Sarepta (SRPT) Q1 Earnings Beat, DMD Drugs' Sales Robust

Sarepta Therapeutics, Inc. SRPT reported a loss of $1.20 per share for the first quarter of 2022, narrower than the Zacks Consensus Estimate of a loss of $1.35 per share. The loss was also narrower than the year-ago loss of $2.10 per share.

The company reported adjusted loss of 56 cents per share, down from $1.44 in the year-ago quarter. The adjusted figure excludes one-time items, depreciation & amortization expenses, interest expenses, income tax benefit, stock-based compensation expenses, and other items.

Sarepta recorded total revenues of $210.8 million, up 43.5% year over year. Revenues beat the Zacks Consensus Estimate of $203.52 million. The year-over-year increase in revenues was driven by additional sales following the launch of Amondys 45 in February 2021 and continued demand for Sarepta’s two other drugs — Exondys 51 and Vyondys 53.

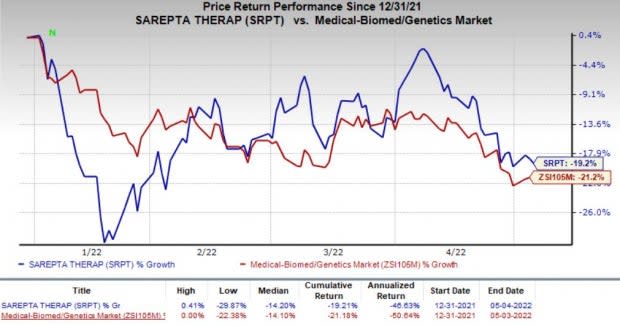

Shares of Sarepta were up 1% in after-hours trading on May 4 following better-than-expected first-quarter results. Sarepta’s shares have lost 19.2% so far this year compared with the industry’s decrease of 21.2%.

Image Source: Zacks Investment Research

Quarter in Details

Sarepta’s commercial portfolio includes three drugs approved for treating Duchenne muscular dystrophy (“DMD”) — Exondys 51, Vyondys 53 and Amondys 45.

The company derived product revenues of $188.8 million, up 51.2% year over year.

The company recorded $22 million in collaboration revenues, primarily from its licensing agreement with Roche RHHBY. Collaboration revenues were flat compared with the year-ago quarter.

Sarepta and Roche entered into a licensing agreement to develop SRP-9001 in 2019. Per the agreement, Roche has exclusive rights to launch and commercialize SRP-9001 in ex-U.S. markets.

Adjusted research and development (R&D) expenses totaled $173.2 million in the first quarter, down 2.4% year over year.

Adjusted selling, general & administrative (SG&A) expenses were $53.2 million, down 3.2% year over year.

2022 Guidance

Sarepta reiterated its guidance for revenues in 2022. The company expects total revenues in 2022 to be more than $880 million. The company expects its net product revenues to be more than $800 million in 2022, indicating year-over-year growth of more than 30%.

Pipeline Update

In March, Sarepta presented new functional and biopsy data from a phase I/II study — Study SRP-9003-101 — evaluating its gene therapy for treating limb-girdle muscular dystrophy Type 2E (LGMD2E). Data from the study demonstrated that treatment with SRP-9003 leads to sustained improvements in functional outcomes in LGMD2E patients.

Sarepta Therapeutics, Inc. Price, Consensus and EPS Surprise

Sarepta Therapeutics, Inc. price-consensus-eps-surprise-chart | Sarepta Therapeutics, Inc. Quote

Zacks Rank and Stocks to Consider

Sarepta currently has a Zacks Rank #3 (Hold).

A couple of better-ranked drug/biotech stocks include Xencor XNCR and Lyell Immunopharma LYEL. While Xencor sports a Zacks Rank #1 (Strong Buy), Lyell carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Xencor’sloss per share estimates have improved from $2.96 to $2.67 for 2022 and from $3.24 to $3.03 for 2023 in the past 30 days. XNCR stock has lost 35.7% so far this year.

Xencor delivered an earnings surprise of 125.72%, on average, in the last four quarters.

Lyell's loss per share estimates have narrowed from $1.19 to $1.09 for 2022 and from $1.52 to $1.41 for 2023 in the past 30 days. LYEL stock has lost 30% so far this year.

Lyell delivered an earnings surprise of 25.26%, on average, in the last four quarters.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Roche Holding AG (RHHBY) : Free Stock Analysis Report

Sarepta Therapeutics, Inc. (SRPT) : Free Stock Analysis Report

Xencor, Inc. (XNCR) : Free Stock Analysis Report

Lyell Immunopharma, Inc. (LYEL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance