SI Research: 4 Reasons To Like About Netlink NBN Trust

The past few months had been a tumultuous period for investors. After the Federal Reserve hiked interest rate again on 18 December 2018, investors have been exiting the stock market in droves. The problem was further compounded by dismal economic data from China which showed manufacturing activity in December contracting for the first time in over two years amid a bruising trade war with the US.

As the global manufacturing hub, China’s latest economic indicator could be signaling a slowdown in global economic growth. Sharing a similar tale, Singapore also started 2019 with negative news relating to our manufacturing sector. For the month of December last year, local factory growth slowed for the fourth straight month, with the local Purchasing Managers’ Index dipping by 0.4 point to reach a reading of 51.1.

In an uncertain global economic environment, risk appetite is waning and investors are looking for safe havens to protect their portfolio. Amidst this backdrop, Netlink NBN Trust has recently been receiving rather positive recommendations from the street. We take a look at the counter and here are four reasons to like about Netlink NBN Trust.

Defensive Nature

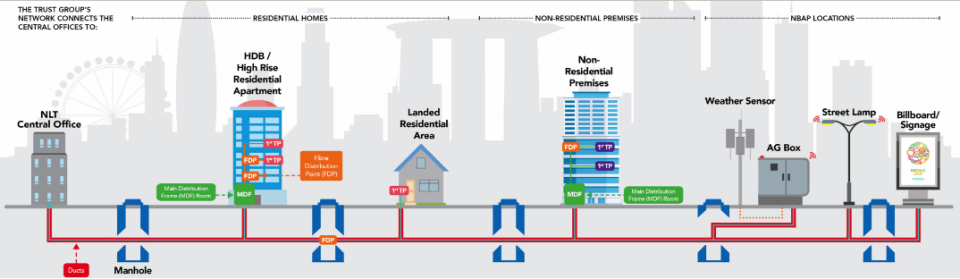

Netlink NBN Trust is the largest fibre network operator in Singapore. The Trust is the sole appointed “Network Company” for Singapore’s Next Gen National Broadband Network. The Trust designs, builds, owns and operates the local fibre network infrastructure, which is then leased to Requesting Licensee to reach end-users. As the provision of network services is largely regulated, the space is dominated by Netlink NBN Trust, accompanied with high barriers of entry.

Due to Singapore’s drive to digitalise and become a Smart Nation, the long-term prospect for Netlink NBN Trust lies in the growing number of connections to residential and non-residential premises. As fibre is the most suitable medium for high-speed data transmission, the Trust’s extensive reach is also well-suited to support extensive deployment of sensors, meters and connected devices in Singapore.

As of 2Q19, the Trust has connected 1.24 million residential units and 45,514 non-residential premises, representing a market share of 90 percent and 35 percent respectively.

Fibre Of Smart Nation

Netlink NBN Trust is one of the best proxies to ride on Singapore’s Smart Nation initiative. Due to the rising number of devices that need to be connected, the Non-Building Access Points (NBAP) segment is seeing the fastest growth rates in terms of connections. For 1H19, NBAP connections have grown 53.3 percent from 835 in FY18 to 1280.

While residential connections still make up the bulk of its fibre business revenue, NBAP connections would be a meaningful revenue driver as the Government agencies ramp up the deployment of devices to push the Smart Nation initiative.

Meanwhile, while the entry of the fourth mobile network operator TPG Telecom (TPG) is proving headwinds for the local telecommunication incumbents, the new entrant is a potential customer for Netlink NBN Trust. This is because in its mobile network deployment, TPG will need to tap on the Trust’s fibre network to connect its base stations, further boosting prospects for the Trust’s NBAP segment.

Evidence Of Strong Execution

The Trust’s latest 2Q19 results exemplified its abilities to execute well on all fronts. For the topline, revenue grew 39.9 percent to $90.6 million, beating its IPO projection of $84.9 million by 6.7 percent. The outperformance came from higher diversion revenue for completed projects mainly for government agencies.

Meanwhile, the Trust continued to add more connections in 2Q19. As a result, residential connections contributed $50.9 million in revenue while non-residential connections contributed $7.5 million, representing a growth of 23.9 percent and 49.8 percent compared to 2Q18 respectively. Contributions from NBAP and segment connections also saw growth of 7.3 percent to $1.7 million during the same period.

Owing to its strong topline performance, 2Q19 net profit grew 43.9 percent to $18.7 million, beating its projection by 16.2 percent. Growth in the bottom line further translated to more cash generated from its operations. For 2Q19, Netlink NBN Trust generated $61.1 million net cash from operating activities, compared to $43 million last year.

Better Yield At A Bargain

Based on its IPO prospectus, Netlink NBN Trust had projected a DPU of $0.0464 per unit for FY19. However, for 1H19, actual distribution per unit (DPU) of $0.0244 per unit exceeded expectations to make up 52.6 percent of FY19 forecast.

Assuming distribution for 2H19 remains the same, annualised DPU would be $0.0488 per unit, surpassing the IPO projection. If this materialises, unitholders would be expecting a solid yield of 6.3 percent at the current unit price of $0.775.

Notwithstanding that, Netlink NBN Trust is currently trading at a discount to its book value of $0.792 per unit, representing a price-to-book value of 0.98 times. As such, the current unit price should offer investors a slight margin of safety.

Yahoo Finance

Yahoo Finance