ScottsMiracle-Gro (SMG) Buys Luxx Lighting & True Liberty Bags

The ScottsMiracle-Gro Company SMG has acquired Luxx Lighting, a lighting company, and True Liberty Bags — the industry’s leading provider of liners and storage solutions to dry and cure plant products. The Luxx Lighting buyout considerably strengthens The Hawthorne Gardening Company’s industry-leading lighting portfolio.

Luxx Lighting is an addition to a product portfolio that includes the Gavita and Sun System brands. This would open up opportunities for significant cost synergies and process improvements across the portfolio that will be disclosed in greater detail in the weeks ahead, the company noted.

The company acquired the assets of Luxx Lighting for $215 million. Hawthorne will expand the marketing and distribution of Luxx Lighting in emerging markets, including the East Coast. The acquisition, completed on Dec 30, 2021, adds roughly $100 million in sales and $20 million in operating income to Hawthorne on an annualized basis. ScottsMiracle-Gro projects revenues of roughly $75 million from Luxx Lighting through fiscal 2022. The transaction is projected to be neutral to earnings for the year due to purchase accounting and one-time deal costs.

True Liberty was acquired for $10 million. It launched storage solutions directly to the hydroponic market, developing a full offering of liners and storage solutions to dry and cure plant products. Hawthorne has been the primary U.S. provider of True Liberty brands, which boosts Hawthorne’s harvest portfolio.

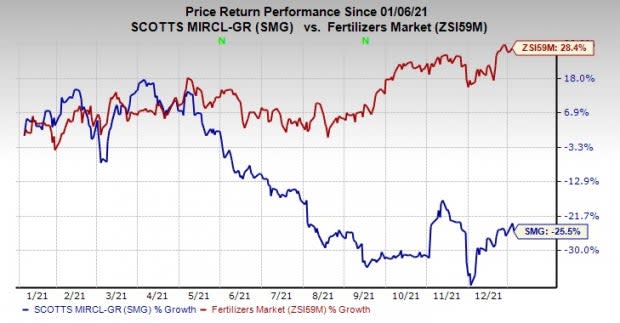

Shares of ScottsMiracle-Gro have declined 25.5% in the past year against a 28.4% rise of the industry.

Image Source: Zacks Investment Research

It is retaining its full-year company-wide outlook for adjusted earnings per share, despite a greater-than-expected decline in Hawthorne sales inthe fiscal first quarter, ended Jan 1. First-quarter sales in Hawthorne are forecast to decline roughly 40% due to a slowdown in the cannabis market and supply chain disruptions that have delayed the sale of certain product lines.

The company noted that its U.S. Consumer segment performs well with POS growth in dollars and units in every major product category and continued support in all retail channels. First-quarter sales in the U.S. Consumer segment are forecast to drop less than 20%, which is better than the company’s expectations.

Zacks Rank & Key Picks

Scotts Miracle-Gro currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks worth considering in the basic materials space include Albemarle Corporation ALB, Commercial Metals Company CMC and AdvanSix Inc. ASIX.

Albemarle, currently sporting a Zacks Rank #1, has an expected earnings growth rate of 49.8% for the current year. The Zacks Consensus Estimate for ALB's current-year earnings has been revised 9.2% upward in the past 60 days. You can see the complete list of today’s Zacks #1 Rank stocks here.

Albemarle beat the Zacks Consensus Estimate for earnings in each of the trailing four quarters, the average being 22.1%. ALB has rallied around 39% in a year.

Commercial Metals, flaunting a Zacks Rank #1, has a projected earnings growth rate of 10.5% for the current fiscal year. CMC's consensus estimate for the current fiscal year has been revised 6.6% upward in the past 60 days.

Commercial Metals beat the Zacks Consensus Estimate for earnings in three of the last four quarters while missing once. It has a trailing four-quarter earnings surprise of roughly 7.4%, on average. CMC has rallied around 60% in a year.

AdvanSix has a projected earnings growth rate of 3.9% for the current year. The Zacks Consensus Estimate for ASIX’s earnings for the current year has been revised 1.6% upward in the past 60 days.

AdvanSix beat the Zacks Consensus Estimate for earnings in each of the trailing four quarters, the average being 46.9%. ASIX has rallied 111.1% in a year. It currently carries a Zacks Rank #2 (Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Albemarle Corporation (ALB) : Free Stock Analysis Report

The Scotts MiracleGro Company (SMG) : Free Stock Analysis Report

Commercial Metals Company (CMC) : Free Stock Analysis Report

AdvanSix (ASIX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance