SI Research: 3 Defensive Stocks On Sale From Last Year’s Underperforming Sectors

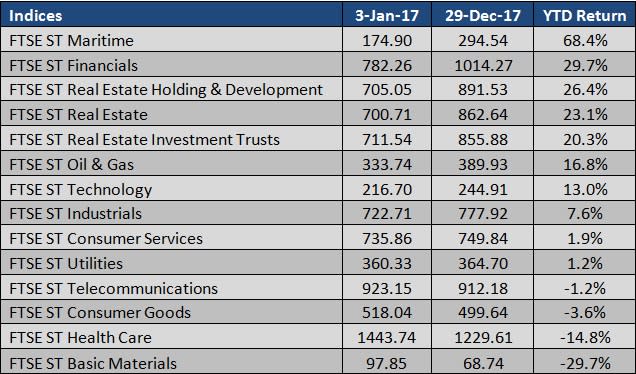

2017 ended with many reasons for investors to rejoice as the Straits Times Index posted a stellar 17.9 percent year-to-date (YTD) return finishing at 3,402.92. Looking back at the performances of each respective sectors, Maritime, Financials and Real estate sectors topped the chart delivering remarkable double-digit gains amidst oil price recovery, a gradual US rates hike and property market rebound. On the other hand, sectors such as Telecommunications, Consumer goods and Healthcare which are usually perceived as more defensive in nature, lost favour among investors as they lagged behind the general market registering negative returns.

If you are a contrarian like me who believes that opportunities lie in investing in the underperformers, then you might be interested to invest in them waiting for their intrinsic value to be realised eventually when investors’ interest returns. This issue SI Research has hand-picked three defensive stocks from the underperforming sectors, who we feel have the potential to ride through market volatility as we look forward to another exciting year ahead.

Source: Author’s Own Compilation

M1

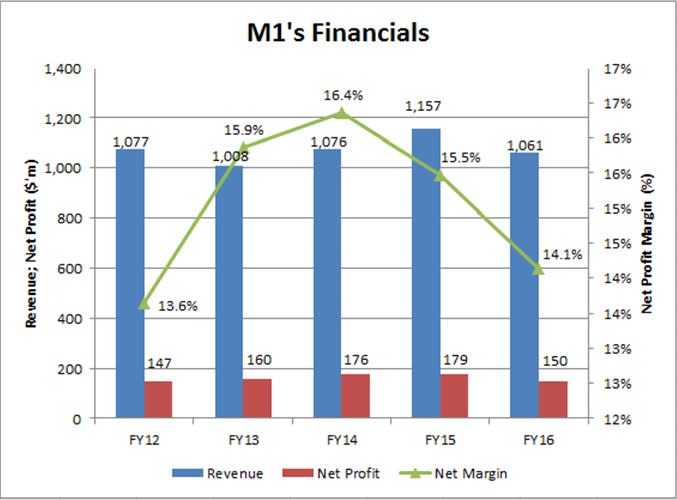

Closing at $1.78 on 29 December 2017, M1 slid 9.2 percent throughout the year falling from $1.96 in the beginning of the year. The telecommunication sector generally did not perform well in 2017, against a backdrop of intensifying competition in the mobile landscape with the impending entry of TPG, aggressive marketing of mobile virtual network operator (MVNO) Circles.Life as well as MyRepublic’s intention to become the second MVNO in Singapore. M1’s counterparts, Singapore Telecommunications, also slipped 1.9 percent along with the group’s decline while StarHub, on the other hand, rose moderately by 1.8 percent.

As the local mobile space gets more crowded, M1 is likely going to be the most affected company among the three telcos due to its heavy reliance on Singapore’s mobile segment – where the group derive approximately 87.7 percent of its total operating revenue from. Looking at M1’s latest results, 9M17 revenue increased slightly by 2.3 percent to $763.9 million owing to higher postpaid and fixed services revenue, but net profit sank 13.9 percent to $101.5 million.

Comparing 9M17 profitability with the figures in 9M15, net profit shed 24.8 percent from $134.9 million two years ago. Nevertheless, M1’s share price has plunged more than 55.1 percent from its historical high of $3.99 in March 2015. We suspected that the massive sell-off could be a little overdone amidst a bleak outlook of the group’s business.

M1’s management has guided that payout ratio at 80 percent will be maintained. Assuming that there is no sharp decline in earnings in the coming quarters, annualised earnings-per-share of $0.1453 would imply a dividend of $0.1163 per share. This translated to a yield of 6.5 percent based on the market price of $1.78 as at 2 January 2018 which is also the highest yield among those currently offered by the three telcos.

Source: Company Annual Reports

Sheng Siong Group

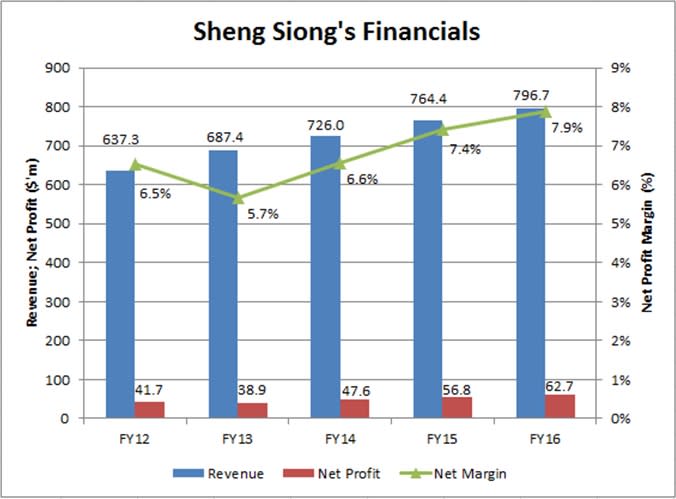

Threatened by Amazon’s Prime entry into Singapore as well as fierce competition from RedMart and other online retailers, the share price of Sheng Siong Group (Sheng Siong) has drifted sideways for the past year registering a YTD net loss of 2.6 percent to $0.925 as at 29 December 2017.

Sheng Siong is the third largest supermarket chain in Singapore with 43 outlets in Singapore as at 30 September 2017 spanning over 430,000 square feet. In face of the challenging consumer goods landscape, the group’s performances have been remarkably resilient. Over the last five years, the group’s revenue and net profit grew at a compounded annual growth rate (CAGR) of 5.7 percent and 10.7 percent to hit $796.7 million and $62.7 million respectively. 9M17 revenue grew five percent to $629.6 million with higher new stores and comparable same store sales while net profit jumped 11.8% to $52.9 million as a result of higher gross profit coupled with a $2.2 million worth of tax refund. Gross margin remained stable standing at 25.8 percent because of efficiency arising from the central distribution centre and higher rebates received from suppliers.

Source: Company Annual Reports

Always on a lookout for appropriate retail space in areas which it does not already have a presence, the group successfully bid for three new HDB shops at Woodlands Street 12, Edgedale Plains Bllk 660A in Punggol and Anchorvale Crescent Block 338 in Sengkang which would be operational in 4Q17. The increasing number of new store openings will continue to allow the group to deliver consistent growth in its top line. In addition, being mindful of the developments and impacts of e-commence on traditional brick and mortar grocery retailing, this has manifested in Sheng Siong’s pilot online project, which currently offers e-commerce services in some residential areas in Singapore.

Based on Sheng Siong’s FY16 dividend payout of $0.0375 and its market price of $0.93 as at 2 January 2017, this translated to a yield of around four percent. With the group’s robust balance sheet of zero debts and net cash position of $64.5 million as at 30 September 2017, as well as its strong cash flows from operations, we believe that Sheng Siong’s yield could very well be sustained in the near term.

Raffles Medical Group

Raffles Medical Group (RMG) is a leading integrated private healthcare provider with presence in 13 cities in Asia, serving more than two million patients through over 100 clinics and medical centres in Singapore.

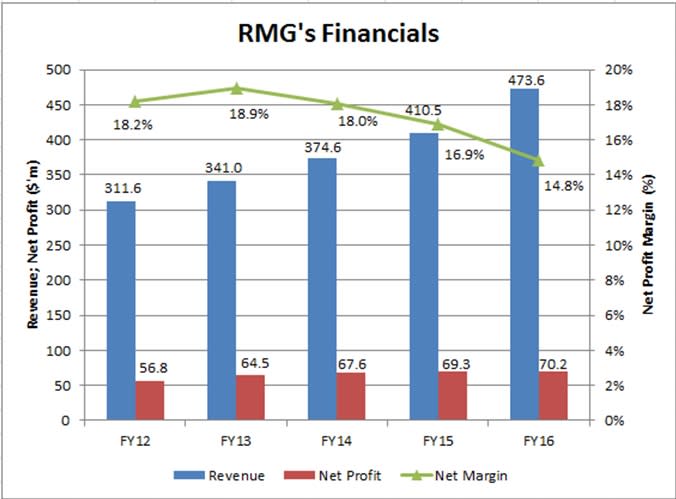

Weighed by muted earnings in recent quarters attributed to higher startup costs from its expansion projects, RMG share price has sunk 21.7 percent from $1.43 at the beginning of last year to $1.12 as at 29 December 2018.

Latest 9M17 revenue dipped 0.1 percent to $354.6 million due to lower Healthcare Services revenue as a result of lower renewal of international healthcare plans for expatriates, partially offset by a higher contribution from Hospital Services arising from an increase in local patient load. Net profit, on the other hand, registered a marginal increase by 0.5 percent to $48.7 million.

Nevertheless, over the last five years, RMG saw a remarkable growth in its revenue by a CAGR of 11 percent to $473.6 million from FY12 to FY16, while net profit grew at a CAGR of 7.3 percent to $70.2 million over the same period.

Source: Company Annual Reports

Most notably, RMG’s balance sheet remains healthy with a net cash position of $40.6 million after accounting for $74.3 million of borrowings from its $114.9 million of cash assets. This was despite the group’s payment of $30.9 million for investment properties under development in FY17. RMG’s strong financials would therefore allow much headroom for the group to take on additional debts to fund its overseas projects.

The construction of Raffles Hospital Extension is nearing completion at the end of 2017, while Raffles Hospital Chongqing and Raffles Hospital Shanghai are scheduled to be opened in 2H18 and 2H19 respectively. Management estimates that both Chinese hospitals are likely to incur start-up losses in their first two years of operations, before breaking even by the third year.

Hence, going forward we foresee that RMG’s earnings would continue to be unexciting characterised by higher capital expenditure and gearing. However given Singapore’s rather mature healthcare market, we deem RMG’s short-term pains from its overseas endeavours as necessary evils in order to attain longer-term potential growth, underpinned by exposure to the emerging China markets as well as enhanced capacity of its Chinese hospitals.

Yahoo Finance

Yahoo Finance