Retirement Planning in Singapore: A Starter Guide for Confused Millennials and Gen Zs

When you think “retirement”, do you imagine travelling the world or cruising on your own yacht? Sorry, but retirement in Singapore isn’t quite as cushy as that, unless you happen to be sitting on a fortune.

For me, being time-rich and cash-poor (as many Singapore retirees are) is a horrible combination. To make mattes worse, retirement planning is complicated. From estimating retirement expenses to managing your CPF money, preparing for your retirement can be overwhelming.

So, as a confused Millennial or Gen Z, how do you plan now to provide a decent lifestyle for future you? Here’s a guide to how to plan for your retirement in 6 simple and digestible steps.

Starter Guide to Retirement Planning in Singapore

1. What’s the official Singapore retirement age?

Well… depends on whether you’re asking MOM or CPF.

Singapore retirement age | Implications |

55 years old | You can start withdrawing money from your CPF Retirement Account. |

63 years old | MOM’s stipulated retirement age. Employers cannot legally ask you to “retire” before this age. |

65 years old | You can start getting monthly payouts if you meet the CPF Retirement Sum |

67 years old | If you work past MOM retirement age, you can re-contract with your employer until this age |

According to the Ministry of Manpower, the official Singapore retirement age is now 63 years old —although it’s slated to be raised to 64 years on 1 July 2026.

This number is primarily meant to regulate employers, not workers. Should your employer suggest you “retire early to spend time with your grandkids” before age 62, you may have a case against them for unfair dismissal and can appeal to MOM.

If you’re lucky to be with a good employer who doesn’t mind your age, you are free to continue working after you’ve passed retirement age. MOM sanctions this up to age 68. This is also known as the re-employment age, and, along with the retirement age’s raise, it will be adjusted to 69 in 2026.

On the other hand, if you want access to the CPF savings the government has seemingly been holding hostage (for your own good), your retirement funds will be available to you from age 55. That’s a whole different “retirement age”.

Assuming you haven’t liquidated all your CPF funds and run off to retire in Batam, you need to wait another 10 years before you can smell your first CPF monthly payout, at age 65 (or later up to age 70, if you choose).

Why does the retirement age matter?

If you know your retirement age(s), you know how many years you have to plan for your retirement. Ideally, you should start planning early because that allows you more flexibility to adapt to changing financial needs, healthcare costs, and lifestyle shifts over the years. By starting early, you can secure a more comfortable and stable retirement, no matter how trends evolve.

2. How much would I spend during retirement in Singapore?

As everyone already knows, the cost of living in Singapore is pretty high. Just ‘cause you’ve retired doesn’t mean it’ll go down magically.

In fact, your cost of living might even increase, because (1) getting old usually means more medical bills and (2) free time costs money to fill up with all that fun retirement stuff we dream about.

So, how do you figure out how much your expenses will be when you retire? Is there a magic number? To figure out how much you’ll need, consider these 4 main areas: daily living costs, healthcare, leisure activities, and an emergency stash.

Daily living costs: Assuming you’ve paid off all your outstanding loans by retirement, your baseline should be your existing living expenses. This would include food, transport, utilities, and more.

Healthcare: Admit it, when your hair turns grey and your bones are all creaky, you’ll be at least a smidge less healthy than you are right now. So you definitely need some kind of plan for healthcare, elderly care and even disability-related costs. Your best bet is to provide for these costs with health insurance and also look into your CareShield Life and CPF Life coverage.

Leisure activities: This is technically a non-essential, but can feel incredibly important after you retire to keep life fun and fulfilling. They can provide a way to stay socially connected, mentally sharp, and physically active. Plus, you worked so hard for most of your life! You deserve the recreational paradise retirement offers.

Emergency buffer: All kinds of emergencies can happen. A bad fall. Your house gets flooded. Family drama. You get depressed and need to seek help. Since you can’t exactly ask CPF for an advance paycheck after you’ve retired, it’s good to have a bit of extra money as buffer. In fact, you should always be maintaining an emergency fund at an age.

How’s that magic number looking? Much higher than you thought, huh?

It’s worth remembering that this number is subject to inflation as well. This rate is typically around 3% a year. Inflation is scary because it erodes the purchasing power of your retirement savings. Basically, that means the same amount of money will buy less over time. As living costs rise, you may need more savings than expected to maintain your desired lifestyle in retirement.

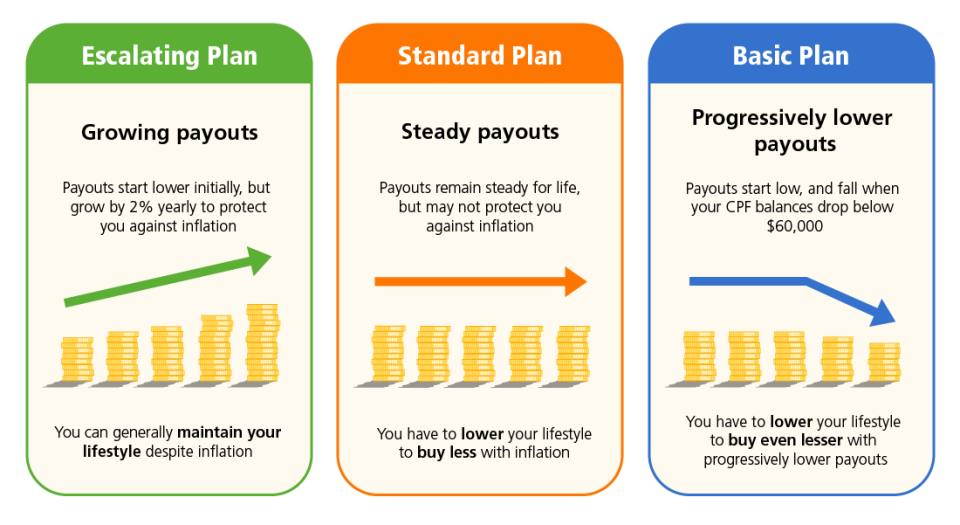

Side note: If inflation is a huge concern for you, the CPF LIFE Escalating Plan might help to allay your fears. Check out the link for more information.

Need help estimating your retirement income? Use this Retirement Payout Planner tool from CPF.

3. Can’t I just withdraw money from my CPF Retirement Account?

I don’t think I’m the first Singaporean to have the impression that I’d be able to cash out all my CPF savings one day.

Guess what? …cannot lah!

You can only withdraw part of your Retirement Account savings, and only down to your Basic Retirement Sum (BRS). That’s also only possible from the age of 55 onwards, and subject to other conditions like you owning a property with a lease that will last you to age 95.

What if you don’t own property? You can withdraw your CPF savings down to your Full Retirement Sum (FRS). The FRS is set at 2 times the BRS.

If you turn 35 in | Your BRS is | Your FRS is |

2024 | $102,900 | $205,800 |

2025 | $106,500 | $213,000 |

2026 | $110,200 | $220,400 |

2027 | $114,100 | $228,200 |

Source: CPF

The CPF Basic, Full and Enhanced Retirement Sum deserve a whole other article to themselves. So a whole new article is exactly what we created. Read more about them in our guide to CPF Retirement Sums.

Should I withdraw my CPF funds early?

Generally, I would advise you not to barring special circumstances. Why? It comes down to opportunity cost and protection in your retirement years.

If you withdraw your CPF savings early, the most obvious problem you might face is that you’ll have less money for retirement. That means you might run out of cash sooner, and don’t forget that you’ll no longer be be pulling in any income.

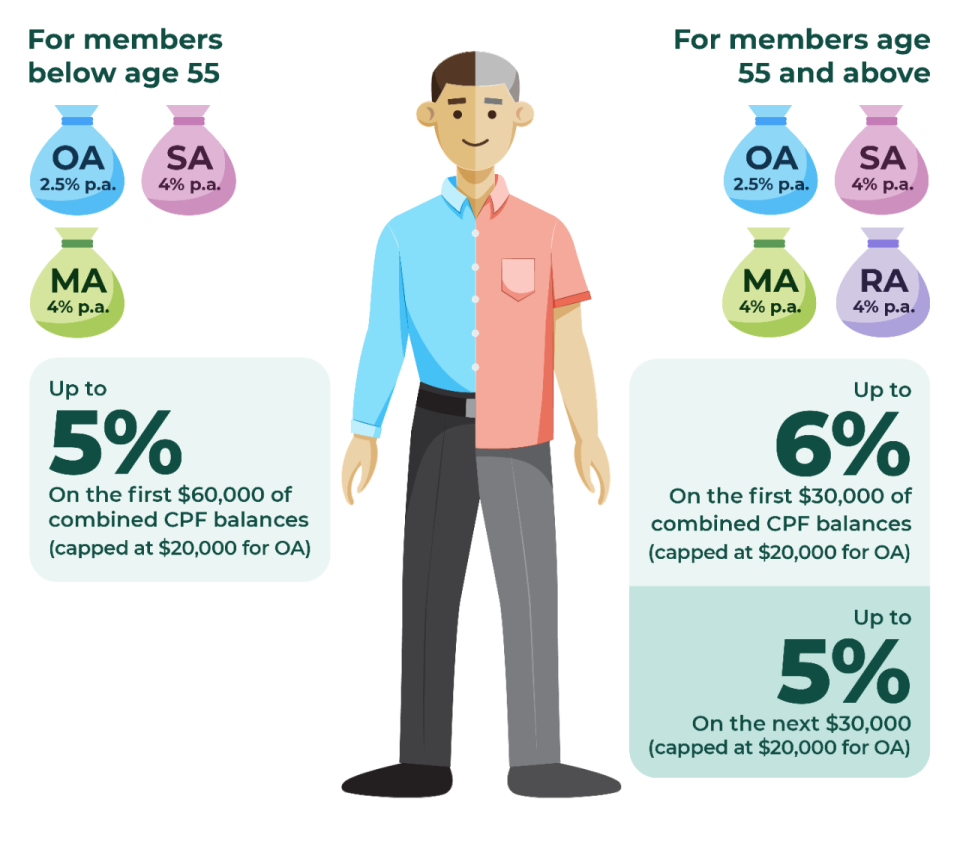

But aside from that, there’s also interest you’ll miss out on. Did you know you can earn up to 5% interest on your CPF savings if you’re below 55, and up to 6% if you’re above 55?

Fixed deposits and T-bills are only getting you between 3% and 4% these days. So instead of withdrawing your CPF money, heck, you may want to voluntarily put money in.

So in what kind of scenarios does it make sense to withdraw CPF savings early? In emergencies when you are strapped for cash (the urgent need for retail therapy does not count), withdrawing some CPF funds gives you instant access to your money for personal use. It also grants you your savings earlier on in life, and you have the flexibility to spend it on anything you need to fund. This could include paying off high-interest debts or supporting family members in times of need.

4. What is CPF LIFE and how does it work?

So, we’ve established that you can’t just demand that the authorities return your CPF in full once you’re 55. There goes my dream of buying a boat and living out the rest of my days at sea.

Instead, you’d withdraw a bit of money when you’re 55, then sit tight and wait until age 65, when your CPF LIFE payouts start.

How much will you receive in CPF payouts? That depends on how much you have in savings by the time you turn 65. For the sake of planning, the better question to ask is how much you want to receive in monthly payouts. Then, work towards having the requisite amount of savings at 55, 60 and 65:

Desired Monthly Payout from 65 | CPF Life Premium at 65 (Savings you need at 65) | Savings you need at 60 | Savings you need at 55 |

$540 – $570 | $97,300 | $75,900 | $60,000 |

$840 – $900 | $159,600 | $127,100 | $102,900 |

$1,170 – $1,250 | $227,900 | $183,300 | $150,000 |

$1,560 – $1,670 | $308,900 | $249,900 | $205,800 |

$2,280 – $2,450 | $458,300 | $372,700 | $308,700 |

Source: CPF

If you look at the monthly payouts, you’ll realise that, actually, CPF payouts aren’t all that high. Given that my plate of economic rice cost $5 the other day, it might not even be enough to sustain the cai png life.

On the other hand, CPF LIFE payouts are for life, so even if you live till 150, you’ll still get a monthly income. That’s why it’s important to check out the CPF LIFE scheme while you’re still young so you have time to save up and plan accordingly.

Once again, this Retirement Payout Planner tool from CPF is very useful, and completely free. Make use of it as early as you can!

Another useful resource you should check out is out guide to CPF LIFE, because there’s a ton more to unpack. For one thing, there are actually 3 CPF LIFE plans Singaporeans can choose from.

5. Will I have enough savings to hit the CPF Retirement Sum?

You might be sweating right now thinking that if you don’t hit the CPF Retirement Sum, you get $0 monthly payouts.

Good news! You do not need to worry about hitting the CPF Retirement Sum. There’s no minimum sum you need in order to get CPF LIFE payouts. Your payouts are simply pro-rated based on the amount of retirement savings you have.

There’s still a CPF Basic Retirement Sum (BRS), but its purpose is to determine how much money you can withdraw at age 55, and how much you need to keep in your account for future payouts. If you don’t hit the BRS by 55, you can only withdraw up to $5,000.

To keep up with inflation and account for increases in life expectancy, the CPF Retirement Sums increase every year. For those turning 55 in 2024, the current BRS is $102,900.

If you clicked on this article, I’m guessing you’re a Millennial or Gen-Z. In this case, to ensure you meet your CPF Retirement Sum by the retirement age in Singapore, the most important thing to is start early. If you’re below 55 or below and working, you’re already contributing to your CPF. Each month, 37% of your salary will go into your CPF, the bulk of it going into your CPF Ordinary Account.

Aside from these monthly contributions, you can also consider voluntary top-ups, minimising early withdrawals, and maximising the amount of savings in your Special Account as it earns higher interest. To do this, you could transfer excess funds from your Ordinary Account to your Special Account when possible. Just be aware of the implications—the transfer is irreversible, and if you need to buy a house, you’re banking on the money in your OA.

6. How else can you do retirement planning in Singapore?

The CPF Retirement Scheme needn’t (and shouldn’t) be your only retirement plan.

If you…

Don’t have enough CPF savings to get the retirement payouts you want

Don’t think CPF LIFE can beat inflation or your inflated lifestyle needs

Want a higher retirement income than what CPF LIFE can provide

Want to diversify risk by putting your retirement eggs in more baskets

Want more information on and control over your payouts

…then it’s a very good idea to diversify your retirement portfolio.

Retirement plans

Many Singaporeans supplement their CPF payouts with a retirement plan from a bank or insurer. These pre-packaged products are offered by most financial institutions, such as Income, Singlife, Manulife, and more.

You simply pay regular premiums while you’re working in exchange for receiving an income during your retirement years. The plan may or may not have an insurance component built in. Do take the time to understand what you’re getting into, because if you thought that CPF LIFE was confusing… oh boy, you’re not gonna enjoy reading insurance policy documents.

Grow your savings

Alternatively, you can also start building your passive income stream with some investments you might already be familiar with, such as renting out spare rooms in your home or investing in dividend-yielding stocks and REITs.

In my opinion, which actual investment vehicle you choose doesn’t matter all that much… as long as you’re doing something. Pick what you understand and feel comfortable with, and start in that direction.

Of course, your retirement investment plan is for the long term, so please don’t try and bank on less predictable instruments, like forex or cryptocurrency speculation.

Supplementary Retirement Scheme

You may also want to consider opening a Supplementary Retirement Scheme (SRS) account and using it for your investments.

The SRS is a voluntary savings plan that helps you build extra funds for retirement. You can contribute money to your SRS account (up to $15,300 a year for Singaporeans/PRs) and get tax relief, which lowers your taxable income. Plus, you can invest those savings in things like stocks and bonds to help your money grow.

When you reach retirement age and start withdrawing, only 50% of the withdrawals are taxed, making it a great way to save on taxes. It’s a flexible way to boost your retirement savings alongside your CPF. Read more about in our SRS guide.

7. How do I even start retirement planning?

If you’ve made it to the end of this article, congratulations! It’s a lot of information to take in, but knowledge is the first step. You’re well on your way to planning for your retirement.

To recap, the first thing to do is set retirement goals based on your estimated retirement expenses and lifestyle. I highly recommend this Retirement Payout Planner tool from CPF to help you out. Check out CPF LIFE and the CPF Retirement Sums, then decide what you’re aiming for.

Once you know where you need to get to, start planning how to get there. Make use of passive income streams, investment tools, and the SRS to help you. Start small—even the littlest of actions can contribute toward securing a comfortable retirement for you if you’re consistent.

Along the way, don’t forget to reviewing and adjusting your retirement plan regularly to account for inflation and your changing needs. After all, planning early gives you the flexibility to adapt to changes.

Need more specific help? Unfortunately, a blog article is a one-way communication channel, and I can’t ask you for the specifics of your situation to give you more specific advice. But you know who can? A financial advisor. It’s never too late to contact one and get your finances sorted out!

Finally, don’t forget to sign up for MoneySmart’s newsletter for more tips and updates on retirement planning.

Share this article with your family and friends who might find it useful!

The post Retirement Planning in Singapore: A Starter Guide for Confused Millennials and Gen Zs appeared first on the MoneySmart blog.

MoneySmart.sg helps you maximize your money. Like us on Facebook to keep up to date with our latest news and articles.

Compare and shop for the best deals on Loans, Insurance and Credit Cards on our site now!

© 2009-2024 MoneySmart. All rights reserved.