While still remaining in the surplus, the figure is much lower as compared to 296,000 tonnes in the previous year as world grindings is expected to increase by 3.9 percent in the current year.

Floor Price Of Cocoa

Low cocoa prices as a result of the global production surplus have impacted cocoa farmers’ revenue. Such a situation negatively affects the sustainability of the cocoa and chocolate sector.

Going forward, Ghana and Ivory Coast, which account for over 40 percent of the global cocoa supply, have agreed to announce bean prices at the start of the next cocoa season. Both countries will jointly conduct a study to determine the floor price.

While a floor price is viewed negatively in terms of the impact on the profits of cocoa processors, it can also be viewed positively in a sense that it will improve the sustainability of the sector.

Potential For Higher Dividends

In FY17, JB Foods paid a generous dividend of $0.02 per share or approximately $4.5 million (US$3.4 million), representing a payout ratio of 44 percent. For 1H18, the group declared a dividend per share of $0.01, representing a payout ratio of 22.8 percent.

Assuming that JB Foods would keep a payout ratio of around 20 to 25 percent, it is likely that there would be a decent final dividend for the year. This is further supported by the group’s growing cash balance which has more than tripled from US$7.1 million to US$25 million over the past six quarters.

Valuations Are More Attractive

The group’s valuations are becoming more attractive amid the weakened upward momentum. Compared to February 2018, trailing 12-months price-to-earnings (TTM P/E) ratio has fallen by more than half, from 11.4 times to 5.4 times.

Meanwhile, the average TTM P/E of locally-listed Agricultural Commodities and Food and Beverage companies stand at 12.5 times and 23.6 times respectively.

While stocks that have a low P/E tend to be an indication of a lack of growth potential and could be a value trap in disguise, JB Foods’ strong growth since recovering from the red in FY15 is certainly deserving of more demanding valuations.

Yahoo Finance

Yahoo Finance