Restaurant Brands (QSR) Q2 Earnings Beat Estimates, Stock Up

Restaurant Brands International, Inc. QSR reported impressive second-quarter 2022 results, with earnings and revenues surpassing the Zacks Consensus Estimate. The metrics increased on a year-over-year basis. The quarterly results were primarily driven by solid sales growth (at Tim Hortons Canada), development strength (at Popeyes) and a strong contribution from digital sales. Following the announcement, shares of the company gained 7.4% during trading hours on Aug 4.

Earnings & Revenue Discussion

During second-quarter 2022, the company reported adjusted earnings per share (EPS) of 82 cents, beating the Zacks Consensus Estimate of 73 cents by 12.3%. The bottom line increased 6.5% year over year from an adjusted EPS of 77 cents reported in the prior-year quarter.

Quarterly net revenues of $1,639 million surpassed the consensus mark of $1,572 million. The top line increased 14% on a year-over-year basis. The upside was driven by a rise in system-wide sales at Tim Hortons, Burger King and Popeyes. However, this was partially offset by unfavorable FX movements. Digital sales during the quarter came in at more than $3 billion.

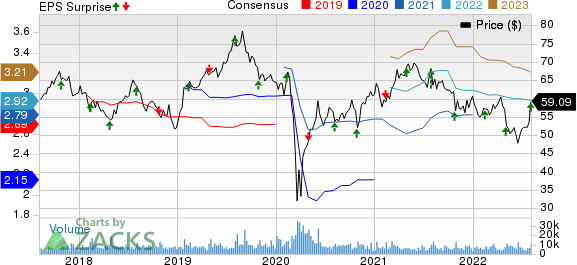

Restaurant Brands International Inc. Price, Consensus and EPS Surprise

Restaurant Brands International Inc. price-consensus-eps-surprise-chart | Restaurant Brands International Inc. Quote

Segmental Revenues

Restaurant Brands operates through four segments — Tim Hortons, Burger King, Popeye’s Louisiana Kitchen and Firehouse Subs.

During second-quarter 2022, revenues in Tim Hortons totaled $968 million, up 16.5% from the prior-year quarter’s levels. System-wide sales increased 16.3% year over year compared with a growth of 33% reported in the prior-year quarter. Comps in the segment rose 12.2% year over year compared with a 27.6% rise reported in the year-ago quarter. In the quarter under review, net restaurant growth was recorded at 5.7% compared with a rise of 2.7% reported in the prior-year quarter.

During the quarter, Burger King’s revenues totaled $473 million, indicating growth of 3.1% from the prior-year quarter’s levels. System-wide sales growth in the segment increased 14.6% year over year compared with 37.9% growth reported in the prior-year quarter. Comps rose 10% year over year compared with a growth of 18.2% reported in the prior-year quarter. In the second quarter, net restaurant growth was 2.8% compared with an increase of 0.1% reported in the prior-year quarter.

Popeye’s Louisiana Kitchen generated revenues of $165 million in second-quarter 2022, up 11.5% from the prior-year quarter’s levels. System-wide sales growth came in at 9.9% year over year compared with a 10.5% growth recorded in the prior-year quarter. Comps in the segment rose 1.4% year over year against a 0.3% decline reported in the prior-year quarter. Net restaurant growth came in at 8.1% compared with a 5.7% growth reported in the prior-year quarter.

During the quarter, Firehouse Subs generated revenues of $33 million. System-wide sales growth came in at 2.2% year over year compared with 37.9% recorded in the prior-year quarter. Net restaurant growth came in at 2.5% year over year, compared with 2.5% reported in the prior-year quarter. Comps in the segment dropped 1.4% year over year against a 31.2% rise reported in the prior-year quarter.

Operating Performance

In the quarter under review, the company’s adjusted EBITDA came in at $618 million compared with $577 million reported in the prior-year quarter. On an organic and reported basis, the upside was driven by an increase in Tim Hortons, Popeye’s and Burger King adjusted EBITDA.

Segment-wise, Tim Horton’s adjusted EBITDA increased 8.3% year over year to $274 million. Burger King’s adjusted EBITDA rose 1.5% year over year to $270 million. Popeye’s adjusted EBITDA came in at $61 million, up 5.2% year over year. During the quarter, adjusted EBITDA from the Firehouse Subs came in at $13 million.

Cash and Capital

Restaurant Brands ended the second quarter with a cash and cash equivalent balance of $838 million compared with $895 million reported in the previous quarter. As of Jun 30, 2022, long-term debt (net of current portion) stood at approximately $12.9 billion, almost flat sequentially.

The company’s board of directors announced a dividend payout of 54 cents per common share and partnership exchangeable unit of Restaurant Brands International Limited Partnership in third-quarter 2022. The dividend is payable on Oct 5, 2022, to shareholders of record at the close of business as of Sep 21, 2022.

Zacks Rank & Key Picks

Restaurant Brands currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

Some better-ranked stocks in the Zacks Retail-Wholesale sector are Titan Machinery Inc. TITN, Arcos Dorados Holdings Inc. ARCO and Dollar Tree Inc. DLTR.

Titan Machinery sports a Zacks Rank #1. TITN has a trailing four-quarter earnings surprise of 52.4%, on average. Shares of TITN have increased 6.4% in the past year.

The Zacks Consensus Estimate for Titan Machinery’s 2022 sales and EPS suggests growth of 23.8% and 6.4%, respectively, from the corresponding year-ago period’s levels.

Arcos Dorados carries a Zacks Rank #2 (Buy). ARCO has a long-term earnings growth of 34.4%. Shares of the company have increased 30.2% in the past year.

The Zacks Consensus Estimate for Arcos Dorados’ 2022 sales and EPS suggests growth of 25.7% and 120.8%, respectively, from the year-ago period’s levels.

Dollar Tree carries a Zacks Rank #2. DLTR has a trailing four-quarter earnings surprise of 13.1%, on average. The stock has gained 63.9% in the past year.

The Zacks Consensus Estimate for Dollar Tree’s 2022 sales and EPS suggests growth of 6.7% and 40.5%, respectively, from the corresponding year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dollar Tree, Inc. (DLTR) : Free Stock Analysis Report

Titan Machinery Inc. (TITN) : Free Stock Analysis Report

Arcos Dorados Holdings Inc. (ARCO) : Free Stock Analysis Report

Restaurant Brands International Inc. (QSR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance