Retail FX Remains Short EUR/USD Ahead of ECB- GBP/USD Eyes June Low

DailyFX.com -

Talking Points:

- EUR/USD Retail Crowd Remains Net-Short Ahead of ECB Meeting.

- GBP/USD Searches for Support Ahead of BoE Rate Decision.

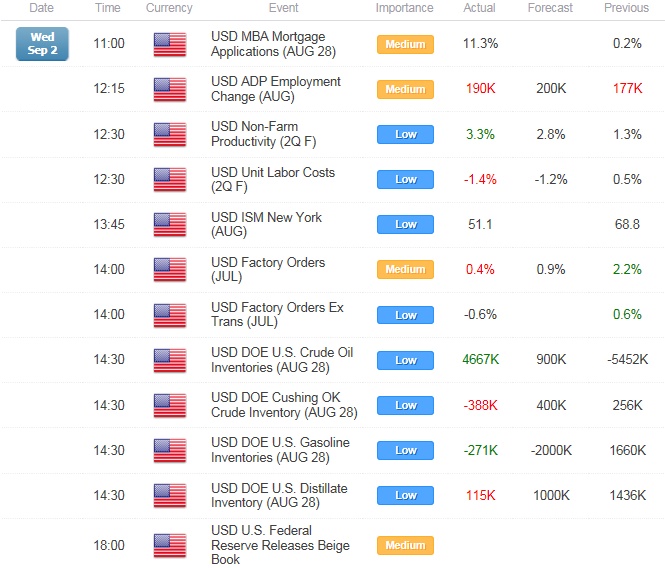

- USDOLLAR Approaches Key Resistance Despite Disappointing ADP Employment Report.

For more updates, sign up for David's e-mail distribution list.

EUR/USD

Chart - Created Using FXCM Marketscope 2.0

Even though the long-term outlook for EUR/USD remains bearish, need a break of the near-term upward trends in price & the Relative Strength Index (RSI) along with a close below soft support around 1.1150 (61.8% retracement)to favor a further decline.

The European Central Bank (ECB) is widely expected to retain its current policy in September, but a downward revision in the economic forecast paired with a more dovish outlook for monetary policy may trigger a near-term selloff in the single currency should the Governing Council show a greater willingness to expand/extend its quantitative easing (QE) program.

DailyFX Speculative Sentiment Index (SSI) shows retail crowd remains net-long EUR/USD since March 9, but the ratio remains off of recent extremes as it holds at -1.46 with 41% of traders long.

GBP/USD

GBP/USD may continue to give back the rebound from June (1.5669) as it fails to hold the July low (1.5329) and marks a closing below 1.5330 (78.6% retracement); will look for the RSI to dip into oversold territory for confirmation.

Nevertheless, fresh comments coming out of the Bank of England (BoE) September 10 interest rate decision may prop up GBP/USD in the week ahead should we see a growing dissent within the Monetary Policy Committee (MPC) following the 8-1 split during the previous meeting.

Break/close below 1.5250 (100% expansion) to expose 1.5669 (June low ) to 1.5180 (23.6% retracement).

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

Read More:

Price & Time: USD/CAD Symmetry Awaits

AUDNZD: Rinse & Repeat- Reversal Scalp Back in Play Ahead of GDP

USDOLLAR(Ticker: USDollar):

Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

DJ-FXCM Dollar Index | 12034.90 | 12047.17 | 12019.78 | 0.17 | 44.71% |

Chart - Created Using FXCM Marketscope 2.0

Dow Jones-FXCM U.S. Dollar continues to work its way towards 12,049 (78.6%) despite the ongoing mixed batch of data coming out of the economy; will keep a close eye on market expectations for the Non-Farm Payrolls (NFP) report as the ADP figures disappoint.

With the ISM Non-Manufacturing survey on tap, will dig into the employment component to better-gauge expectations for job growth; seeing bets that the NFP report may be the deciding factor a Fed September rate hike.

With the previous failed attempts in June, July and August, still waiting for a close above 12,049 (78.6% retracement) to open up the next topside objective at 12,082 (61.8% expansion).

Join DailyFX on Demand for Real-Time SSI Updates!

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance