SGX Research: February Share Buyback Value at a 20 Month High

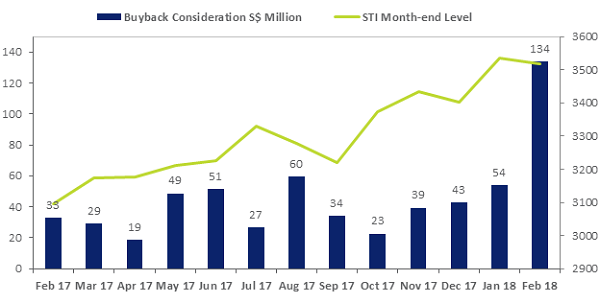

Share buyback consideration in the month of February rose to a 20 month high with $134.2 million in buybacks, with 26.4 million shares repurchased by 17 stocks. The STI declined 0.4% over the month, which coincided with earnings season.

The 17 stocks included as many as eight STI constituents – CapitaLand, Keppel Corporation, Oversea-Chinese Banking Corporation, United Overseas Bank, Singapore Exchange, SATS, Sembcorp Industries and Singtel. These eight stocks made up as much as $131.1 million of the consideration.

CapitaLand reported FY17 results on 13 Feb. The company commenced its share buyback mandate the following week, topping the February tally with buyback consideration of $43.8 million. The mandate to buyback 2% of issued shares had been approved back in April 2017.

Total share buyback consideration in the month of February reached a 20 month high, with consideration value of $134.2 million. This was the highest consideration value since June 2016 when the buyback consideration totaled $218 million.

Over the month of February, there were 26.4 million shares repurchased by 17 companies. The buyback consideration more than doubled the $54 million recorded in January.

Among the stocks that conducted share buybacks in February, eight of them were Straits Times Index (STI) constituents –CapitaLand, Keppel Corporation (Keppel), Oversea-Chinese Banking Corporation, United Overseas Bank, Singapore Exchange, SATS, Sembcorp Industries and Singtel. These eight stocks registered a total share buyback consideration of $131.1 million.

As discussed here the Straits Times Index (STI) declined 0.4% for the month of February bringing its dividend inclusive return for the first two months of 2018 to 3.6%. This compared to SGD denominated average returns of 0.8% for the benchmarks of Australia, Hong Kong and Japan.

Monthly Share Buyback Consideration (S$ Million) & STI Month-End Levels

Source: SGX My Gateway (Data as of 28 February 2018)

CapitaLand reported FY17 results on 13 February, highlighting that FY17 PATMI increased 30.3% YoY to $1.55 billion (click here for more). The company commenced its share buyback mandate the following week, topping the February tally with buyback consideration of $43.8 million. The mandate to purchase 2% of its issued shares had been approved at the Annual General Meeting held on 24 April 2017.

Following CapitaLand, Keppel registered the second highest buyback consideration of $39.3 million in February, taking the total number of shares to date purchased its current mandate to 7,300,000.

Sembcorp Industries and ISOTeam commenced shares buyback during the month with a total consideration of $2.6 million and $101,952 respectively. Sembcorp Industries reported its FY17 results on 23 February (click here) and ISOTeam reported its 2Q18 results (click here) on 12 February.

The table below summarises the buyback considerations in February 2018. The table is sorted by the value of the total consideration amount for the month, which combines the amount of shares purchased and the purchasing price of the shares.

Name | Start Date | Mandate | Total No. of shares bought in Feb 2018 | Total Consideration for Feb $ | Cum No. of Shares Purchased to End of Feb | Pct % |

24/4/2017 | 84,942,722 | 12,133,100 | 43,830,509.66 | 12,133,100 | 0.29 | |

21/4/2017 | 90,882,201 | 4,681,300 | 39,312,530.51 | 7,300,000 | 0.40 | |

28/4/2017 | 209,124,917 | 1,400,000 | 18,415,707.74 | 20,360,000 | 0.49 | |

20/4/2017 | 81,789,445 | 406,213 | 11,310,886.22 | 406,213 | 0.02 | |

21/7/2017 | 22,384,146 | 1,749,700 | 9,105,384.08 | 1,749,700 | 0.16 | |

21/9/2017 | 107,164,240 | 750,000 | 5,595,979.00 | 750,000 | 0.07 | |

19/4/2017 | 35,746,006 | 800,000 | 2,569,943.83 | 800,000 | 0.04 | |

9/2/2018 | 227,146,452 | 1,116,600 | 1,563,520.98 | 7,816,200 | 0.34 | |

20/7/2017 | 816,457,915 | 284,913 | 960,875.97 | 284,913 | 0.00 | |

26/4/2017 | 45,962,384 | 1,810,900 | 717,531.82 | 7,276,800 | 1.60 | |

24/4/2017 | 176,952,559 | 585,600 | 305,379.05 | 10,813,400 | 0.61 | |

24/4/2017 | 32,668,653 | 180,500 | 208,632.99 | 501,400 | 0.15 | |

27/10/2017 | 28,376,204 | 300,000 | 101,952.14 | 300,000 | 0.11 | |

27/7/2017 | 31,968,220 | 77,000 | 67,897.77 | 164,700 | 0.05 | |

24/4/2018 | 119,222,349 | 113,400 | 62,562.94 | 1,439,900 | 0.12 | |

20/7/2017 | 22,393,422 | 14,800 | 48,580.40 | 1,407,300 | 0.13 | |

20/4/2017 | 41,351,400 | 8,800 | 2,893.32 | 568,900 | 0.14 | |

Total | 26,412,826 | 134,180,768.42 |

Source: SGX (data as of 28 February 2018) *percentage of company’s issued shares excluding treasury shares as at the date of the share buyback resolution. For information on January 2018 buybacks, click here.

Share buyback transactions involve share issuers repurchasing some of their outstanding shares from shareholders through the open market. Once the shares are bought back, they will be converted into treasury shares, which means they are no longer categorised as shares outstanding. Other motivations for share buybacks include companies moving to align stock valuations with balance sheet objectives.

The date of the relevant share buyback mandate is also provided in the table above, in addition to the amount of shares authorised to be bought back under the mandate. The total number of shares purchased under the mandate and the percentage of the companies that issued shares that have been repurchased under the mandate are also provided.

Share buyback information can be found on the company disclosure page on the SGX website, using the Announcement category and sub-category of Share Buy Back-On Market (click here).

Yahoo Finance

Yahoo Finance