SG Americas Securities, LLC Acquires New Stake in Ryanair Holdings PLC

Overview of the Transaction

On June 26, 2024, SG Americas Securities, LLC (Trades, Portfolio) made a significant move in the stock market by purchasing 125,298,010 shares of Ryanair Holdings PLC (NASDAQ:RYAAY), marking a new holding in their investment portfolio. This transaction not only reflects a substantial investment but also impacts the firm's portfolio with a 22.06% position, showcasing a strategic commitment to the airline industry. The shares were acquired at a price of $45.828 each, totaling a significant investment in the Ireland-based airline.

SG Americas Securities, LLC (Trades, Portfolio): A Profile

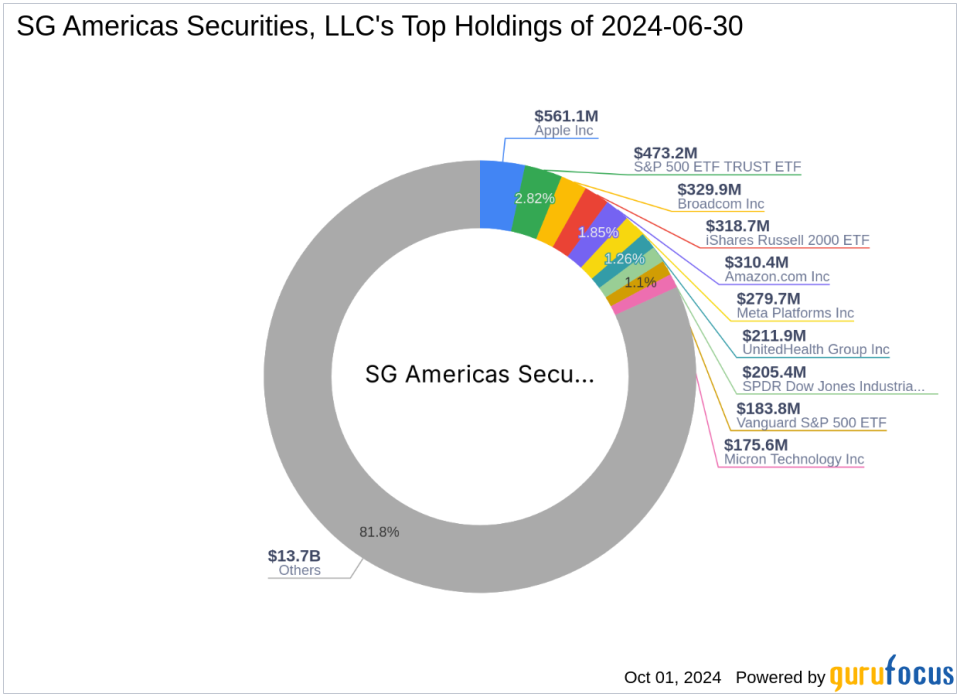

Founded in 1940, SG Americas Securities, LLC (Trades, Portfolio) operates as the broker-dealer arm of SG Americas Securities Holdings, LLC, under the broader umbrella of Societe Generale Group. With a rich history dating back to 1864, Societe Generale employs over 154,000 individuals across 76 countries. SG Americas Securities, headquartered in New York City, offers a range of investment banking services including capital markets operations, securities trading, and more. The firm primarily serves pooled investment vehicles and a diverse array of sectors such as technology and healthcare, which constitute the majority of its investment focus.

Insight into Ryanair Holdings PLC

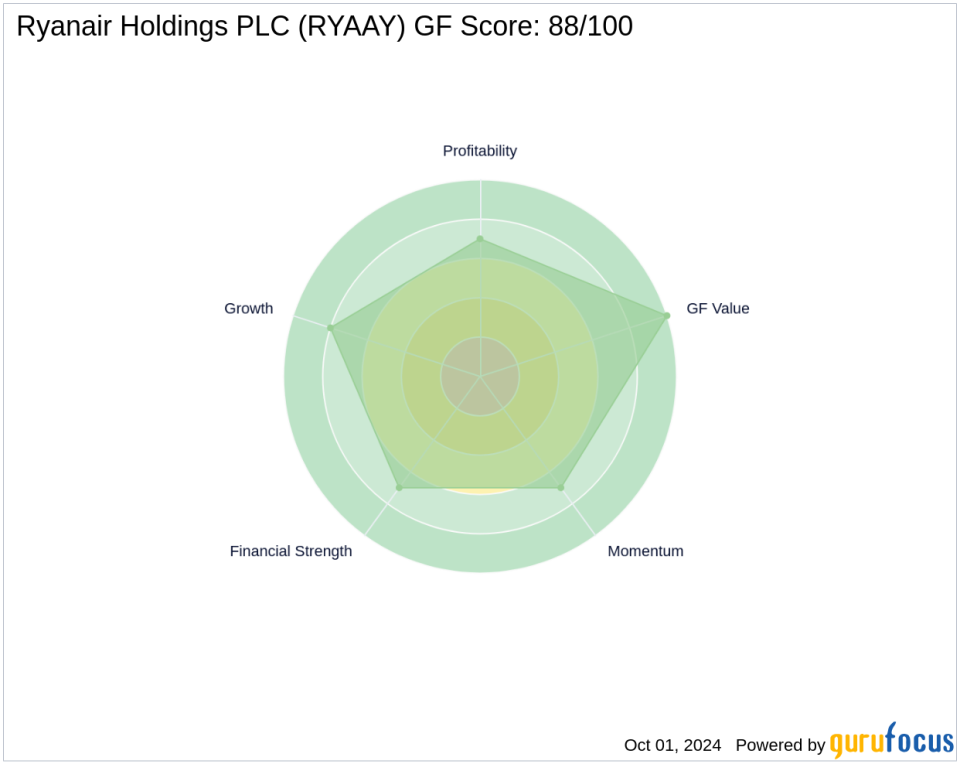

Ryanair Holdings PLC stands as Europe's largest low-cost carrier, renowned for its cost-effective operational model and extensive flight network covering over 200 destinations. Since its IPO in 1997, Ryanair has emphasized operational efficiency and high passenger volumes to maintain its market leader status. Currently, the company is valued at $24.39 billion with a stock price of $44.56, slightly down by 2.77% since the transaction date. Despite recent market challenges, Ryanair remains modestly undervalued with a GF Value of $60.92, indicating potential for future growth.

Strategic Importance of the Trade

The acquisition of a 22.06% portfolio position in Ryanair by SG Americas Securities, LLC (Trades, Portfolio) highlights a strategic diversification into the transportation sector, particularly in a leading low-cost airline. This move aligns with the firm's history of investing in sectors poised for growth or recovery, leveraging Ryanair's strong market presence and operational model to potentially enhance portfolio returns amidst fluctuating market conditions.

Market Context and Comparative Analysis

At the time of the transaction, the market conditions were cautiously optimistic, with Ryanair's stock being modestly undervalued. This acquisition places SG Americas Securities among the significant stakeholders in Ryanair, alongside other notable investors. The firm's top holdings primarily in technology and healthcare sectors, such as iShares Russell 2000 ETF and Apple Inc, indicate a balanced approach towards high-growth and stable investments, with this new addition promising a blend of both stability and potential upside.

Future Outlook and Closing Summary

The strategic acquisition of Ryanair shares by SG Americas Securities, LLC (Trades, Portfolio) is expected to play a pivotal role in the firm's future performance. Given Ryanair's strong GF Score of 88, indicating good outperformance potential, and its robust business model, SG Americas could see significant benefits from this investment. The trade not only diversifies the firm's portfolio but also aligns with its investment strategy focusing on value and growth.

In summary, SG Americas Securities, LLC (Trades, Portfolio)'s recent acquisition of Ryanair Holdings PLC shares marks a significant enhancement to its investment portfolio, potentially setting the stage for favorable returns influenced by the airline's strategic market positioning and operational strengths.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.