Shell (RDS.A) May Exit Prolific Permian Operations for $10B

Royal Dutch Shell plc RDS.A is contemplating the divestment of a portion or all of its interests in Permian Basin – the most prolific shale play in the United States – according to people familiar with the matter, as reported by Reuters.

The company’s Permian assets, spanning across Texas and New Mexico, spread over 260,000 acres. The source added that the sale could fetch the integrated energy firm an amount as high as $10 billion. Thus, Shell is gradually shifting focus from fossil fuels. The proceeds, if the deal is confirmed, will probably be utilized by the company for reducing debt loads and for investing in clean energy, also per the source.

According to the people familiar with the process, the European energy giant will possibly divide its deal into several packages or could also accept shares as a mode of payments from buyers. This will probably increase interests from bidders. According to analysts, as reported by Reuters, the potential bidders for the Permian assets of Shell are Chevron Corporation CVX, Devon Energy Corporation, EOG Resources EOG and ConocoPhillips COP along with few private equity houses.

Reuters added that none of the companies agreed to comment on the news.

Currently, Shell carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

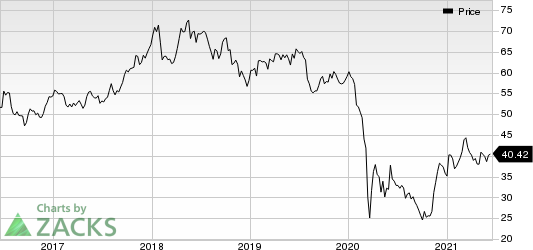

Royal Dutch Shell PLC Price

Royal Dutch Shell PLC price | Royal Dutch Shell PLC Quote

Time to Invest in Legal Marijuana

If you’re looking for big gains, there couldn’t be a better time to get in on a young industry primed to skyrocket from $17.7 billion back in 2019 to an expected $73.6 billion by 2027.

After a clean sweep of 6 election referendums in 5 states, pot is now legal in 36 states plus D.C. Federal legalization is expected soon and that could be a still greater bonanza for investors. Even before the latest wave of legalization, Zacks Investment Research has recommended pot stocks that have shot up as high as +285.9%

You’re invited to check out Zacks’ Marijuana Moneymakers: An Investor’s Guide. It features a timely Watch List of pot stocks and ETFs with exceptional growth potential.

Today, Download Marijuana Moneymakers FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Chevron Corporation (CVX) : Free Stock Analysis Report

ConocoPhillips (COP) : Free Stock Analysis Report

Royal Dutch Shell PLC (RDS.A) : Free Stock Analysis Report

EOG Resources, Inc. (EOG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance