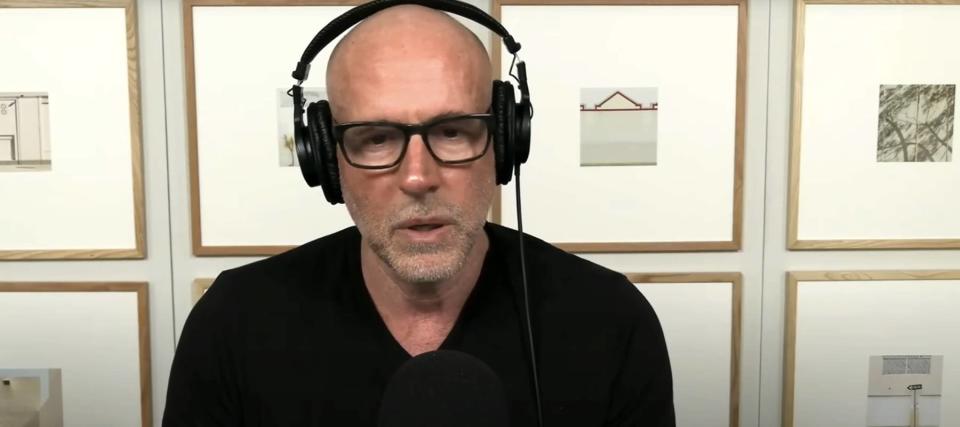

Scott Galloway shares his ultimate strategy for being rich — and you don't have to make loads of money

Not everyone believes being rich means making loads of money. Indeed, NYU professor Scott Galloway defines wealth as “passive income that’s greater than your burn.”

Galloway explained how young Americans can build wealth in an episode of the podcast “Modern Wisdom” with host. And it’s not about getting a bigger paycheck.

Don't miss

Commercial real estate has beaten the stock market for 25 years — but only the super rich could buy in. Here's how even ordinary investors can become the landlord of Walmart, Whole Foods or Kroger

Cost-of-living in America is still out of control — use these 3 'real assets' to protect your wealth today, no matter what the US Fed does or says

These 5 magic money moves will boost you up America's net worth ladder in 2024 — and you can complete each step within minutes. Here's how

The professor claims one of his friends works at an investment bank and makes $3 million in a bad year and $14 million in a good one. While he lives in Connecticut and pays an incredibly high tax rate (around 50%), by all accounts he still earns a lot of money.

“But between his ex-wife, his alimony, his child support, his home in the Hamptons, his Master of the Universe lifestyle that he thinks he needs and wants to signal to his friends, I know firsthand he doesn’t save a lot of money,” Galloway said.

He’s an example of what Galloway refers to as “the working poor.” Despite how much money the friend makes, his need to maintain a certain lifestyle is an enormous source of stress on him and on his marriage.

On the other hand, Galloway’s retired father has a Royal Navy pension and Social Security benefits — plus, he owns about a dozen washing machines in trailer parks. He makes about $52,000 a year without really working (as Galloway points out, he enjoys going out to collect the machine quarters). Yet, he only spends about $48,000 annually.

“His passive income is greater than his burn,” Galloway said. “That’s the definition of rich.”

This is despite the fact that his father makes less than the median annual income of $59,228 for a full-time worker as of the first quarter of 2024, according to the Bureau of Labor Statistics.

Being rich is “an absence from anxiety,” Galloway said. “You want to be able to live well.”

That way, he says, if you choose to keep working in your golden years, it’s a choice rather than an obligation.

Leverage the power of compounding

From Galloway’s perspective, part of being rich means you’re bringing in more income from your investments than you spend. And building that passive income is easier when you start at a younger age since you’ll benefit from the power of compounding.

For example, thanks to compound interest, if you invest $500 each month for 40 years, assuming an 8% annual return, you will end up with over $1.5 million. You may want to sit down with a reputable financial adviser or use retirement planning tools to figure out how much you’ll need to save, accounting for inflation, to meet your retirement goals.

Read more: Car insurance rates have spiked in the US to a stunning $2,150/year — but you can be smarter than that. Here's how you can save yourself as much as $820 annually in minutes (it's 100% free)

Galloway also recommends diversifying your investment portfolio, which means investing in different types of investments. This helps to spread your risk across different asset classes, from more traditional stocks and bonds to alternative assets such as commodities and real estate.

“I don’t put more than 3% of my net worth in any one investment,” Galloway said.

It’s a lesson he claims to have learned the hard way, losing his wealth twice.

“For your own financial well-being, much less your own mental well-being, embrace diversification.”

That way, he says, if the market is down, “nothing’s ever critical, much less fatal.”

Be disciplined with your spending

By Galloway’s own admission, getting rich — losing it — and getting rich again didn’t have a lot to do with him. For better and worse, it had to do with the market. And, in hindsight, it’s not a strategy he would recommend. Rather, he says that while you can’t control fluctuations in the market, you can control how much you spend and how much you save.

When Galloway was younger and worked for Morgan Stanley, he got his first bonus — to the tune of $28,000. He used this money to buy a $35,000 BMW. (He also hung a pair of swimming goggles from the rearview mirror, even though he didn’t swim, thinking it would impress women).

But, he admits, had he bought a significantly less expensive car instead and invested the rest of the money in the market, he would have generated substantial savings.

“Be disciplined about putting some money in low-cost ETFs and index funds,” he said

According to Galloway, building wealth takes time and diversified investments — along with the power of compounding.

What to read next

Car insurance premiums in America are through the roof — and only getting worse. But 5 minutes could have you paying as little as $29/month

Jeff Bezos and Oprah Winfrey invest in this asset to keep their wealth safe — you may want to do the same in 2024

Stop crushing your retirement dreams with wealth-killing costs and headaches — here are 10 'must-haves' when choosing a trading platform (and 1 option that has them all)

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.