ResMed (RMD) Q3 Earnings Miss Estimates, Margins Decline

ResMed Inc.’s RMD adjusted earnings per share (EPS) in the third quarter of fiscal 2022 were $1.32, up 1.5% year over year. However, the metric lagged the Zacks Consensus Estimate by 8.3%.

The adjustments include certain non-recurring expenses/benefits like amortization of acquired intangibles and restructuring costs, among others.

The ongoing recovery of core patient flow across the company’s business and the provision of sleep apnea therapy, respiratory care therapy and digital health solutions boosted ResMed’s bottom line during the fiscal third quarter.

GAAP EPS in the reported quarter was $1.22, compared with the year-ago EPS of 54 cents.

Revenues

Fiscal third-quarter revenues on a reported basis increased 12.5% year over year (up 14% at constant exchange rate or CER) to $864.5 million. However, the figure fell shy of the Zacks Consensus Estimate by 4.9%.

A Closer View of Q3 Top Line

Total Sleep and Respiratory Care revenues in the United States, Canada and Latin America improved 17.9% from the prior-year period to $475.4 million.

Total Sleep and Respiratory Care revenues in combined Europe, Asia and other markets rose 5.8% on a reported basis and 11% at CER to $287.9 million.

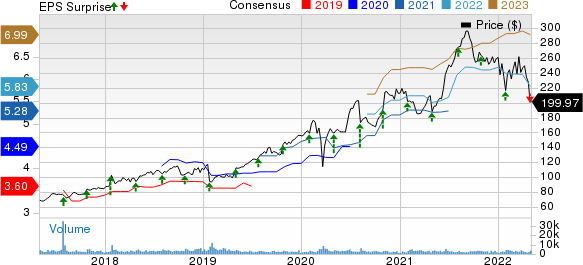

ResMed Inc. Price, Consensus and EPS Surprise

ResMed Inc. price-consensus-eps-surprise-chart | ResMed Inc. Quote

Global revenues from total Sleep and Respiratory Care in the quarter under review were $763.4 million, up 13.1% on a reported basis and 15% at CER.

Meanwhile, Software as a Service (SaaS) revenues grew 7.8% to $101.1 million.

The revenue growth in the quarter was driven by higher demand for ResMed’s sleep and respiratory care devices on a steady recovery of markets and greater device demand in response to a competitor’s ongoing product recall. ResMed also recorded immaterial incremental revenues from COVID-related demand, similar to the year-ago quarter. The upside in SaaS revenues resulted from continued growth in the company’s Durable Medical Equipment category and stabilizing patient flow in out-of-hospital care settings.

Margins

Adjusted gross profit in the quarter under review rose 9.6% to $502.2 million despite a 16.7% uptick in cost of sales (excluding expenses related to amortization of acquired intangibles and restructuring).

Adjusted gross margin for the fiscal third quarter was 58.1%, reflecting a 151-basis point (bps) contraction, primarily owing to higher freight component and manufacturing costs. This was partially offset by a favorable product mix given the strong growth in ResMed’s higher acuity devices and enhancement in average selling prices.

Selling, general and administrative expenses rose 13.7% year over year to $182.4 million (up 17% at CER), predominantly on employee-related expenses. Research and development expenses increased 19.4% to $66.8 million (up 22% at CER).

Adjusted operating income was $252.9 million in the quarter under discussion, up 4.6% from the year-ago quarter. Adjusted operating margin contracted 218 bps year over year to 29.3%.

Financial Updates

ResMed exited the third quarter of fiscal 2022 with cash and cash equivalents of $201.8 million compared with $194.5 million at the end of the fiscal second quarter. Total debt (short and long-term) at the end of the fiscal third quarter was $680.7 million compared with $655.4 million a year ago.

Cumulative net cash flow from operating activities at the end of the fiscal third quarter was $271.7 million, compared with a cumulative net cash inflow of $510.2 million in the year-ago quarter.

The company paid out $61.4 million as dividends during the fiscal third quarter.

Our Take

ResMed recorded robust sales performance in the third quarter of fiscal 2022 on increased demand for sleep and respiratory care devices. The company also registered impressive revenue growth for its products and services across several geographies, instilling optimism. The growing adoption of ResMed’s software solutions, including myAir for patients, AirView for physicians and providers, and Brightree for HME providers, appears promising. The ongoing U.S. launch of AirSense 11 platform continues to be met with great success, raising investors’ confidence.

However, ResMed exited the fiscal third quarter with lower-than-expected earnings and revenues. The persistent supply-chain challenges related to securing sufficient components are hampering its ability to meet the growing device demand. The volatility surrounding COVID-related restrictions across the globe also continues to pose challenges. Escalating operating expenses and contraction of both margins are other headwinds.

Zacks Rank and Key Picks

ResMed currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space that have announced quarterly results are BioMarin Pharmaceutical Inc. BMRN, Molina Healthcare, Inc. MOH and Medpace Holdings, Inc. MEDP.

BioMarin, carrying a Zacks Rank #1 (Strong Buy), reported first-quarter 2022 adjusted EPS of 55 cents, which beat the Zacks Consensus Estimate by 44.7%. Revenues of $519.4 million outpaced the consensus mark by 2.8%. You can see the complete list of today’s Zacks #1 Rank stocks here.

BioMarin has an estimated long-term growth rate of 50.4%. BMRN’s earnings surpassed estimates in the trailing four quarters, the average surprise being 108.8%.

Molina Healthcare, having a Zacks Rank #2 (Buy), reported first-quarter 2022 adjusted EPS of $4.90, which beat the Zacks Consensus Estimate by 3.4%. Revenues of $7.8 billion outpaced the consensus mark by 3.1%.

Molina Healthcare has an estimated long-term growth rate of 16.4%. MOH’s earnings surpassed estimates in the trailing three quarters and missed in one, the average surprise being 1.5%.

Medpace reported first-quarter 2022 adjusted EPS of $1.69, which surpassed the Zacks Consensus Estimate by 34.1%. Revenues of $330.9 million outpaced the Zacks Consensus Estimate by 1.1%. It currently has a Zacks Rank #2.

Medpace has a historical growth rate of 27.3%. MEDP’s earnings surpassed estimates in the trailing four quarters, the average surprise being 17.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BioMarin Pharmaceutical Inc. (BMRN) : Free Stock Analysis Report

Molina Healthcare, Inc (MOH) : Free Stock Analysis Report

ResMed Inc. (RMD) : Free Stock Analysis Report

Medpace Holdings, Inc. (MEDP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance