Sherwin-Williams' (SHW) Earnings & Sales Lag Estimates in Q4

The Sherwin-Williams Company SHW logged earnings (as reported) of $2.66 per share in fourth-quarter 2019, up 148.6% from $1.07 in the year-ago quarter.

Barring one-time items, adjusted earnings in the quarter came in at $4.27 per share, which missed the Zacks Consensus Estimate of $4.40.

Sherwin-Williams posted revenues of $4,114.4 million, up 1.2% year over year. However, the figure missed the Zacks Consensus Estimate of $4,185.5 million. The company’s results gained from higher paint sales volume in The Americas Group, which was partly offset by weaker sales outside of North America as well as in specific industrial end markets.

2019 Highlights

The company recorded net sales of $17.9 billion for 2019, up 2.1% year over year. Earnings rose 41.3% year over year to $16.49 per share.

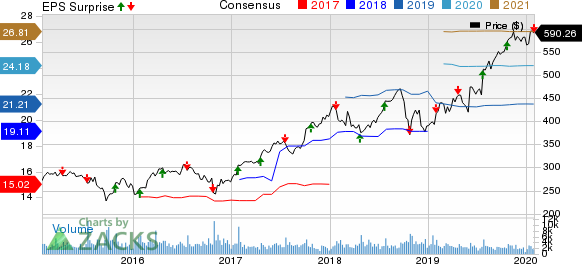

The Sherwin-Williams Company Price, Consensus and EPS Surprise

The Sherwin-Williams Company price-consensus-eps-surprise-chart | The Sherwin-Williams Company Quote

Segment Review

The Americas Group segment registered net sales of $2.36 billion in the fourth quarter, up 4.8% year over year. The upside can be attributed to higher paint sales across most end markets.

Net sales in the Consumer Brands Group segment inched up 0.9% to $539.4 million. Results gained form higher selling prices and increased sales volume related to some of the group's retail customers.

Net sales in the Performance Coatings Group fell 5% year over year to $1.21 billion in the reported quarter. The decline was mainly caused by softness in sales outside North America and unfavorable currency translation effect, which were partly offset by higher selling prices.

Financials and Shareholder Returns

At the end of 2019, Sherwin-Williams had cash and cash equivalents of $161.8 million, up 4.1% year over year. Long-term debt declined 7.5% year over year to roughly $8,050.7 million.

The company purchased 1,675,000 shares of its common stock in the 12-month period ended Dec 31, 2019. It had remaining authorization to purchase 8.45 million shares through open market purchases.

Outlook

Heading into 2020, the company stated that North American architectural demand is strong and industrial demand remains variable in terms of geography and end market.

For first-quarter 2020, Sherwin-Williams projects net sales to increase 2-5% year over year.

For 2020, The company expects net sales to increase 2-4% from 2019 levels. Based on this projection, the company expects earnings per share in the range of $19.91-$20.71 for 2020, which indicates a rise from $16.49 in 2019.

Price Performance

Shares of Sherwin-Williams have rallied 45.7% in the past year compared with the industry’s 43.8% rise.

Zacks Rank & Key Picks

Sherwin-Williams currently carries a Zacks Rank #3 (Hold).

Few better-ranked stocks in the basic materials space are Daqo New Energy Corp DQ, Royal Gold, Inc RGLD and Sibanye Gold Limited SBGL, each currently sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Daqo New Energy has projected earnings growth rate of 326.3% for 2020. The company’s shares have rallied 44.3% in the past year.

Royal Gold has an estimated earnings growth rate of 83.5% for fiscal 2020. Its shares have returned 32.5% in the past year.

Sibanye Gold has an expected earnings growth rate of 587.5% for 2020. The company’s shares have surged 213.8% in the past year.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DAQO New Energy Corp. (DQ) : Free Stock Analysis Report

Sibanye Gold Limited (SBGL) : Free Stock Analysis Report

Royal Gold, Inc. (RGLD) : Free Stock Analysis Report

The Sherwin-Williams Company (SHW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance