How Risky Is Kinder Morgan Canada?

Kinder Morgan Canada (NASDAQOTH: KMLGF) (TSX: KML) has a very low-risk profile today. But you can't examine the Canadian midstream company in isolation or without a close look at its history. When you step back and consider the big picture, it becomes clear that investors are taking on more risk than they may realize if all they consider are the company's financials.

A strong company

Kinder Morgan Canada owns three main assets: the Edmonton Terminals, the Cochin Pipeline, and the Vancouver Wharves Terminal. It's a relatively small company, with a market cap of $380 million and expected adjusted EBITDA of $213 million in 2019. That's barely a rounding error when you compare it with the company's parent, Kinder Morgan Inc. (NYSE: KMI), which is projecting adjusted EBITDA of $7.8 billion this year.

Image source: Getty Images

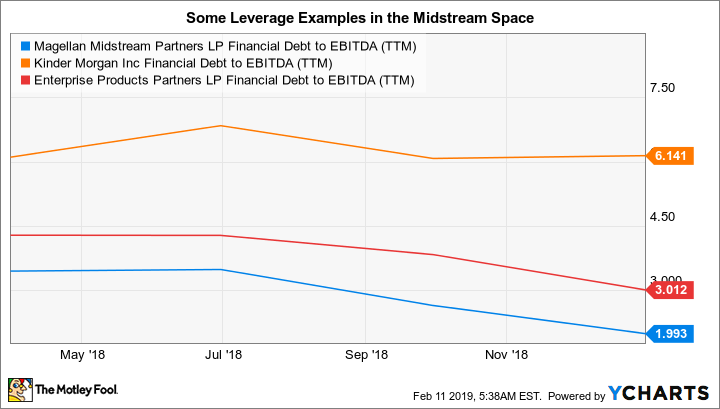

That said, Kinder Morgan Canada is projecting distributable cash flow of $0.90 per share and dividends of $0.65 per share. That leads to robust distribution coverage of almost 1.4 times in an industry where 1.2 is considered very good. Moreover, Kinder Morgan Canada's ratio of debt to adjusted EBITDA is projected to be around 1.3 times in 2019. That's a very conservative leverage ratio that puts the midstream company in a league with conservative industry bellwethers like Magellan Midstream Partners. For reference, parent Kinder Morgan Inc.'s debt-to-EBITDA ratio has been up around 6 in recent years.

MMP Financial Debt to EBITDA (TTM) data by YCharts

As for growth, Kinder Morgan Canada plans to spend around $32 million on expansion projects at its three assets. It's projecting 13% EBITDA growth in 2019, which is noteworthy, but a longer-term growth catalyst is missing. Which is where the trouble starts to show up here. Kinder Morgan Canada is in a transition today because of a huge asset sale it made in 2018. It has a solid foundation, but the asset sale that's left it so financially strong has also left it without a clear long-term direction.

What you need to know beyond the numbers

Kinder Morgan Canada is a young company, spun out of Kinder Morgan Inc. in 2017 to own the trio of assets that are its only operations today, along with the Trans Mountain Pipeline. That pipeline was a multibillion-dollar growth project that was expected to drive Kinder Morgan Canada's business for years to come. But local pushback put the project in jeopardy, leading Kinder Morgan Canada to sell the asset to the Canadian government for roughly $3.4 billion. It was a good move to get out from under this troubled project.

That, however, is when the real problem with Kinder Morgan Canada showed up. U.S. parent Kinder Morgan Inc. owns 70% of Kinder Morgan Canada. It wasn't content to let the cash from the Trans Mountain deal sit on the Canadian company's balance sheet, preferring to pull as much cash as possible back into its own coffers. So it voted for a large special dividend. It didn't completely fleece Kinder Morgan Canada, which was able to use some of the Trans Mountain cash to reduce debt. That's part of the reason for the company's strong financial condition today. And Kinder Morgan Inc. didn't exactly take advantage of Kinder Morgan Canada's shareholders, who also received the special dividend.

KMLGF cash and equivalents (quarterly) data by YCharts

Still, that huge cash outlay means that any future growth at Kinder Morgan Canada will require tapping the capital markets. That means more debt or the potentially dilutive issuance of additional shares. Kinder Morgan Canada's low leverage means it has the financial wherewithal to increase its use of debt and still remain in line with industry leverage norms. However, if Kinder Morgan Inc. didn't push through that dividend, or perhaps backed a smaller dividend, Kinder Morgan Canada would have been able to pay cash for acquisitions and growth projects. You can argue that so much cash might have sat idle or could have led to spending for the sake of spending. However, Kinder Morgan, Inc. never really gave Kinder Morgan Canada a chance to find a use for the money that would benefit Kinder Morgan Canada, it simply pushed through a special dividend as soon as it could so it could bring onto its own balance sheet.

So there are really three risks that investors need to be aware of here. First, Kinder Morgan Canada has to spend some time figuring out how it will grow over the longer-term now that it no longer has the Trans Mountain pipeline to rely on. That's probably the biggest issue for investors to watch over the next year or so. The second big risk is that the strong financial condition investors see today will only weaken as Kinder Morgan Canada finds new engines of growth. Based on its robust balance sheet, it has plenty of leeway before its financial condition would be compromised. But the impact of every deal on the company's distribution coverage and balance sheet should still be carefully monitored. The company is something of a blank slate, and you'll want to make sure the direction it heads makes financial sense.

The third issue is the relationship between U.S. parent Kinder Morgan Inc. and Kinder Morgan Canada. So far it looks like Kinder Morgan Inc. has put its interests ahead of those of Kinder Morgan Canada and its shareholders. Kinder Morgan Inc. hasn't done anything wrong. It's just that Kinder Morgan Canada clearly doesn't control its own destiny. The choices that have been made so far look like they were chosen with an eye to what's best for parent Kinder Morgan Inc. That's a risk that investors need to consider very carefully before jumping aboard.

A complicated relationship

For many investors, Kinder Morgan Canada may look like a financially strong company with huge opportunities and a healthy 4.5% dividend yield. The long-term opportunities aren't clear right now, but over the next year or so, the company will figure out how to leverage its financial strength to support long-term growth. That said, parent Kinder Morgan Inc. is the largest shareholder in the picture, putting some notable clouds in Kinder Morgan Canada's clear blue skies.

The big dividend that, essentially, stripped Kinder Morgan Canada of the cash left from the Trans Mountain asset sale is a clear example of just how influential Kinder Morgan Inc. can be -- and why Kinder Morgan Canada may not be as low risk as its financials suggest. If you invest here, you need to understand what Kinder Morgan Inc. wants, because that's what is most likely to get done -- whether or not it's best for the rest of Kinder Morgan Canada shareholders.

More From The Motley Fool

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Kinder Morgan. The Motley Fool recommends Magellan Midstream Partners. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance