Roper (ROP) to Report Q4 Earnings: What's in the Offing?

Roper Technologies, Inc. ROP is scheduled to release fourth-quarter 2021 results on Feb 2, before market open.

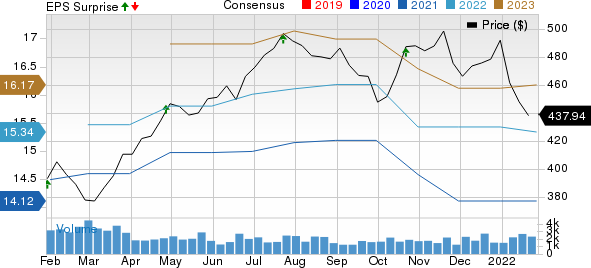

The company delivered better-than-expected results in the last four quarters, the earnings surprise being 3.62%, on average. In the last reported quarter, the company’s earnings of $3.91 surpassed the Zacks Consensus Estimate of $3.86 by 1.30%.

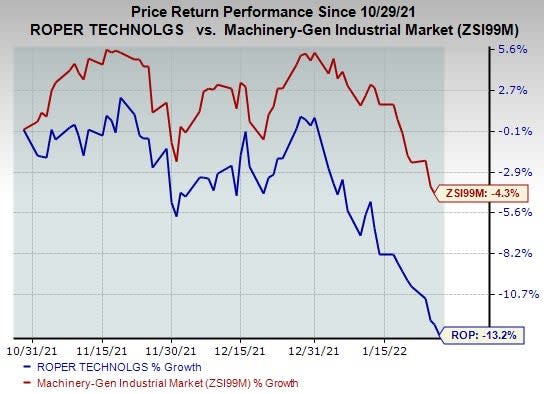

In the past three months, shares of Roper have lost 13.2% compared with the industry’s decline of 4.3%.

Image Source: Zacks Investment Research

Let us delve deeper.

Key Factors & Estimates for Q4

Roper is expected to have gained from solid product offerings and focus on innovation in the fourth quarter of 2021. Solid operational execution and market strategies are likely to have boosted the quarter’s performance. Synergies from buyouts and gains from business divestments are anticipated to get reflected on the results. Notably, acquired assets/divestments boosted the company’s sales by 9% in the third quarter of 2021.

On the flip side, Roper’s results are anticipated to reflect the impacts of high costs and expenses. Notably, the company’s third-quarter margins suffered from a 20.2% year-over-year increase in the cost of sales and a 23.6% hike in selling, general and administrative expenses. Headwinds related to supply-chain restrictions, high debts and international operations are likely to have influenced fourth-quarter performance.

For the fourth quarter, Roper anticipates earnings (continuing operations) of $3.62-$3.66 per share. The projection suggests a decline from earnings of $3.91 per share reported in the third quarter of 2021 and growth from $3.56 per share recorded in the year-ago quarter.

The Zacks Consensus Estimate for Roper’s revenues is pegged at $1,502 million for the fourth quarter of 2021, suggesting a 0.2% decrease from the year-ago quarter’s reported number and 2.7% growth from the previous quarter’s reported figure. Earnings estimates are pegged at $3.66, indicating an increase of 2.8% from the year-ago reported figure and a 6.4% fall from the previous quarter’s reported number. Segmental discussion is provided below.

For the Application Software segment, strength in the healthcare segment as well as healthy Data Innovations, Aderant, Deltek, and CliniSys are anticipated to have aided in the fourth quarter. Both recurring and non-recurring revenues are expected to have been solid. For fourth-quarter 2021, the company anticipates the segment’s organic sales to increase in the double-digit range. The Zacks Consensus Estimate for the segment’s sales, pegged at $609 million, suggests a year-over-year increase of 10.9% and sequential growth of 1%.

The Network Software & Systems segment’s SoftWriters, DAT, SHP and MHA businesses are likely to have benefited from customer retention, end-market recovery and network expansion. For fourth-quarter 2021, the company anticipates organic sales of the segment to grow in the low-double-digit range. The consensus estimate of $349 million for the segment indicates a decline of 22.1% and growth of 1.7% from the respective year-ago and sequentially reported numbers.

Measurement & Analytical Solutions is anticipated to have gained from strength across Verathon, Neptune, and medical and industrial businesses in the quarter under review. The consensus estimate of $404 million suggests a rise of 8.3% from the year-ago reported number and 3.1% growth from the sequential figure.

Improvement in end markets is likely to have benefited the Process Technologies segment. The consensus estimate for Process Technologies, pegged at $138 million, suggests year-over-year growth of 1.5% and a sequential increase of 11.3%.

Earnings Whispers

Our proven model does not conclusively suggest an earnings beat for Roper this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of beating estimates. This is not the case with Roper as shown below. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: Roper has an Earnings ESP of 0.00% as both the Most Accurate Estimate and the Zacks Consensus Estimate are pegged at $3.66.

Roper Technologies, Inc. Price, Consensus and EPS Surprise

Roper Technologies, Inc. price-consensus-eps-surprise-chart | Roper Technologies, Inc. Quote

Zacks Rank: Roper currently carries a Zacks Rank #4 (Sell).

Stocks to Consider

Here are some companies that you may want to consider as, according to our model, these have the right combination of elements to beat on earnings this reporting cycle.

Sealed Air Corporation SEE currently has an Earnings ESP of +1.75% and is a Zacks #2 Ranked player. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Sealed Air’s earnings is pegged at $1.14 per share for the fourth quarter of 2021. The company delivered better-than-expected results in three of the last four quarters, while lagging estimates once. The average earnings surprise for SEE is 6.54%.

AGCO Corporation AGCO presently has an Earnings ESP of +25.42% and a Zacks Rank of 2.

For the fourth quarter of 2021, the Zacks Consensus Estimate for AGCO’s earnings has been decreased by 1.2% to $1.71 in the past 60 days. The company delivered better-than-expected results in the last four quarters, with an earnings surprise of 47.53%, on average.

Graco Inc. GGG currently has an Earnings ESP of +0.22% and a Zacks Rank #2.

The Zacks Consensus Estimate for Graco’s earnings is pegged at 64 cents per share for the fourth quarter of 2021. GGG delivered better-than-expected results in three of the last four quarters, while lagging estimates once. The earnings surprise was 6.58%, on average.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Roper Technologies, Inc. (ROP) : Free Stock Analysis Report

AGCO Corporation (AGCO) : Free Stock Analysis Report

Sealed Air Corporation (SEE) : Free Stock Analysis Report

Graco Inc. (GGG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance