Scotia Canadian Equity Fund's Strategic Moves: A Deep Dive into the Sale of WSP Global Inc

Insights from the Latest N-PORT Filing for Q2 2024

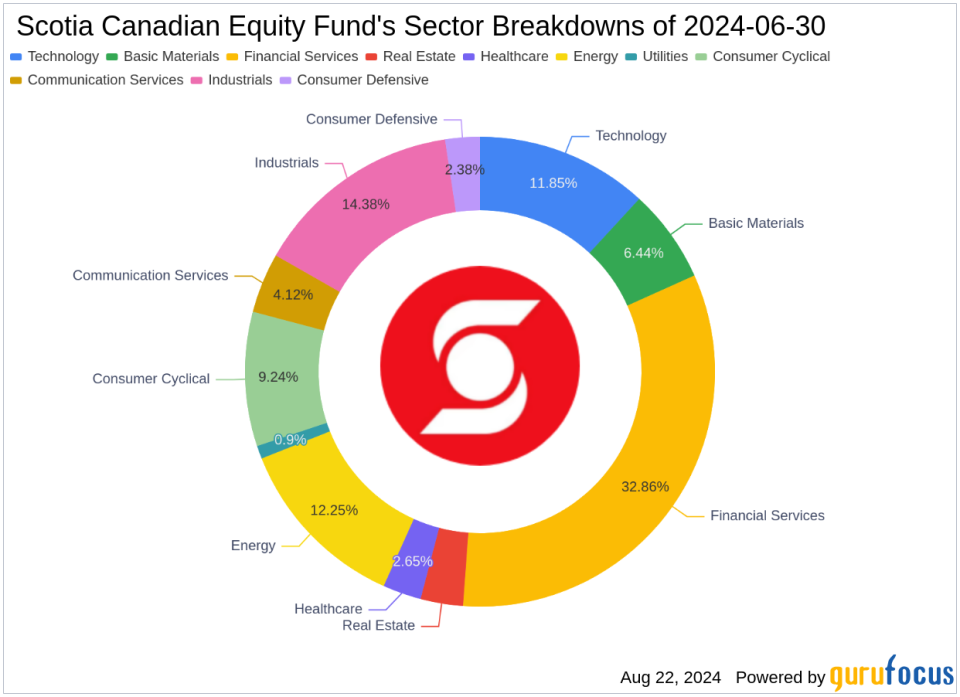

Scotia Canadian Equity Fund (Trades, Portfolio), known for its strategic investments in large Canadian companies, recently disclosed its portfolio updates for the second quarter of 2024 through an N-PORT filing. The fund aims for long-term capital growth by investing in a diverse range of high-quality equity securities, focusing on large-cap Canadian equities with a growth bias. This approach provides investors with substantial exposure to various economic sectors, enhancing the portfolio's resilience and potential for growth.

New Additions to the Portfolio

During the second quarter, Scotia Canadian Equity Fund (Trades, Portfolio) expanded its portfolio by acquiring shares in two notable companies:

Open Text Corp (TSX:OTEX) was the primary new addition with 165,000 shares, making up 1.44% of the portfolio, valued at C$6.78 million.

ATS Corp (TSX:ATS) followed, with the fund purchasing 130,000 shares, which represent about 1.22% of the portfolio, totaling C$5.76 million.

Significant Increases in Existing Positions

The fund also increased its stakes in several companies, with the most significant boosts in:

West Fraser Timber Co. Ltd (TSX:WFG), where the fund added 27,700 shares, increasing the total to 58,700 shares. This adjustment marked an 89.35% increase in share count, impacting the portfolio by 0.62%, with a total value of C$6.17 million.

Atkinsrealis Group Inc (TSX:ATRL) saw an addition of 41,000 shares, bringing the total to 158,000. This adjustment represents a 35.04% increase in share count, with a total value of C$9.36 million.

Complete Exits from Certain Holdings

The fund decided to exit completely from four holdings, including:

WSP Global Inc (TSX:WSP), where all 36,300 shares were sold, resulting in a -1.49% impact on the portfolio.

Salesforce Inc (NYSE:CRM), with all 13,200 shares liquidated, causing a -1.02% impact on the portfolio.

Reductions in Key Positions

Reductions were also part of the fund's strategy this quarter, with significant cuts in:

Carlisle Companies Inc (NYSE:CSL), where 5,800 shares were sold, leading to a -28.16% decrease in shares and a -0.53% impact on the portfolio. The stock traded at an average price of $371.62 during the quarter and has returned -2.75% over the past three months and 32.42% year-to-date.

The Walt Disney Co (NYSE:DIS), with 19,200 shares reduced, marking a -24.62% reduction in shares and a -0.51% impact on the portfolio. The stock traded at an average price of $106.08 during the quarter and has returned -12.31% over the past three months and 0.05% year-to-date.

Portfolio Overview and Sector Allocation

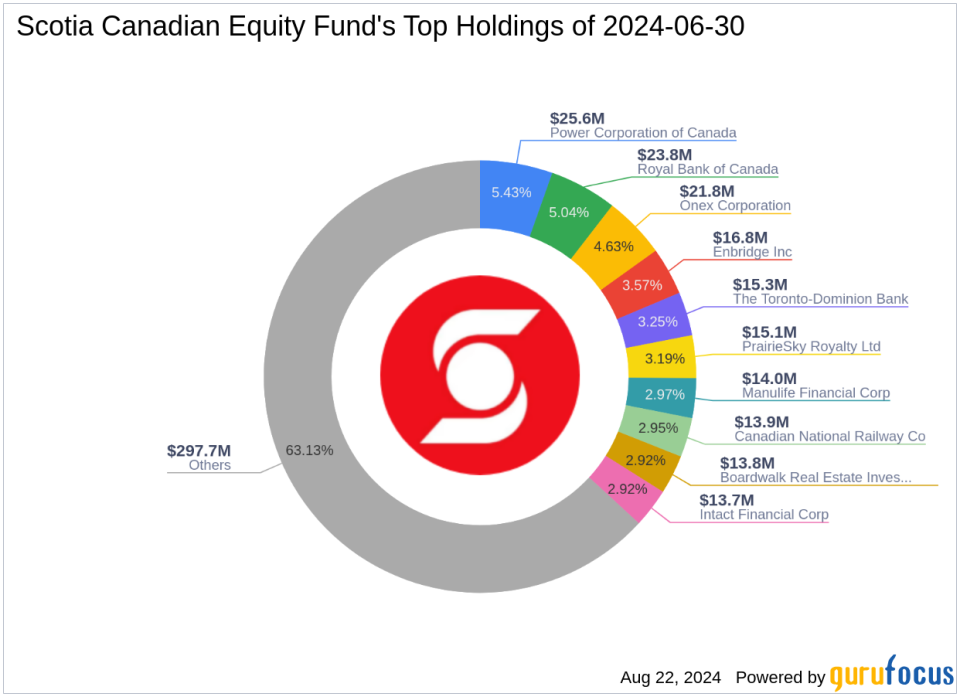

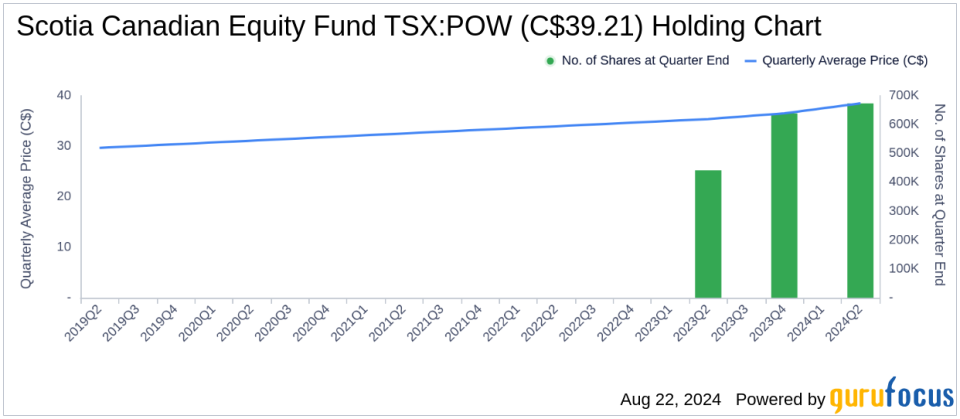

As of the second quarter of 2024, Scotia Canadian Equity Fund (Trades, Portfolio)'s portfolio included 44 stocks. The top holdings were 5.43% in Power Corporation of Canada (TSX:POW), 5.04% in Royal Bank of Canada (TSX:RY), 4.63% in Onex Corporation (TSX:ONEX), 3.57% in Enbridge Inc (TSX:ENB), and 3.25% in The Toronto-Dominion Bank (TSX:TD). The holdings are mainly concentrated across 11 industries, ensuring a balanced exposure to various sectors.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.