Scientific Games (SGMS) Q3 Earnings Beat, Revenues Rise Y/Y

Scientific Games SGMS reported third-quarter 2021 earnings of 96 cents per share that beat the Zacks Consensus Estimate by 113.3%. The company had reported a loss of $2.03 per share in the year-ago quarter.

Revenues were $539 million, up 24.8% year over year, driven by strong growth in the Gaming business. The figure lagged the consensus mark for revenues by 29%.

Services revenues surged 21.1% year over year to $408 million. Product sales soared 37.9% year over year to $131 million.

Quarter Details

Gaming revenues (62.9% of revenues) surged 46.8% year over year to $339 million, driven by the robust performance of Table Products.

Digital (9.8% of revenues) revenues increased 6% year over year to $53 million.

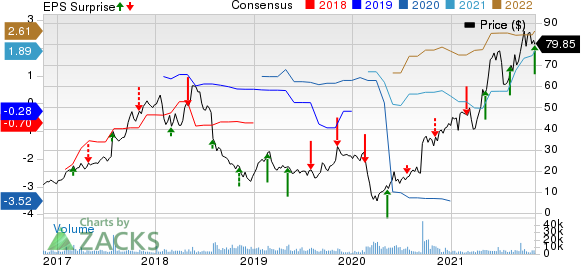

Scientific Games Corp Price, Consensus and EPS Surprise

Scientific Games Corp price-consensus-eps-surprise-chart | Scientific Games Corp Quote

SciPlay revenues (27.3% of revenues) declined 2.6% year over year to $147 million. Average Revenue Per Daily Active User was 69 cents, down 4.2% year over year.

Consolidated adjusted EBITDA (AEBITDA) surged 73.5% year over year to $203 million. AEBITDA margin, as a percentage of revenues, were 37.7%, significantly higher than 27.1% reported in the year-ago quarter.

Gaming AEBITDA was $172 million, up 123.4% year over year. Digital AEBITDA soared 12.5% from the year-ago quarter to $18 million. SciPlay AEBITDA decreased 8.2% to $45 million.

Selling, general and administrative expenses increased 12.3% year over year to $164 million. Research & development expenses surged 30.6% to $47 million.

Balance Sheet & Cash Flow

As of Sep 30, 2021 cash and cash equivalents were $821 million compared with $983 million as of Jun 30, 2021.

Total debt was $8.85 billion as of Sep 30, 2021 compared with $9 billion as of Jun 30, 2021.

Net debt leverage ratio was 6.6 times as of Sep 30, 2021.

Acquisition

On Nov 3, Scientific Games completed the acquisition of Authentic Gaming.

Zacks Rank & Stocks to Consider

Scientific Games currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the broader technology sector include Cisco Systems CSCO, Applied Materials AMAT and Box BOX. All the three stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Cisco, Applied Materials and Box are set to report their earnings results on Nov 17, 18 and 30, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Scientific Games Corp (SGMS) : Free Stock Analysis Report

Cisco Systems, Inc. (CSCO) : Free Stock Analysis Report

Applied Materials, Inc. (AMAT) : Free Stock Analysis Report

Box, Inc. (BOX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance