Roku founder: We are in the golden age of TV

In Anthony Wood’s mind, Roku (ROKU) is just getting started on its mission to upend how people consume content.

So why bother riding off into the sunset?

“I have no plans on leaving. We have only been public a year and there are still huge opportunities in the streaming area,” Wood tells Yahoo Finance when asked if he has plans to step aside soon from the company he founded in 2002 and currently leads as CEO. Not only is he staying put, but he also has no desire to unload Roku to a larger media player like Netflix or Apple.

Wood owns about 21 million Roku shares, according to Bloomberg data.

“I have had several companies. I have done well on prior companies. I have no financial need to sell Roku or anything like that. I think that also makes it a little easier to focus on the bigger prize,” he says.

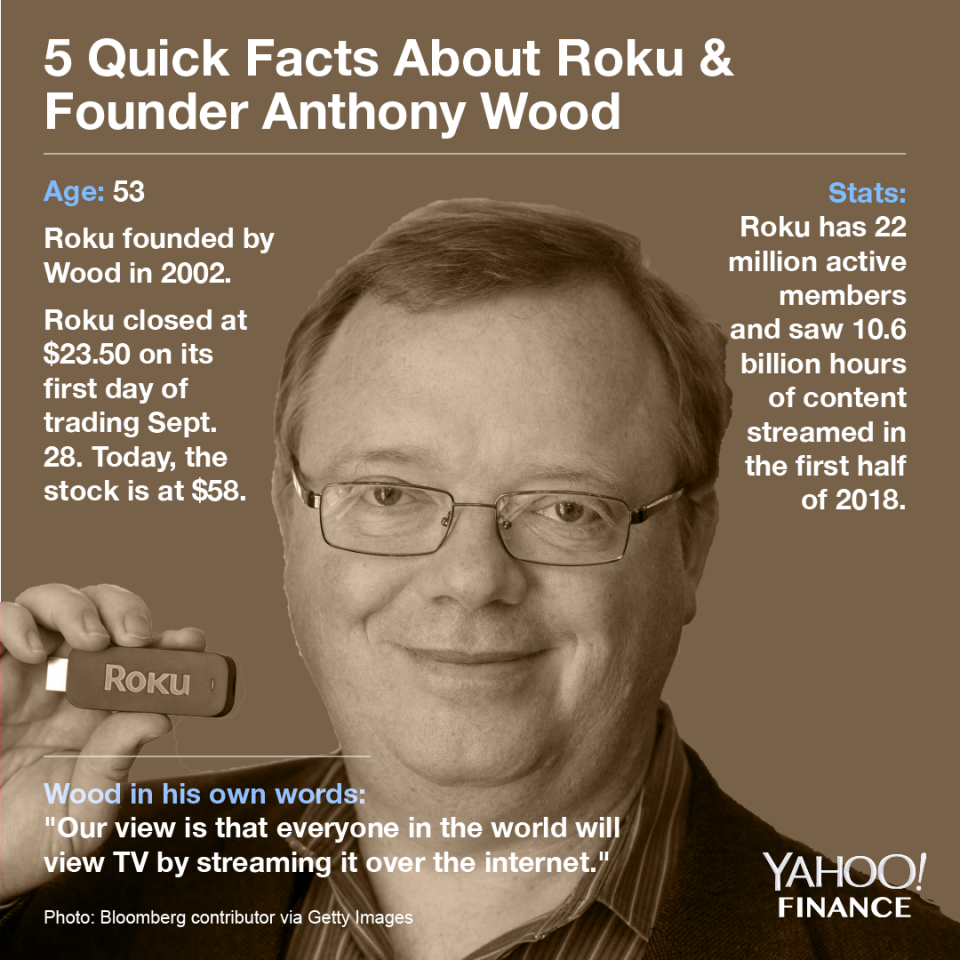

Thus far, Wood’s laser focus on the big prize – being the de facto distribution platform of choice for streaming content – has paid off handsomely. Since a well-received initial public offering on Sept. 28, 2017 (the stock closed up 68% on the day), Roku’s stock has skyrocketed 145%. Wood’s stake in Roku is now valued at $1.2 billion.

The company has won over a good portion of Wall Street with impressive growth in active accounts and the number of hours content is streamed on the Roku platform. Roku’s active accounts surged 46% to 22 million in the second quarter. Hours streamed on the platform rose 58% to 5.5 billion as people consume more of their content on demand.

Helping to fuel that rapid growth is the relatively cheap Roku device. For $30 or so, a consumer can quickly get into content streaming. Easy setup and a slick user interface have also long been key selling points.

Meanwhile, Roku, based in Los Gatos, Calif., has charted a path to being the operating system of choice in smart TVs while also launching wireless surround sound speakers. Roku says its operating system is the number one licensor to TV manufacturers. One in four smart TVs in the first half of 2018 came equipped with a Roku built in, according to Roku. These products, Wood says, are part of Roku’s efforts to make it easier for people to enjoy content from the confines of their own home. They also help diversify Roku from its ubiquitous streaming device.

Finding a bear on Roku on Wall Street is as tough as unearthing a weak episode of “Orange is the New Black” – it almost doesn’t exist. Morgan Stanley does cast a skeptical eye on Roku given the stock’s valuation. But even Morgan Stanley says Roku’s future is bright as consumers ditch linear TV for streaming services. The investment bank estimates Roku’s active accounts could blow past the 40 million mark by 2020, compared with more than 22 million currently.

Yahoo Finance spoke with Wood about the outlook for Roku. What follows is an edited and condensed version of the interview.

Yahoo Finance: Did you envision what Roku is today back when you founded the company?

Anthony Wood: Yes. When I started the company, basically the focus was hey, there will be a next generation of products for the home that combine digital technologies, media and the internet. The exact product that would become the big hit didn’t become clear until around 2006. We shipped a few products, all commercially successful. But the streaming player was obviously the breakout success.

Yeah, the goal has always been to a be a public company and to be a leader in platforms for distribution. When we shipped the first Netflix player in 2008, all it did was play Netflix. But even then the goal was to be an open platform, have an app store and be the leading next-generation platform for content and then build a large installed base and monetize it.

Yahoo Finance: How have you stayed focused on doing that through the years? Surely companies have tried to purchase Roku.

Wood: Well, it’s not that hard. That’s why I started Roku – because I wanted to build a large company. So that’s my goal. I guess it’s a little bit easier because I have been a successful entrepreneur. I have had several companies. I have done well on prior companies. I have no financial need to sell Roku or anything like that.

I think that also makes it a little easier to focus on the bigger prize.

Yahoo Finance: Is the streaming movement nearing a peak?

Wood: We have not reached peak streaming, I am pretty confident. Streaming has become mainstream, but most TV is still traditional and not growing. Roku’s active accounts are growing by a mid-40%, whereas large traditional cable companies are basically flat or negative growth. So that growth has been pretty consistent in that range for a long-time.

We are still early days. Our view is that everyone in the world will view TV by streaming it over the internet. Still most people don’t do that today. And, all the TV advertising is switching over to streaming. Most advertisers haven’t moved their budgets yet, but they will. They are starting to follow viewers, but they are lagging a bit.

Yahoo Finance: What’s the future look like for traditional TV watching?

Wood: The big change will be the distribution platform, so moving away from cable boxes to streaming platforms usually built into the TVs. In our view, all TVs will have an operating system like Roku and you won’t need an external box – you just download apps to your TV.

In that world, you have access to a lot more content so they will have more choice, and prices will come down as there is more competition. But then the other way to ask that question is whether all linear TV will switch to on-demand? The answer is no. There will still be live news, live sports, live events — some people still like the discovery of watching a linear stream with random content.

Yahoo Finance: Is it the perfect storm right now for Roku with the likes the Netflix and Disney creating a ton of original content?

Wood: Obviously, Roku is in a unique position of being the leading streaming distribution platform. Those examples you mentioned are illustrations of how consumers have so much more choice in the streaming world. Before you had distribution controlled by a few large companies and there were only a certain number of channels. There was limited content. In streaming, companies are free to compete on the quality of their content and pricing.

Consumers are the ones that are winning. Prices are coming down. I think we are in the golden age of TV. There has never been so much great TV produced before.

Yahoo Finance: What keeps you up at night or gets you worried when it comes to Roku?

Wood: Well, I think in general, I am not worried because I think there is a lot of huge opportunity in front of us. We have worked for years to build a leading position in streaming. All that work is paying off. What I think about a lot is that we are growing very fast, so that’s hard.

At our last annual on-boarding event, I asked how many were here for the first time. Almost half the room raised their hands. When you have that many people that are new in the company making sure everyone is working well and working toward the same goal is where the challenges lay.

So growth is a big area of focus. Another area of focus is innovation. We win in streaming because we built the only purpose built platform and we innovate a lot. We have built a lot of firsts. Making sure we keep that innovation lead is important for us as well.

Yahoo Finance: Where is your focus on when it comes to innovation?

Wood: I would say the Roku channel is big. There is more work to be done there. I would say Roku TV is another focus. We believe all TVs will ship with an operating system and we want that system to be a Roku. We are leading there today.

But I also think there is a lot of room to make the TV experience better and to innovate and to grow our lead there. We are working a lot on making the Roku TV a better experience. That’s why we are making speakers. We want to make it super easy to improve the audio.

Yahoo Finance: How could someone that has seen your story go about achieving the same level of success?

Wood: There are a few characteristics. I think one is being persistent. Things always take longer than you expect or would like. Another really important thing is timing. You need to focus on big markets and be early, but not too early. Then having the ability to attract talent to work with you is also very important. It usually requires that you are respected and seen as someone that people want to work for.

Yahoo Finance: We recently talked with former Cisco CEO John Chambers on how he identifies good talent. How have you found the next generation of leaders for Roku?

Wood: As companies grow, the kinds of people they can attract change. When you are small you have to look for people who are entrepreneurs, who want to take a risk. Often that means maybe younger, less experienced people who don’t have a lot to lose. As you get bigger, you can start to attract those different kinds of people.

So you attract the best you can for the stage of company you are and then they grow with you. Or you replace them as you reach a new stage of growth. That’s probably the hardest part.

Brian Sozzi is an editor-at-large at Yahoo Finance. Follow him on Twitter @BrianSozzi

Read more:

Burger King CEO: we will be ‘much bigger’

Philip Morris International tries risky move of making cigarettes extinct

PepsiCo isn’t looking at a ‘substantive’ breakup, CFO says

3 massive problems J.C. Penney’s new CEO must solve

Snap CEO reportedly says its redesign was botched in an internal memo

Yahoo Finance

Yahoo Finance