Sanofi (SNY) Ends Development of Breast Cancer Drug, Stock Down

Shares of Sanofi SNY were down 5.8% in the pre-market trading session on Aug 17, after management announced its decision to discontinue the development of its investigational oral selective estrogen receptor degrader (SERD) candidate, amcenestrant, which was being evaluated for breast cancer.

The decision was based on results from a prespecified interim analysis of the phase III AMEERA-5 study, which evaluated amcenestrant plus Pfizer’s PFE Ibrance (palbociclib) versus letrozole plus Ibrance in patients with ER+/HER2- advanced breast cancer.An independent data monitoring committee (IDMC) determined that the amcenestrant plus Ibrance combination, when compared to the letrozole plus Ibrance combination arm, failed to achieve the prespecified boundary required to continue the study.

Ibrance is a blockbuster drug marketed by Pfizer, which the FDA has approved for treating HR+, HER2- advanced or metastatic breast cancer in adults. In the first half of 2022, Pfizer recorded $2.6 billion from Ibrance product sales.

Based on this analysis, the IDMC recommended stopping the study and transitioning the study participants to an appropriate standard of care therapy, as determined by their physician. The study did not report any safety concerns among the participants who were administered the amcenestrant plus Pfizer’s Ibrance combination.

While Sanofi continues to review the above data, it has also decided to discontinue all other studies evaluating amcenestrant.

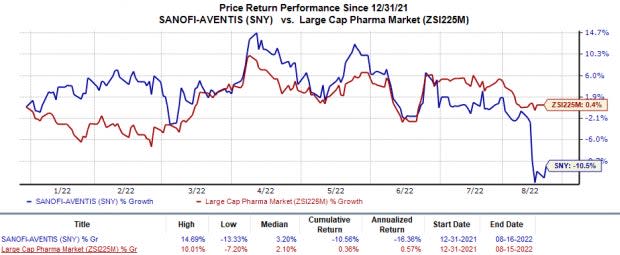

Shares of Sanofi have lost 10.6% in the year so far against the industry’s 0.4% rise.

Image Source: Zacks Investment Research

Earlier this March, Sanofi reported the phase II AMEERA-3 study, evaluating amcenestrant for treating ER+/HER2- advanced or metastatic breast cancer failed to meet the primary endpoint of improvement in progression-free survival.

The failure of a late-stage candidate like amcenestrant puts high pressure on Sanofi, whose sales are currently being driven by Dupixent, a blockbuster drug developed in partnership with Regeneron Pharmaceuticals REGN. The drug is currently approved for eczema, asthma, chronic rhinosinusitis with nasal polyposis and eosinophilic esophagitis indications.

Currently, Dupixent is the leading driver of growth for both Regeneron and Sanofi. Both REGN and SNY are also evaluating dupilumab in late-stage studies for a broad range of diseases driven by type 2 inflammations like chronic obstructive pulmonary disease, bullous pemphigoid and prurigo nodularis indications, among others. Continued label expansion of the drug has pulled up profits at both Sanofi and Regeneron.

Sanofi Price

Sanofi price | Sanofi Quote

Zacks Rank & Stocks to Consider

Sanofi currently carries a Zacks Rank #3 (Hold). A better-ranked stock in the overall healthcare sector is Sesen Bio SESN, which sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Estimates for Sesen Bio’s 2022 bottom line have narrowed from a loss of 44 cents to 43 cents in the past 30 days. Loss estimates for 2023 have narrowed from 35 cents to 1 cent during the same period. Share prices of Sesen Bio have fallen 12.0% in the year-to-date period.

Earnings of Sesen Bio beat estimates in each of the last four quarters, the average surprise being 89.49%. In the last reported quarter, Sesen Bio delivered an earnings surprise of 61.54%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Regeneron Pharmaceuticals, Inc. (REGN) : Free Stock Analysis Report

Sanofi (SNY) : Free Stock Analysis Report

Pfizer Inc. (PFE) : Free Stock Analysis Report

SESEN BIO, INC. (SESN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance