Shell shares slide as profits dive 36% on weak oil prices

Shell’s underlying profits crashed 36% last year, as weak oil prices hit the company.

Oil giant Royal Dutch Shell said on Thursday that underlying earnings fell 36% to $15.3bn (£11.8bn) in 2019. The company blamed lower oil and gas prices, and squeezed margins in refining and chemicals businesses.

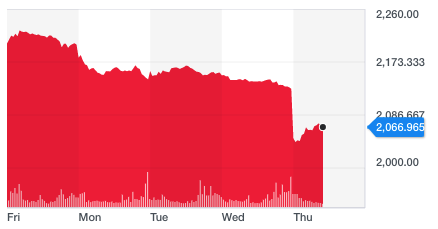

The results were below market expectations. Shares (RDS-B.L) were down over 3% in London at 10.30am.

“The strength of Shell’s strategy and portfolio has enabled delivery of competitive cash flow performance in 2019 despite challenging macroeconomic conditions in refining and chemicals, as well as lower oil and gas prices,” chief executive Ben van Beurden said in a statement.

“We generated $47bn in cash flow from operating activities excluding working capital movements and distributed over $25bn in dividends and share buybacks to our shareholders.”

Shell said it would launch the next phase of its share buyback programme, with plans to buy up to $1bn-worth of its own stock by the end of April this year.

“We remain committed to prudent capital discipline supported by world-class project delivery and are looking to further strengthen our balance sheet while we continue with share buybacks,” van Beurden said.

READ MORE: Markets slide as WHO due to meet over coronavirus

Neil Wilson, chief market analyst at Markets.com, said: “Shell is suffering from persistently weak oil and gas prices. The world is awash with crude and natural gas and prices will likely be a headwind for some time. The demand side has yet to really recover.

“The coronavirus is not helping and could materially reduce average prices this year.”

Oil prices were under pressure on Thursday, as travel lockdowns and factory shutdowns linked to the spread of coronavirus continued. Crude (CL=F) was down 1.5% to $52.49 and Brent (BZ=F) was down 1.6% to $58.82. Brent had been trading as high as $71 per barrel at the start of the month.

Yahoo Finance

Yahoo Finance