Savings among millennials jumped 31% per annum, the highest among all age groups, says UOB

Millennials, or those born between 1981 and 2000, had the biggest increase in their savings balances from mid 2015 to mid 2018, compared to other age groups. Their savings balances jumping 31% per annum to $27,000 over the three year period. These numbers were cited by United Overseas Bank, based on their analysis of the transaction patterns of its flagship UOB One Account holders.

Millennials also make up the majority (54%) of UOB One Account holders.

The findings corroborated the findings from the Visa Millennials Study 2016 where – compared with other generations – millennials were found to be the most focused on saving and investing.

According to UOB, the next best savers were the Generation X, those born between 1965 and 1980, whose savings balances rose 11% per annum to $34,000. Savings balances for Baby Boomers – those born between 1946 and 1964 – were relatively unchanged at $32,000.

“Contrary to conventional wisdom, millennials are not focused solely on living in the moment,” said Jacquelyn Tan, Head of Personal Financial Services Singapore, UOB. “They are actually very conscious of the need to save for the future. We can see from the results that they use the UOB One Account as a foundational part of their savings and investment plan.”

What’s so great about the UOB One Account?

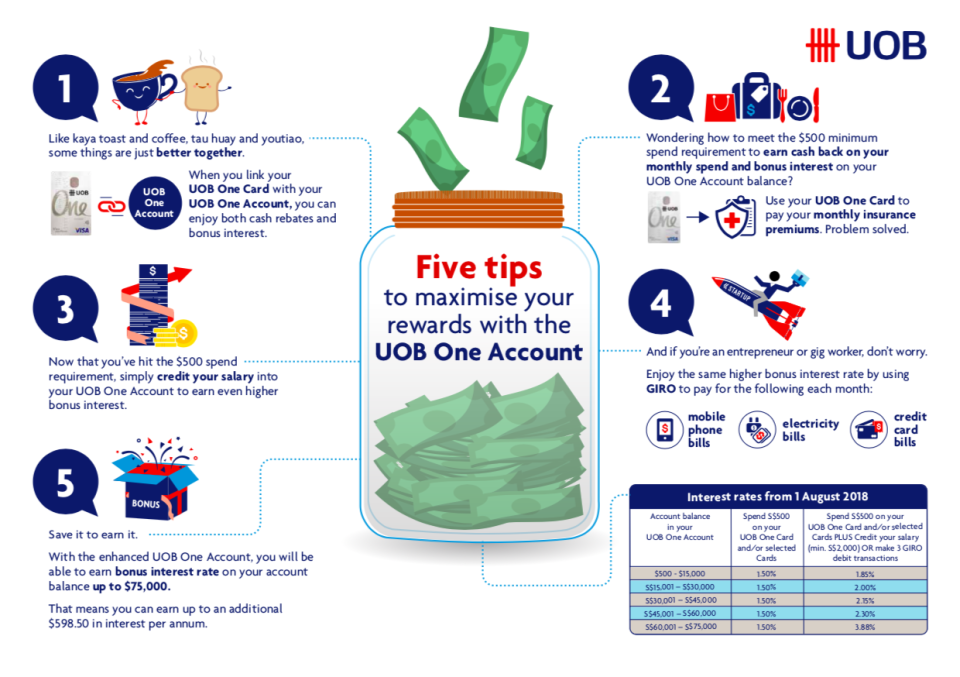

The UOB One Account rewards account holders by offering bonus interest rates for salary crediting and GIRO payments. Account holders are also able to earn a cash back rebate of up to 5% when they spend a minimum of $500 on their UOB One credit card. 50% of UOB One Account holders also hold a UOB One credit card.

Since the launch of the UOB One Account, UOB has seen more than a quarter of a million accounts opened, and has rewarded UOB One Account holders with more than $70 million in interest.

New enhanced features on the UOB One Account

With the aim of incentivising and maximising this saving habit among millennials, UOB is celebrating the third anniversary of the UOB One Account with enhanced features to reward customers who spend on their UOB One credit card and increase their account balances in their UOB One Account.

From 1 August 2018, UOB One Account holders will enjoy a higher bonus interest of 1.5% on the first $15,000 when they also spend a minimum of $500 on their UOB One credit card. The bonus interest is an increase from the 1% bonus previously enjoyed by account holders on the first $10,000.

UOB has also increased the balance amount on which UOB One Account holders can earn the maximum bonus interest, from $50,000 to $60,000, up to $75,000.The top bonus interest has also been increased from 3.33% to 3.88%, for customers with an account balance of between $60,000 to $75,000.

That means, a customer with $75,000 in their UOB One Account will earn an extra $600 in bonus interest per annum with the refreshed UOB One account and card bundle benefits.

If that’s too much information to take in at once, here’s a useful infographic to sum it all up.

5 tips to maximise your rewards with the UOB One Account

Source: UOB

“With the latest enhancements, we are giving consumers more reasons to save and to transact using a single account,” added Ms Tan.

Right now, UOB is also running its ‘Nation of Savers’ campaign from now to 31 August 2018. As part of the promotion, customers – who are Singapore citizens or SPR – will receive $100 in their new UOB One Account when they apply for it online. Accounts can be opened instantly between 8.30am and 9pm at www.uob.com.sg/oneaccount through MyInfo, with the use of their SingPass. Once the account open, customers will be able to login, view their balances and fund their accounts immediately. The digitised UOB Debit Card will be available on the next working day and online transactions like PayNow, fund transfer and bill payment would be available upon the set up of Mighty Secure with the customer’s new Card and PIN.

(By Gwyneth Yeo)

Related Articles

- Myths about Will Writing in Singapore: Debunked!

- Travel Taboos You Should Follow – Better Be Safe Than Sorry!

- Romantic Getaway Destinations You And Your Partner Will Love

Yahoo Finance

Yahoo Finance