Savings rates reach their highest since 2016

The rates of notice savings accounts are at their highest levels since 2016, according to new analysis.

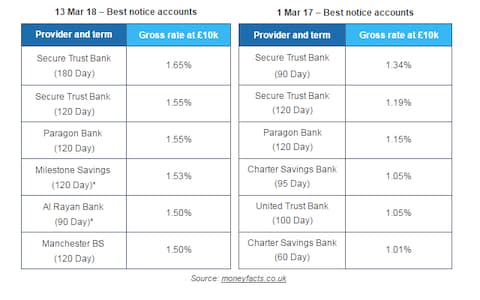

While notice accounts are not every saver's first choice, competition among providers has bolstered rates by up to 30pc in the last year.

Secure Trust Bank's 120-day notice account, which paid 1.19pc in March 2017, now offers 1.55pc, according to Moneyfacts, the data firm. The same bank's 180-day notice account pays a top rate of 1.65pc – the highest rate on offer since June 2016.

The more restrictive the savings account, the more savers can earn.

Notice periods tend to be between 30 days up to around six months. The interest rate is not fixed and can change at any time.

Notice accounts pay more than easy-access – 1.3pc is the top rate from RCI Bank and Virgin Money – but significantly less than longer-term accounts, the rates of which have also been creeping up.

In the last few weeks, providers of fixed-rate bonds and Isas have jostled for position in the best buy tables.

The improvements have been small but experts suggest better deals could be around the corner, which would be welcome news to savers after years of poor interest rates.

Vanquis Bank Savings' recently launched market-leading three, four and five-year bonds pay 2.3pc, 2.47pc and 2.56pc respectively. These savings rates are the highest on offer since 2016.

These accounts slide just ahead of Ikano Bank's bonds of the same terms, which offer returns of 2.26pc, 2.36pc and 2.52pc.

Virgin Money's new fixed-rate Isas pay slightly more than rivals. Its one-year Isa offers 1.5pc, pushing OakNorth Bank's 1.46pc account into second place.

Virgin has also launched a three-year Isa offering 2pc, the highest rate available since last November.

The top variable rate Isas are also paying the best rates since 2016.

Rachel Springall from Moneyfacts said as rates improve we could see more competition in the best buy tables as providers "extend their range of deals to suit different types of savers".

Yahoo Finance

Yahoo Finance