Will Segment Sales Hurt General Dynamics' (GD) Q1 Earnings?

General Dynamics Corporation GD is set to release first-quarter 2023 results on Apr 26 before market open.

General Dynamics delivered an earnings surprise of 2.63% in the last four quarters, on average. The dismal revenue performance across most of its business segments is likely to have negatively impacted its first-quarter results.

Aerospace Unit to Boost the Overall Top Line

Increased global air travel demand is likely to have contributed to General Dynamics’ Aerospace business unit’s sales performance. Higher service revenues from both Gulfstream and Jet Aviation may have continued to add impetus to the unit’s sales performance in the first quarter of 2023. Moreover, three extra aircraft deliveries, which were held up in the fourth quarter for delivery in the first quarter, may have aided first-quarter revenues.

The Zacks Consensus Estimate for the Aerospace segment’s revenues in the first quarter is pegged at $1,979 million, indicating a 3.9% improvement from revenues reported in the year-ago quarter.

Marine Systems Likely to be Unimpressive

Marine Systems’ revenues are likely to have been positively impacted by the increased volume on the Columbia-class submarine program, the John Lewis-class (T-AO-205) fleet replenishment oiler program and the Arleigh Burke-class (DDG-51) destroyer program in the soon-to-be-reported quarter. However, the lower submarine engineering volume, coupled with the supply-chain constraints of the Virginia program, is likely to have negatively impacted this segment’s first-quarter results.

The Zacks Consensus Estimate for the Marine segment’s revenues in the first quarter is pegged at $2,588.1 million, suggesting a 2.4% decline from revenues reported in the year-ago quarter.

Combat Systems Sales May Diminish

A strong pipeline of orders and international orders for Abrams is likely to have added impetus to the top line of the segment. However, the strengthening of the U.S. dollar against the euro and British pound may have negatively impacted the Combat Systems unit’s first-quarter revenues.

The Zacks Consensus Estimate for the Combat Systems segment’s revenues in the first quarter is pegged at $1,654.7 million, indicating a 1.2% decrease from revenues reported in the year-ago quarter.

Technologies Unit’s Revenues Likely to Decline

Strong service activity at General Dynamics Information Technology is likely to have benefited the Technologies segment’s sales performance in the soon-to-be-reported quarter. However, supply-chain challenges at Mission Systems may have dampened the performance of revenues from this segment in the first quarter.

The Zacks Consensus Estimate for the Technologies segment’s revenues in the first quarter is pegged at $3,124.2 million, implying a 1.2% decline from revenues reported in the year-ago quarter.

Other Factors to Note

The unimpressive sales performance across the majority of the company’s segments makes us skeptical about GD’s overall top line in the first quarter. This, along with foreign exchange rate fluctuations, is likely to have impacted the bottom line of General Dynamics in the soon-to-be-reported quarter.

Q1 Estimates

The Zacks Consensus Estimate for first-quarter revenues is pegged at $9.32 billion, suggesting a 0.8% decrease from the year-ago quarter.

The Zacks Consensus Estimate for first-quarter earnings is pegged at $2.56 per share, indicating a decline of 1.9% from the prior-year reported figure.

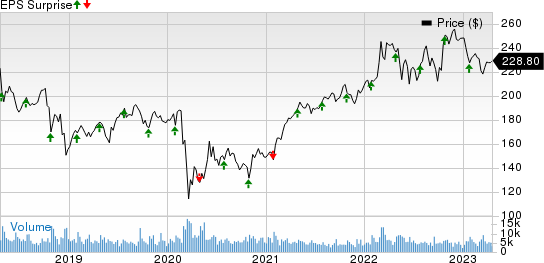

General Dynamics Corporation Price and EPS Surprise

General Dynamics Corporation price-eps-surprise | General Dynamics Corporation Quote

GD: General Dynamics - Price & EPS Surprise - Zacks.com https://www.zacks.com https://staticx-tuner.zacks.com

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for General Dynamics this time. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for an earnings beat. However, that is not the case here, as given below.

General Dynamics has an Earnings ESP of -0.41% and a Zacks Rank #3. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks to Consider

Here are a few defense companies that you may want to consider as these have the right combination of elements to post an earnings beat this season:

Embraer S.A. ERJ has an Earnings ESP of +116.7% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Embraer has a four-quarter average earnings surprise of 105.32%. The Zacks Consensus Estimate for ERJ’s first-quarter sales indicates an improvement of 16.7% from the prior-year reported figure.

Spirit Aerosystems SPR has an Earnings ESP of +16.58% and a Zacks Rank #3. Spirit Aerosystems delivered a four-quarter average negative earnings surprise of 157.65%.

The Zacks Consensus Estimate for SPR’s first-quarter sales and earnings is pegged at $1.48 billion, indicating an improvement of 25.8% from the prior-year reported figure.

Raytheon Technologies RTX has an Earnings ESP of +3.60% and a Zacks Rank #2. The long-term earnings growth rate of RTX is pegged at 8.3%.

The Zacks Consensus Estimate for Raytheon’s first-quarter earnings, pegged at $1.11 per share, indicates a decline of 3.5% from the prior-year reported figure. The Zacks Consensus Estimate for RTX’s sales suggests a growth rate of 7.3% from the prior-year reported figure.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Dynamics Corporation (GD) : Free Stock Analysis Report

Embraer-Empresa Brasileira de Aeronautica (ERJ) : Free Stock Analysis Report

Spirit Aerosystems Holdings, Inc. (SPR) : Free Stock Analysis Report

Raytheon Technologies Corporation (RTX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance