Sears Holdings' Boom Will Be Short-Lived

It had been nearly four years since Sears Holdings (NASDAQ: SHLD) was able to report a comparable sales decline as small as 4% -- until last quarter. But the improvement in Sears' comp sales trend doesn't mean the company's turnaround plan is working, as the achievement can be described at best as less bad.

The department store chain is benefiting from a rising tide that is lifting all retailers' boats. However, the tide will run out again -- especially for Sears -- and the retailer will resume sinking once more.

Silver linings on gray clouds

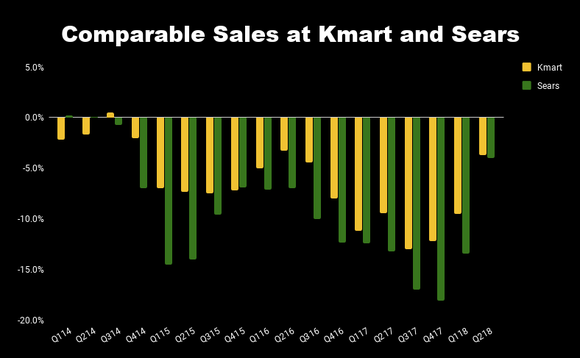

Sears' Q2 comp sales decline of 3.9% came as a complete surprise to most observers. Same-store sales were down 3.7% at Kmart and off 4% at Sears. This was Kmart's best comp sales performance since 2016. Meanwhile, you have to go back to 2014 to find a quarter when the Sears chain was able to report a smaller comp sales decline.

Considering that comp sales had been plunging by double-digit rates for both chains recently, last quarter's performance was a major reversal for Sears Holdings, even though comp sales didn't turn positive. Moreover, Sears said it experienced positive comps growth of 3% during July and 2.5% in August.

Data source: Sears Holdings quarterly SEC filings. Chart by author.

But as Chairman and CEO Eddie Lampert said in the release announcing Sears' quarterly results, "While we are encouraged by the improved comparable stores sales trend... we have yet to achieve our goal of returning the Company to profitability."

Earlier this year, Sears laid out a plan to return to profitability this year. Getting comps close to positive territory is a step in the right direction. However, the retailer's losses more than doubled from the year-ago period to $508 million last quarter, with total debt and capital lease obligations increasing to $4.95 billion from $4 billion a year earlier.

Even with the improved comp sales trend, Sears Holdings' total revenue declined 26% last quarter, primarily due to store closures. Over the past year, the company has closed 384 Kmart and Sears stores. Last month, it identified another 46 it wants to shutter. Lampert says the retailer is committed to reducing its footprint to a size where it can operate profitably, and the comps numbers would seem to indicate that it is approaching that point.

Yet over the past few months, virtually all of retail has experienced an incredible lift. Target (NYSE: TGT) reported its best quarterly comps performance in 13 years, as same-store sales rose 6.5% in the second quarter. Walmart said its quarterly comp performance was its best in a decade.

Image source: Getty Images.

Not-so-benign neglect

There are a number of factors accounting for retailers' robust second quarter results. Many retailers have made necessary investments in their businesses to stave off the retail apocalypse, including new technologies, services, and customer-focused experiences.

The economy is also much better than it has been in years. The unemployment rate is near historical lows and incomes are rising. The benefits of President Trump's tax reform also continue to be felt, as businesses share their savings with employees through bonuses and higher wages.

The problem for Sears is that unlike its rivals, it can't afford to invest in its stores. All of its efforts are focused on simply keeping the doors open and the lights on.

So far this year, Sears Holdings spent just $32 million in capital expenditures. Spread across its 866 stores, that's an average of just $25,600 per store. In contrast, Target has spent over $1.8 billion on capex year-to-date: an average of about $1 million per store.

Key investment takeaway

The spending boost that retailers are getting from bonuses will eventually fade. While the better economy will keep the stronger retailers going, Sears is still fighting a rearguard action, trying to stave off the inevitable.

Sears needs to shrink even faster if it wants to have any chance of surviving. However, as a smaller company, it will be hard for Sears Holdings to pay its substantial financial obligations, even if it reduces expenses. It still suffers from gaping wounds it inflicted on itself over the years, and investors will come to realize that this quarter's improvements were only a temporary salve.

Sears remains on life support, and the prognosis is not good.

More From The Motley Fool

Rich Duprey has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance