SI Research: 3 Dividend Growth Stocks With Deep Moats

High-yield stocks are always popular amongst retail investors but in the hunt for dividends, investors sometimes choose to prioritise yield over quality. Yes, not all high-yielding stocks are superior.

Take Singapore Press Holdings (SPH) for example; SPH declared a total of $0.12 in dividend for FY17, and based on the current share price of $2.70, the stock would yield about 5.5 percent. Not too shabby you say, but if investors actually bought the stock at $3.8 a year ago, they would only have seen a yield of 3.2 percent. Conversely, they would have had seen their investment in SPH shrink by 40 percent if they bought the stock then.

As Warren Buffet once pointed out, we can all compute finance formulas and read figures, but the real challenge lies in understanding the concept of moats. Of course, if you are a retiree with a substantial capital, putting your money in a stable and high-yielding stock may just help fund your passive retirement income. But if you are a young adult earning a meagre income, then time is probably your best friend.

Although not high-yield paying, dividend growth stocks are often a sign of a solid and growing business. If you are a young investor, consider accumulating and reinvesting dividends from such stocks and see your portfolio grow year in and year out. Voila! In 20 years, chances are that you would have built a sturdy retirement nest. No rocket science.

But as with all long-term investments, uncertainties are the enemies and highlighting the importance of deep moats around a business. As Buffett says, you will even want “sharks in the moat”.

The Moats

Appreciating investment moats can be abstract, so here is the best tip: Forget the financials first and focus on the big picture. Intangible assets are sometimes the strongest moats around.

Consider The Coca-Cola Company Buffett always raves about. The beverage giant has a war chest of US$27 billion in cash but Buffett almost only praises the company for its branding. How about McDonald’s? The fast food restaurant chain reigns supreme because of its cost leadership it acquired through operational efficiencies.

Adding on, a good business should not be dependent on certain demography, that is to say that products or services should be demanded regardless of age, gender or race. Lastly, a low payout ratio should be desirable as it means that company is likely to reinvest its retained earnings to fund expansion. Furthermore, a low payout ratio also indicates that the company can grow dividends sustainably without having to take up additional debt – another sign of a good business.

Emulating the Oracle of Omaha, we set out to screen for quality dividend growth stocks in our local stock exchange. For the purpose of this article, we did not exclude special dividends since we are focusing on the ability of companies to increase payouts instead of yield.

Straco Corporation

Straco Corporation (Straco) is an owner and operator of tourism-related assets. The company bought over the Singapore Flyer in 2014 and is also the owner of other landmark attractions such as Shanghai Ocean Aquarium and Lintong Lixing Cable Car.

Owning these prominent attractions is equivalent to owning catchments for the tourism boom amongst the rising Chinese middle class. Testament to that, from FY07 to FY16, Straco’s revenue jumped five-folds from $24.2 million to $125.2 million while net profit increased from $6.2 million to $46.5 million.

During the same period, Straco’s dividends have grown from about $0.0025 to $0.025, representing a growth of 900 percent. Meanwhile, its payout ratio remains low at about 46.2 percent in FY16 and the company’s current cash assets have grown from $30.8 million to $159.5 million in 1H17. Straco is also in a net cash position of $103.6 million. As such, unless the company has any acquisition targets, investors should be looking at continued dividend growth going forward; perhaps even a special dividend in the near term.

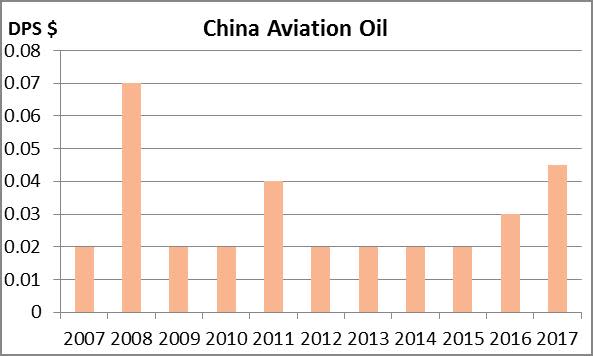

China Aviation Oil

China Aviation Oil (CAO) was originally embroiled in legal dispute in 2004 involving its then chief who amassed US$500 million of losses by trading oil futures.

The physical jet fuel trader has since made a turnaround and investors have been coming back to this stock. CAO is the largest physical jet fuel trader in Asia Pacific region and the sole importer of jet fuel into China. Its monopolistic position in the Chinese market is further cemented by the fact that the group is a state-owned enterprise.

CAO’s prospect bodes well with the booming Chinese aviation industry, as air passenger trips are growing at double digits. The group supplies jet fuel to 17 international airports in China, including key gateways such as Beijing Capital International Airport as well as Shanghai Pudong International, in which CAO owns a 33-percent stake of the sole jet fuel supplier Shanghai Pudong International Airport Aviation Fuel Supply Company. Outside of China, CAO also supplies aviation fuel to 43 international airports.

The group has also been raising its dividends and has been occasionally rewarding faithful investors with special dividends such as in FY08 and FY11. Excluding special dividends, ordinary dividends declared have risen from $0.02 in FY07 to $0.045 in FY16. The Chinese jet fuel giant has a payout ratio of above 20 percent and has no debt. Meanwhile CAO is sitting on a cash pile of US$260.3 million as of 1H17.

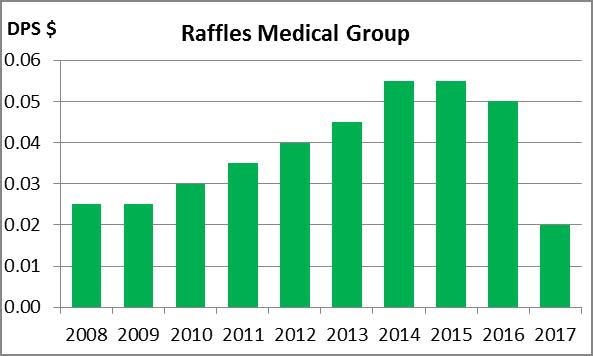

Raffles Medical Group

Like it or not, people get sick. In the local space, Raffles Medical Group (RMG) is one of the best medical practicing brands in Singapore. As part of its latest expansion developments, RMG extended Raffles Medical Hospital at North Bridge Road and the works is scheduled for completion in 2H17. The group also has gotten a foothold in China, with two new hospitals – Raffles Chongqing and Raffles Shanghai – scheduled for opening in FY18.

From 2008 to 2015, RMG’s dividends have risen steadily before coming down in FY16 and FY17. Perhaps, this is probably due to the fact that the upcoming opening of the new hospitals might cause the group to incur startup losses and hence the move to preserve working capital.

That said, resumption in dividend growth is bound to occur when growth eventually materialises, as RMG continues to ride on Singapore as a medical tourism hub, its aging population, as well as China’s rising demand for medical care. RMG’s payout ratio is only about 20 percent while it sits on a net cash position of $59.3 million in 1H17. Since the beginning of the year, RMG shares corrected almost 25 percent to $1.15 and current share price could be screaming a buying opportunity.

Conclusion

The three dividend-growth stocks we mentioned are examples of good businesses with deep moats. That said, each company has its unique set of risks. Investors should carry out their own due-diligence and also delve into the companies’ financials before committing to any investments.

Yahoo Finance

Yahoo Finance