SI Research: 3 Reasons To Like About Frasers Centrepoint Trust

The changes are not reflected in the physical magazine issue #606.

The global economic outlook for 2019 is not looking too great with US growth constrained by ebbing fiscal stimulus and higher interest rates while China is facing the twin pressure of US tariffs and economic rebalancing. With the increasing uncertainty and volatility continuing to rattle financial markets, investors would be better off sticking to a more defensive investment option.

Strategic And Resilient Portfolio

Frasers Centrepoint Trust (FCT) is a Singapore-domiciled retail real estate investment trust (REIT) that owns six suburban malls in its current property portfolio. These suburban retail properties are Causeway Point, Northpoint City North Wing (including Yishun 10 retail podium), Changi City Point, Bedok Point, YewTee Point and Anchorpoint.

While the local economy could face pressure going forward and consumers might be more prudent when it comes to spending, suburban malls are less likely to be impacted as they are located in residential areas with good shopper catchment and connectivity to public transport. Also, suburban malls provide shoppers a wide range of products and services that cater to consumers’ convenience, necessity shopping needs and dining options or what we classify as non-discretionary spending.

Furthermore, FCT’s two biggest malls can be seen as having strategic or “monopolist” presence in the areas they operate in. Northpoint, which is located next to Yishun train station, is the only shopping mall in the entire Yishun area (includes Khatib, Nee Soon and Lower Seletar), which houses more than 210,000 residents (according to data from Singapore Department of Statistics, as of 30 June 2018). Hence, it is no surprise that Northpoint continues to benefit from healthy shopper traffic throughout the day while getting incredibly crowded during lunch and after-work peak periods, as well as during the weekends.

On the other hand, Causeway Point that is located in Woodlands (one of Singapore’s most populous residential estate), is situated next to a bus interchange and a train station. Being near to the Singapore-Johor Bahru checkpoint, the mall is popular amongst people travelling between Singapore and JB. Also, as compared to the smaller malls in the area, Causeway Point boasts a cinema and other prominent tenants including Cold Storage, Metro, Courts and Uniqlo, ensuring an ample shopper traffic.

Solid Financial Position

In 1Q19, gross revenue and net property income increased 2.9 percent and 2.5 percent to $49.3 million and $35.4 million respectively. The revenue growth was mainly driven by the two larger malls, Changi City Point and NorthPoint City North Wing. Between the two, Changi City Point delivered the strongest growth with its revenue and net property income jumping 12.7 percent and 18.7 percent to $6.8 million and $4.5 million respectively from higher turnover rent and improved gross rental income. In the meantime, distributable income inched up 0.9 percent to $28 million.

FCT’s portfolio occupancy stood at 96.2 percent, while rental reversion for 1Q19 clocked a positive 6.9 percent, a great improvement as compared to a positive 0.2 percent for 4Q18 amidst the considerable challenges facing the retail industry.

Balance sheet wise, FCT maintains a low gearing of 28.8 percent of total debt/equity. The relatively low gearing provides ample headroom for the trust to pursue inorganic growth through acquisitions, either from sponsor Frasers Property or from external parties. In particular, its sponsor’s pipeline assets – Northpoint City’s South Wing and one third interests in Waterway Point – could further strengthen FCT’s suburban-mall footprint.

Looking at debt maturity, some investors seem to be concerned about a sizable portion of FCT’s debt expiring in 2019 (27.1 percent amounting to $222 million), given the backdrop of rising interest rates in the US, which increases borrowing costs. However, FCT is likely to have no issues refinancing this debt and we would probably not see a marked increase in its borrowing costs, given its size and sponsor backing.

Reasonable Valuations

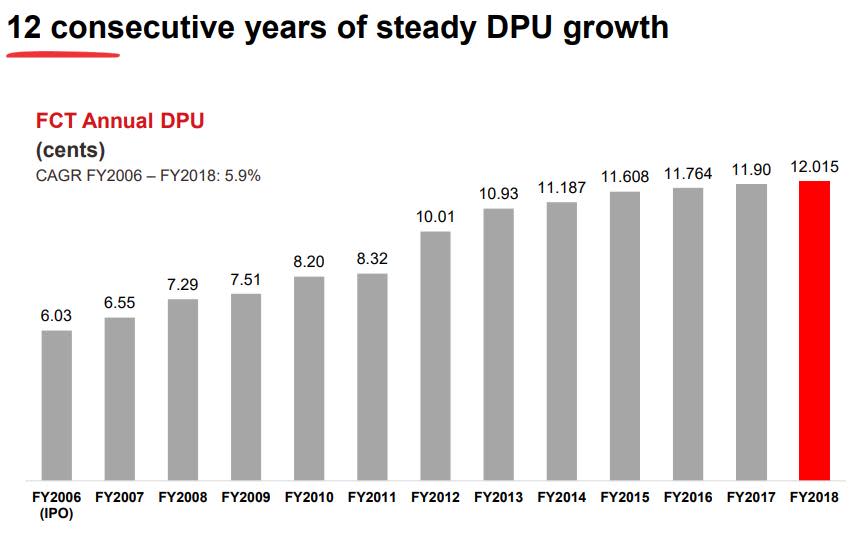

Most investors put money into REITs for its rather stable dividend payout and FCT certainly does not disappoint in this aspect. Owing to the strong stability in suburban properties, the distribution per unit (DPU) grew steadily to $0.12015 in FY18 at a compound annual growth rate (CAGR) of 5.9 percent over the 12 years since its initial public listing. In the latest 1Q19, FCT announced a DPU of $0.0302, up 0.7 percent from $0.03 in 1Q18. Meanwhile, its total assets also grew from $938 million at its listing to $2.84 billion as at 31 December 2018 and net asset value (NAV) per unit stood at $2.08.

Based on its current share price of $2.24, this translates into a price-to-book ratio of 1.08 times and a decent trailing-twelve-month distribution yield of 5.4 percent. Currently FCT is trading at 8 percent premium to its book value which may seem a tad expensive. However, with FCT’s track record of growth and resilient portfolio asset, investors who are willing to pay a premium now could very well be rewarded in the future.

Yahoo Finance

Yahoo Finance