SI Research: 3 Defensive Strategies To Protect Your Portfolio

Consensus seems to agree that the investment climate is shifting. Stepping into the 3Q18 earnings season, analysts are turning marginally cautious as earnings revisions have turned negative. Amidst a myriad of economic and geopolitical uncertainties, market watchers are on the lookout for the first signs of economic recession as the International Monetary Fund also fuelled uneasiness when it warned of institutions struggling to find the next battle plan.

Despite Singapore’s robust fundamentals and healthy corporate earnings performance in first half of 2018, management commentary coincided with a less upbeat outlook for the coming quarters.

Many has cited global trade tensions and the surprise tightening of property cooling measures as primary concerns that have caused the level of optimism in Singapore to slide. Others have touted that borrowing costs are also starting to rise meaningfully as interest rates continue to climb.

Yet, while investors’ sentiments are indeed dampened, not all is doom and gloom. After all, according to UBS, consensus is still projecting an acceleration of earnings-per-share (EPS) growth from 7.2 percent in 2017 to 14.7 percent in 2018. That said, the bottom line is the main theme for investors now is to stick to more defensive and resilient sectors in the market.

Stick With Banks If In Doubt

Bank stocks are easily understood. Equivalent to the financial bloodline of an economy, banks take deposits to lend out as loans. The spread of the interest between loans and deposits is known as the net interest margin. In a rising interest rate environment, interest rates on loans rise faster than deposits which widen the net interest margins and hence the profitability for banks.

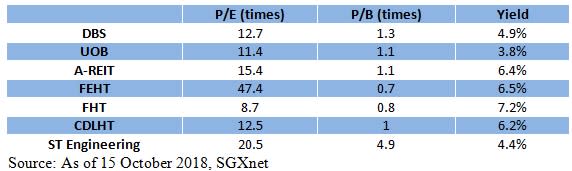

Amongst the three local banks, DBS Group Holdings (DBS) is probably the most preferred pick given that it has been the leader in digitalisation of the local bank industry. For DBS, digitalisation has begun to reap the benefits of lowering costs, thus improving efficiency and hence pushing down its cost-to-income ratio.

Meanwhile, non-performing loans in the oil and gas sector that have dragged on banks’ profitability over the last two years are beginning to recover as oil prices have risen to more accommodative levels. Apart from DBS, United Overseas Bank (UOB) is also benefitting from healthier asset quality. Coupled with excess capital buffer, UOB could see scope for dividend hikes.

Income Stability With REITs

REITs are often perceived as fixed-income assets due to the requirement that 90 percent of net profit is distributed to unitholders. As a result, when the risk-free rate rises, REITs often become less “appealing”. However, investors should bear in mind that REITs have scope for capital gains as well.

Apart from the element of rising interest rates, local-listed REITs in Singapore are generally seeing stabilising fundamentals. For instance, both industrial and hospitality space are at an inflection point characterised by tightening supply-demand dynamics. This bodes well for investors looking to ride on the recovery of these sectors.

One of our regular recommendations for industrial REITs would be none other than Ascendas REIT (A-REIT). A-REIT offers a distinct advantage of a diversified portfolio of quality assets that generates resilient earnings and sustainable dividends. The REIT recently further expanded its presence in UK after it acquired a portfolio of logistic properties that enjoys an overall high physical occupancy of 92 percent. Following the acqusitions, A-REIT portfolio composition by asset value would be in Singapore, Australia and the UK.

In the hospitality sector, growth in new supply of hotel rooms continues to taper off whiledemand for hotel rooms continued to grow as tourist arrivals hit a record of 9.2 million in 1H18, up 7.6 percent from a year ago.

The improving fundamentals are benefitting hospitality REITs such as Far East Hospitality Trust (FEHT), Fraser Hospitality Trust (FHT) and CDL Hospitality Trusts (CDLHT) as they experience better room rates as well as occupancy rates. Notwithstanding that, return of corporate travel demand following the high profile Trump-Kim summit should especially bode well for CDLHT given that its assets could target the niche MICE (Meetings Industry) market. Generally, the valuations in the hospitality sector are still lagging behind other sectors, but the yields are meaningfully more attractive.

Still Spots Of Secular Growth

Bearing in mind, while analysts have moderated their earnings call, EPS growth in general is still projected to accelerate albeit at a less aggressive pace.

Amidst the less upbeat outlook, there are still some spots of secular growth in our local market. One example would be ST Engineering whose strong order book provides visibility and underpins its earnings performance.

The conglomerate has all its hands in the indispensable industries from defence systems to smart city technologies. Recently, it ramped up presence in the US with the acquisition of MRA Systems (MRAS) to further scale up its aerospace expertise.

The new subsidiary MRAS manufactures engine nacelles and their thrust reversers, allowing the group to move up the value chain in the business of high-value nacelle components and replacement parts. Besides being synergistic to the group’s composite manufacturing capabilities, the acquisition is also earnings accretive according to management.

Forward-looking, the backlog for the next-gen engines will offset the decline in demand for more mature nacelles. Furthermore, ST Engineering further gains a one-stop platform to provide maintenance and overhaul services for advanced engines via MRAS.

Notwithstanding that, the group’s strong balance sheet also backs its track record of dishing out stable dividends. Overall, ST Engineering offers a unique proposition of both earnings growth and stability.

Yahoo Finance

Yahoo Finance