Saba Capital Management, L.P. Reduces Stake in Blackrock Muniyield NY Quality FD, Inc

On September 30, 2024, Saba Capital Management, L.P. (Trades, Portfolio), a prominent investment firm, executed a significant transaction by reducing its holdings in Blackrock Muniyield NY Quality FD, Inc (NYSE:MYN). This move involved the sale of 287,772 shares at a price of $10.78 each, adjusting the firm's total shares in MYN to 1,913,913. This adjustment represents a 0.34% position in the firm's portfolio and a 4.99% ownership in MYN.

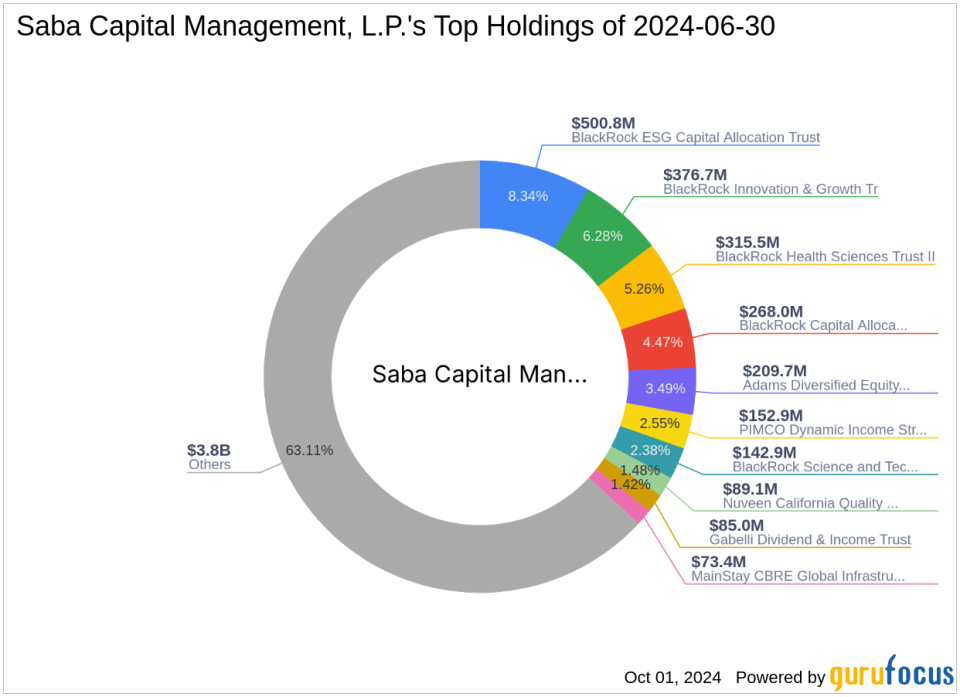

Insight into Saba Capital Management, L.P. (Trades, Portfolio)

Saba Capital Management, L.P. (Trades, Portfolio), based at 405 Lexington Avenue, New York, NY, is recognized for its strategic investment approaches, focusing primarily on opportunities that provide high returns. The firm manages an equity portfolio worth approximately $6 billion, with significant positions in sectors like Financial Services and Communication Services. Its top holdings include Adams Diversified Equity Fund Inc (NYSE:ADX), BlackRock Capital Allocation Trust (NYSE:BCAT), and several others reflecting a diverse and strategic market engagement.

Transaction Details and Portfolio Impact

The recent transaction by Saba Capital Management marks a reduction in their stake in MYN, bringing down their total shares to 1,913,913. This move has a minor impact on their portfolio, reducing it by 0.05%. Despite this sale, MYN still constitutes a significant part of their investment strategy, holding nearly 5% of the total shares outstanding of the fund.

About Blackrock Muniyield NY Quality FD, Inc

Blackrock Muniyield NY Quality FD, Inc is a closed-end management investment company focusing on high current income exempt from federal income taxes, primarily through investment in long-term municipal obligations. With a market capitalization of approximately $414.407 million and a PE ratio of 31.91, MYN offers a unique value proposition in the asset management industry.

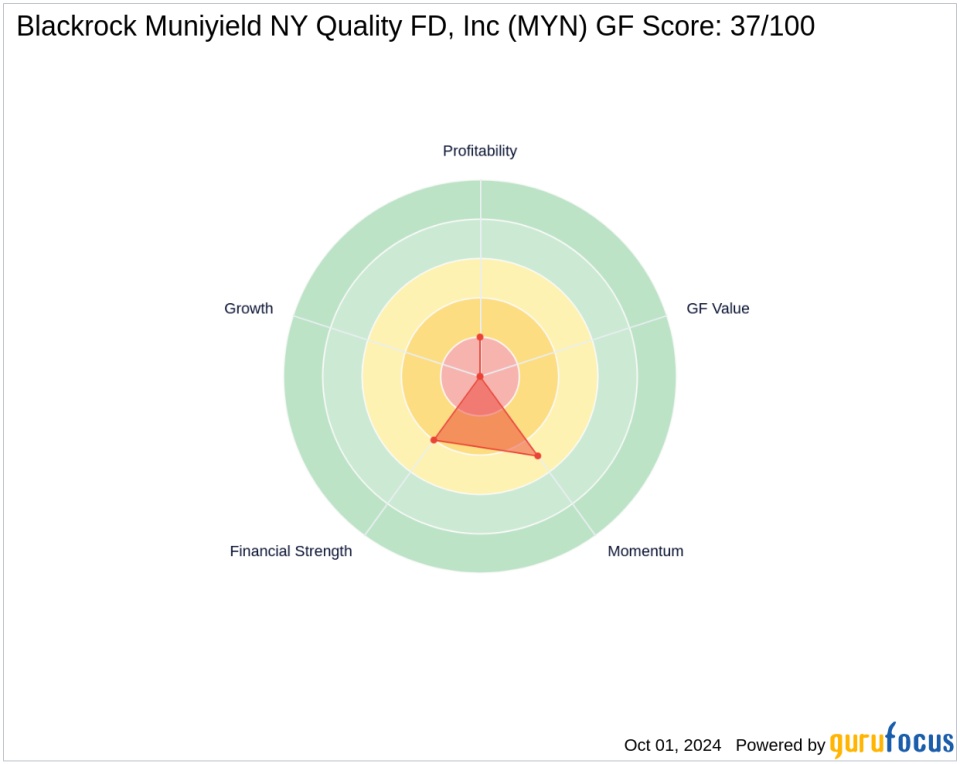

Market Performance and Valuation Metrics

Currently, MYN's stock price stands at $10.8163, showing a year-to-date increase of 4.2%. However, the stock has experienced a decline of 27.89% since its IPO. The GF Score of 37/100 indicates potential challenges in future performance, with specific weaknesses in profitability, growth, and valuation ranks.

Investment Rationale Behind the Reduction

The decision by Saba Capital to reduce its position in MYN could be influenced by several factors including the fund's current market performance, its GF Score, and the broader market conditions. The firm's strategy often involves rebalancing its portfolio to optimize returns, and this reduction might reflect a strategic realignment with its investment objectives.

Sector and Market Context

The asset management sector is currently experiencing various shifts, influenced by economic changes and market dynamics. Saba Capitals adjustment in MYN holdings might also be a response to these broader sector movements, aiming to capitalize on more lucrative opportunities or to mitigate risks associated with the current market environment.

This transaction by Saba Capital Management, L.P. (Trades, Portfolio) not only reflects its strategic financial maneuvers but also highlights the dynamic nature of investment decisions in response to changing market conditions and portfolio objectives.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.