Scalping the NZDJPY Breakdown

DailyFX.com -

Talking Points

NZDJPY outside reversal week shifts bias back to the downside

Weekly opening range taking shape just below multi-month infection zone

NZD/JPY Daily Chart

Chart Created Using FXCM Marketscope 2.0

Technical Outlook

NZDJPY breaks multi-month support structure at 85.66/84- now resistance

Scalps looking to sell rallies sub today’s high 86.07-bearish invalidation

Breach targets 200DMA & Pitchfork resistance

Interim support 84.25- break targets support objectives at 83.42 & 82.50/59

Daily RSI support-trigger break last week- bearish

Deepest pullback in momentum since January- bearish

Event Risk Ahead: Australia Building Permits & ANZ Business Confidence and Japanese Jobless Rate & Industrial Production tonight and Japanese Tankan Index tomorrow

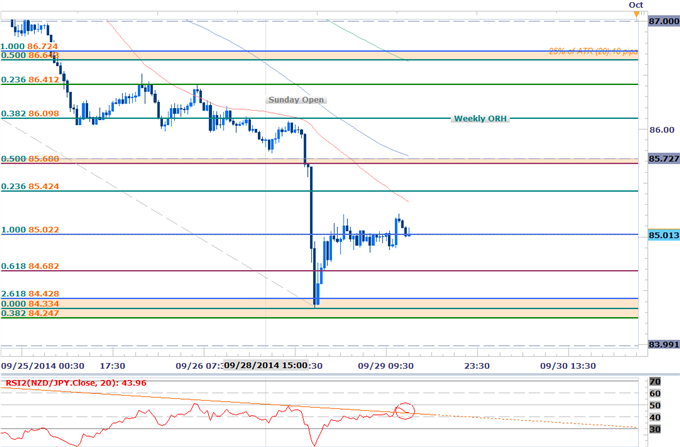

NZD/JPY 30min Chart

Notes: Last week’s outside reversal candle took out the entire monthly range with the break of the monthly opening range low re-affirming our short-side scalp bias. The pair rebounded off the 2.618% Fibonacci extension off the September highs (at 84.42) in overnight trade and we’ll look to use this move to re-establish short exposure at more favorable levels.

Bottom line: looking to sell rallies while below the 85.68/72 resistance target with only breach above this week’s high at 86.07 invalidating our near-term scalp bias. Caution is warranted on this pair heading into the close of the month/quarter with event risk out of Japan tonight and tomorrow likely to fuel added volatility in yen crosses. Follow the progress of trade setups like these and more throughout the trading week with DailyFX on Demand.

* It’s extremely important to give added consideration regarding the timing of intra-day scalps with the opening ranges on a session & hourly basis offering further clarity on intra-day biases.

Key Threshold Grid

Entry/Exit Targets | Timeframe | Level | Technical Relevance |

Resistance Target 1 | Daily / 30min | 85.02 | 100% Extension |

Resistance Target 2 | 30min | 85.42 | 23.6% Retracement |

Resistance Target 3 | Daily / 30min | 85.68/73 | 50% Retrace / August Low |

Bearish Invalidation | 30min | 86.07/10 | Weekly ORH / 38.2% Retracement |

Break Target 1 | Daily / 30min | 86.41 | 23.6% Retracement |

Break Target 2 | 30min | 87.00 | Soft Resistance / Pivot |

Break Target 3 | 30min | 87.19/26 | 61.8% Retracement & Extension |

Break Target 4 | 30min | 87.55/60 | Soft Resistance / Pivot / 100DMA |

Break Target 5 | 30min | 87.97 | 78.6% Retracement |

Support Target 1 | Daily / 30min | 84.68 | 61.8% Retracement (2014 Range) |

Bullish Invalidation | Daily / 30min | 84.25/42 | 38.2% Retrace / Sept Low / 2.618% Ext |

Break Target 1 | 30min | 84.00 | Feb Swing Low / October High |

Break Target 2 | Daily / 30min | 83.45 | 76.4% Retracement |

Break Target 3 | Daily / 30min | 82.50/59 | 50% Retracement / 1.618% Extension |

Break Target 4 | Daily | 82.00 | Psychological Barrier / Big Figure |

Break Target 5 | Daily | 81.42 | 2014 Low |

Daily (20) | 72 | Profit Targets 16-18pips | |

*ORH: Opening Range High

*ORL: Opening Range Low

Other Setups in Play:

GBPUSD Range in Focus- Scalps Target Key Inflection Zone at 1.6253

GBPAUD Rally Stalls at Key Resistance - Long Scalps at Risk Sub 1.8444

AUDNZD Scalps Targets Key Inflection Range - 1.1020 Critical Support

AUDJPY Outside Reversal Day- Scalps Favor Buying Dips Above 96.38

EURUSD Short Bias at Risk Ahead of FOMC- 1.29 Bullish Invalidation

AUDCHF Monthly Opening Range Setup- Scalps Target Key Support

---Written by Michael Boutros, Currency Strategist with DailyFX

For updates on this scalp and more setups follow him on Twitter @MBForex

To contact Michael email mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars next week on Monday on DailyFX and Tuesday – Thursday on DailyFX Plus (Exclusive of Live Clients) at 12:30 GMT (8:30ET)

Interested in learning about Fibonacci? Watch this Video

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance