SI Research: 3 Largest REITs, Better Than 2.5 Percent

Singaporeans appear to be getting better at putting their money to work. A recent report by the Central Provident Fund (CPF) showed that 78 percent of CPF investment scheme (CPFIS) members who invested their savings under the ordinary account (OA) made profits of more than the legislated minimum interest of 2.5 percent per annum for FY16. However, this figure is only to be expected given that the Straits Times Index took a plunge in January 2016 to below 2,600 points before staging a strong recovery to end the year at 2,880 points.

Investors typically hope for positive returns through capital gains or dividends, but how many actually have set a target return for their portfolio and subsequently went on to adjust their portfolio holdings to achieve this return?

In fact, the benchmark of 2.5 percent is far below the average annual compounded returns of the SPDR Straits Times Index Exchange Traded Fund (ETF) at 7.4 percent since inception in April 2002. Impressive? Yes, but before the remaining 22 percent of CPFIS members jump onto the ETF bandwagon, we need to highlight that such funds come with their fair share of risks, which could be more complicated as compared to individual securities.

Putting ETFs aside, we explore three SGX-listed real estate investment trusts (REITs) which could have carried the 22 percent members several times above the 2.5 percent benchmark.

Ascendas REIT

The largest REIT with a market capitalisation of over $7.8 billion, Ascendas REIT (A-REIT) played a crucial role in the development of the Singapore REIT sector, providing an attractive platform for investment in business parks and industrial properties. As at 30 June 2017, the REIT has 103 properties in Singapore and 29 properties in Australia.

An investor who put his money in A-REIT at the start of 2016 for $2.28 per share would not have made any capital gains during the year as A-REIT’s share price ended the year flat. However, he would have received dividends amounting to a yield of around seven percent, easily joining the 78 percent camp. Since January 2017, not including the dividend payout, A-REIT’s share price has already gained over 17 percent.

(Source: Shares Investment)

A-REIT delivered positive results for 1Q18 with a 10.9 percent increase in total amount available for distribution. The REIT reported a foreign exchange gain of $17 million as compared to a loss of $23.7 million. Finance costs were also down by $11.3 million as the REIT reduced its total debt by around $254 million.

With a whopping debt of $3.4 billion, should investors be concerned about A-REIT’s ability to dish out dividends? Not at the moment. A-REIT’s last twelve months (LTM) interest coverage ratio of 5.9 times indicates a high margin of safety. A-REIT also has a long history of reporting positive levered free cash flow, with LTM levered free cash flow at $546.8 million.

CapitaLand Mall Trust

Currently in second place, CapitaLand Mall Trust (CMT) has 16 properties strategically located in the suburban areas and downtown core of Singapore under its portfolio. CMT also holds an approximate 14.1 percent stake in CapitaLand Retail China Trust, which comprises 11 shopping malls in China.

Unlike A-REIT, CMT’s share price fell 2.6 percent for 2016. However, shareholders were rewarded with dividends representing a dividend yield of approximately 5.8 percent, hence, still placing them above the 2.5 percent mark at 3.2 percent after accounting for the loss in capital.

(Source: Shares Investment)

For 1H18, CMT’s flat performance could be seen as rather impressive despite the absence of contribution from Funan, which is under redevelopment and expected to reopen its doors in 4Q19. The reinvented Funan live-work-play mall will go beyond selling IT products to incorporating the tech experience throughout the entire integrated development.

Brick-and-mortar retailers in Singapore have been impacted by the rise of e-commerce and competition from foreign destinations. Close to half of CMT’s properties are located in the tourist-reliant downtown area where retailers as well as landlords felt the heat. Suburban malls, which were previously the retail sector’s bright spot, are also starting to face challenges as online stores continue to gain traction.

Regardless whether the reinvention of retail malls can give them an edge against the competition, earnings will continue to face downward pressure. Though in the worst case scenario, retail malls still could move towards having a higher composition of e-commerce immune businesses such as food and beverage or professional services.

CapitaLand Commercial Trust

The largest commercial REIT by market capitalisation, CapitaLand Commercial Trust’s (CCT) portfolio comprises of quality office and commercial buildings located in Singapore’s Central Business District.

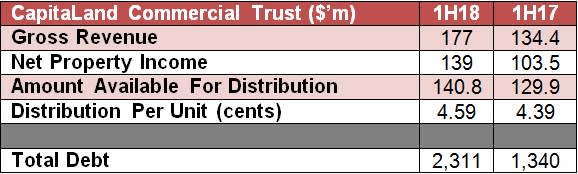

CCT delivered stellar results for 1H18 with a 34.3 percent increase in net property income, mainly boosted by contributions from CapitaGreen, which was acquired in August 2016.

Although total debt level increased to $2.3 billion, CCT has managed its balance sheet well with average cost of debt at 2.6 percent and around 85 percent of borrowings pegged to fixed rates, providing much certainty of interest expense while remaining largely protected in a rising interest rate environment. That said, S&P Global Ratings lowered CCT’s long-term corporate credit rating to BBB+ from A- citing the likelihood of increased leverage over the next 24 months.

(Source: Shares Investment)

As at end June 2017, CCT’s portfolio committed occupancy rate of 97.6 percent remained above the market occupancy rate of 94.1 percent despite oversupply conditions in the office market. During the last quarter, CCT also announced the sales of One George Street and Wilkie Edge at sale prices of 16.7 percent and 39.3 percent above the respective 31 December 2016 book values and at exit yields of 3.2 percent and 3.4 percent per annum respectively.

Valuations

In terms of valuations, A-REIT’s current dividend yield of 6.6 percent is slightly ahead of the industry average of 6.5 percent, while the price-to-book (P/B) ratio of 1.2 times represents a 20 percent premium to the average.

Meanwhile, CMT’s P/B is at valuation, though dividend yield of five percent is below the industry average.

On the other hand, CCT is valued at a P/B of 0.9, indicating a slight 10 percent discount to book value, while providing a dividend yield of 5.6 percent.

(As at 9 October 2017)

Given the stable returns of these REITs, there is really not much reason to fall into the CPFIS’ 22 percent underperforming group. Going forward, perhaps if all CPFIS members could make profits above 2.5 percent, there might be a good reason to increase CPF interest rates.

Yahoo Finance

Yahoo Finance