How Sanderson Farms (SAFM) Looks Just Ahead of Q2 Earnings

Sanderson Farms, Inc. SAFM is scheduled to report second-quarter fiscal 2020 results on May 28. Notably, this Mississippi-based company has a trailing four-quarter negative earnings surprise of 29.4%, on average.

The Zacks Consensus Estimate for second-quarter 2020 is pegged at a loss of 80 cents per share, compared with earnings of $1.83 reported in the year-ago quarter. Notably, the loss estimate has widened significantly in the past 30 days. The consensus mark for revenues is pegged at $872.3 million, which indicates an increase of 3.2% from the prior-year quarter’s reported figure.

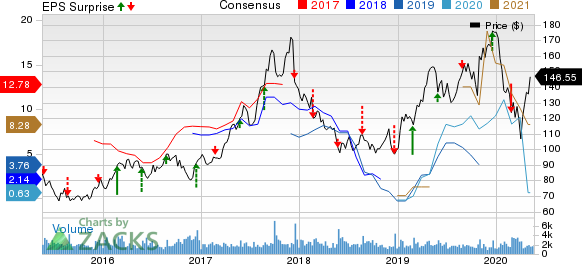

Sanderson Farms, Inc. Price, Consensus and EPS Surprise

Sanderson Farms, Inc. price-consensus-eps-surprise-chart | Sanderson Farms, Inc. Quote

Factors to Consider

Sanderson Farms has been seeing rising labor costs for the past few quarters now. Notably, during first-quarter fiscal 2020, the company’s labor costs rose $31.7 million or $1.67 per pound. Moreover, increased costs of the company’s primary feed ingredients like soybean meal and corn is a concern. Apart from these, Sanderson Farms announced on Mar 31 that it implemented a temporary weekly attendance bonus for its employees for each hour worked amid the coronavirus outbreak. We believe that such rise in employee-related costs is likely to have put pressure on the company’s bottom line in fiscal second quarter.

Nevertheless, Sanderson Farms has been benefiting from elevated average sales price for its poultry products including jumbo wings and leg quarter among others. Moreover, poultry products in the retail grocery stores are enjoying favorable demand. Also, with regard to the export market, the company has been optimistic about demand and prices for its poultry products courtesy of worldwide protein deficit stemming from the African swine fever’s impact on Asian pork supplies.

What the Zacks Model Unveils

Our proven model doesn’t predict an earnings beat for Sanderson Farms this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Sanderson Farms carries a Zacks Rank #3 and an Earnings ESP of -100.00%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Stocks With Favorable Combinations

Here are some companies you may want to consider, as our model shows that these too have the right combination of elements to post an earnings beat.

Campbell Soup CPB has an Earnings ESP of +12.17% and a Zacks Rank #2.

Smucker SJM has an Earnings ESP of +4.06% and a Zacks Rank #2.

Conagra Brands CAG has an Earnings ESP of +5.39% and a Zacks Rank #2.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Conagra Brands Inc. (CAG) : Free Stock Analysis Report

Campbell Soup Company (CPB) : Free Stock Analysis Report

The J. M. Smucker Company (SJM) : Free Stock Analysis Report

Sanderson Farms, Inc. (SAFM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance