Rollins' (ROL) Acquisitions Aid, Rising Expenses Ail

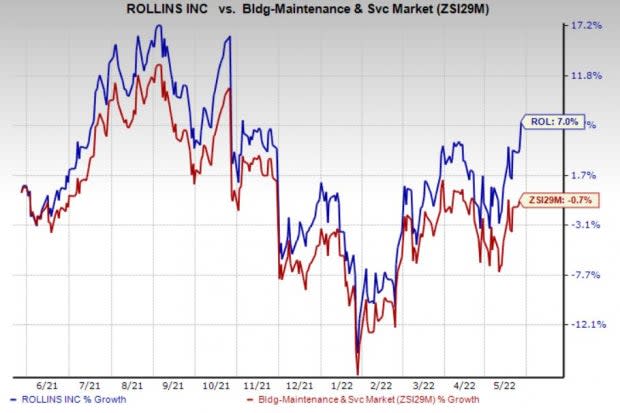

Rollins, Inc. ROL is a consistent dividend payer with a balanced approach to organic and inorganic growth. ROL’s shares have gained 7% in the past year against the 0.7% decline of the industry it belongs to.

Image Source: Zacks Investment Research

Rollins recently reported impressive first-quarter 2022 results, with both earnings and revenues beating the Zacks Consensus Estimate. Adjusted earnings of 15 cents per share surpassed the Zacks Consensus Estimate and the year-ago figure by 7.1%. Revenues of $590.7 million beat the consensus mark by 2.8% and improved 10.3% year over year.

How is Rollins Doing?

Rollins’ revenues have witnessed decent growth over the past five years. A balanced approach to organic and inorganic growth profiles is the key to its success. ROL’s organic revenue growth rate is healthy, driven by a strong technician and customer retention. Enhanced benefits are expected to improve employee and customer retention for the upcoming years.

Acquisitions are a significant catalyst for Rollins’ business development. With the help of strategic buyouts, ROL continues to expand its global brand recognition and geographical footprint, while also boosting its revenues. During first-quarter 2022, it completed eight purchases. Over the last three years, Rollins completed almost 100 transaction deals, including 39 in 2021. Last year, ROL witnessed revenue growth in its operations across Canada, Australia, the United Kingdom and Singapore. Its global network offers ample growth opportunities to access new markets.

Rollins is also consistent in rewarding its shareholders through dividend payments. Such concerted efforts not only instill investor confidence in the stock but also bolster its earnings per share. In first-quarter 2022, ROL paid out $49.2 million worth of dividends. Dividends amounting to $208.7 million, $160.5 million and $153.8 million were disbursed in 2021, 2020 and 2019, respectively.

However, Rollins continues to witness an escalation in costs resulting from acquisitions and IT-related expenses. During March-quarter 2022, operating expenses of $499.01 million grew 11.5% year over year.

Zacks Rank and Stocks to Consider

Rollins currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some better-ranked stocks in the broader Business Services sector are Cross Country Healthcare CCRN, Gartner IT and Avis Budget CAR, each sporting a Zacks Rank #1 at present.

Cross Country Healthcare has an expected earnings growth rate of 54.2% for the current year. CCRN has a trailing four-quarter earnings surprise of 29.2%, on average.

Cross Country Healthcare has a long-term earnings growth rate of 6.9%.

Gartner’s shares have risen 10.6% in the past year. IT delivered a trailing four-quarter earnings surprise of 24.2%, on average.

The Zacks Consensus Estimate for Gartner's current-year earnings has moved up 13.6% in the past 90 days.

Avis Budget has an expected earnings growth rate of 59.8% for the current year. CAR delivered a trailing four-quarter earnings surprise of 102.1%, on average.

Avis Budget has a long-term earnings growth rate of 19.4%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Avis Budget Group, Inc. (CAR) : Free Stock Analysis Report

Gartner, Inc. (IT) : Free Stock Analysis Report

Rollins, Inc. (ROL) : Free Stock Analysis Report

Cross Country Healthcare, Inc. (CCRN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance