The Return of the Semis: 3 Semiconductor Securities to Navigate the Volatility

The major indices are retesting the breakout level from January as selling pressure has intensified in recent days. The Nasdaq, S&P 500 and Dow Jones Industrial Average have all touched down between 3-6% from their January peaks.

The VIX Index, commonly referred to as the ‘fear gauge’, has spiked more than 20% in the past month. The VIX generates a 30-day forward projection of volatility. It is derived from the prices of SPX index options and represents expectations for short-term price changes in the S&P 500.

In other words, the market is expecting price ranges to widen in the near-term, which is a common theme when stocks are falling. While not always the case, normally volatility is low or trending lower as stocks rise and typically trends higher as stocks fall. The old market adage speaks to this - stocks take the stairs up and the elevator down.

One area of the market that has been navigating the volatility and leading the charge this year is semiconductors. Looking at the return of the VanEck Vectors Semiconductor ETF SMH over the past four months, you wouldn’t realize that volatility had spiked so drastically recently:

Image Source: TradingView

The VanEck Vectors Semiconductor ETF has nearly doubled the Nasdaq’s performance this year with a return of about 18%. The relative outperformance of the SMH ETF, particularly during a time of heightened volatility, is a clear sign that these stocks are in high demand. SMH contains 25 of the top semiconductor holdings, including two leaders we will discuss below.

Both companies are part of the Zacks Semiconductor – Analog and Mixed industry group, which is ranked in the top 33% out of more than 250 industries. This industry group has outperformed this year with a return of over 15%:

Image Source: Zacks Investment Research

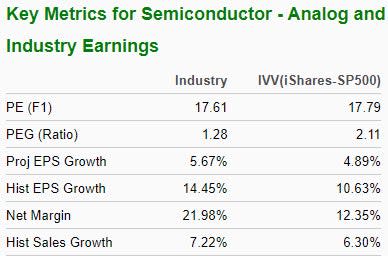

Historical studies have shown that about half of a stock’s future price appreciation is due to its industry grouping. Also note the favorable characteristics for this industry below:

Image Source: Zacks Investment Research

By targeting stocks within leading industry groups, we can dramatically improve our stock-picking success.

Analog Devices, Inc. (ADI)

Analog Devices is a global leader in the design, manufacturing and marketing of high-performance analog, mixed-signal, and digital signal processing circuits used in most electronic equipment. Founded in 1965 and headquartered in Norwood, MA, ADI’s focus has been on key strategic markets where their signal processing technology plays an important role in their customers’ products.

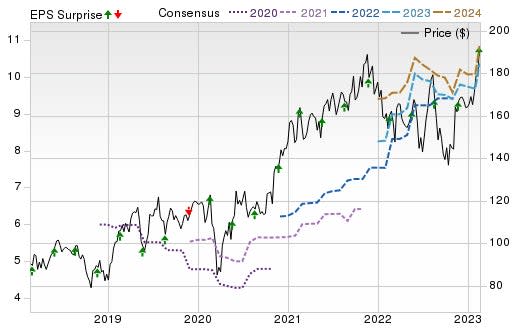

With a Zacks #2 (Buy) ranking, ADI has exceeded earnings estimates in each of the last four quarters, delivering average surprise of 7.23% over this timeframe. The company most recently posted fiscal Q1 earnings just last week of $2.75/share, a 6.18% surprise over consensus estimates.

Image Source: Zacks Investment Research

Analysts covering ADI have recently upped their 2023 EPS estimates by 7.99%. The Zacks Consensus Estimate now stands at $10.54/share, translating to potential growth of 10.14% relative to fiscal 2022.

Image Source: Zacks Investment Research

ON Semiconductor Corp. (ON)

On Semiconductor is a supplier of standard semiconductors and power management integrated circuits used in various devices such as high-speed fiber optic equipment and portable electronics. Headquartered in Phoenix, AZ, ON provides data flow management for precision computing and communications systems, as well as power management for distributing and monitoring the supply of power within electronic devices.

ON has exceeded earnings estimates in each of the last four quarters. The company most recently reported fourth-quarter earnings earlier this month of $1.32/share, a 3.94% surprise over estimates. ON has produced a trailing four-quarter average earnings surprise of 9.29%.

Image Source: Zacks Investment Research

Make sure to keep an eye on the semi space as the group looks poised to continue its recent outperformance.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Analog Devices, Inc. (ADI) : Free Stock Analysis Report

VanEck Semiconductor ETF (SMH): ETF Research Reports

ON Semiconductor Corporation (ON) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance