ResMed (RMD) Gains on Product Uptake Even as Expenses Rise

ResMed RMD continues to see growth in the patient diagnosis trends in sleep apnea, COPD and asthma. The company is expecting an increase in digital health demand with the adoption of digital healthcare management systems. The stiff competition faced by ResMed is worrying. This apart, reimbursement issues and competitive bidding continue to affect the stock. ResMed currently carries a Zacks Rank #3 (Hold).

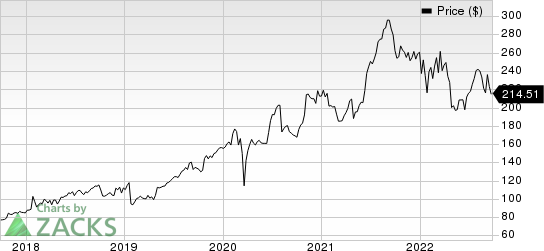

In the past year, ResMed has outperformed its industry. The stock has lost 23.5% compared with the 51.2% decline of the industry.

ResMed exited the fourth quarter of fiscal 2022 with better-than-expected earnings and revenues. The company recorded robust sales performance on increased demand for sleep and respiratory care devices. Revenue growth across several geographies is impressive. The growing adoption of ResMed’s AirSense 11 and AirSense 10 platforms raises investors’ confidence.

The continued uptake of core non-invasive ventilation and life support ventilation solutions for COPD and neuromuscular disease is encouraging too. The expansion of gross margin seems promising. Increased focus on international markets, a robust product line and strong solvency are added benefits.

ResMed Inc. Price

ResMed Inc. price | ResMed Inc. Quote

To meet the additional demand in relation to a competitor’s recall, the company is working closely with its global supply chain partners to improve access to further supplies of critical components. The company is also reengineering designs, validating new parts, pieces, supplies and speeding up product launches as well as development to keep up with the demand. In the fiscal fourth quarter, the company derived incremental revenues in the range of $60-$70 million associated with the competitor’s recall.

ResMed continues to see robust demand for a market-leading mask portfolio despite facing challenges related to declining new patient setups from a competitor recall. The company recorded increased masks and other sales in the United States, Canada and the Latin-America region in the fiscal fourth quarter, where growth was 13% on a reported basis, reflecting solid resupply revenues amid a challenging device supply environment. In combined Europe, Asia and other markets, masks and other sales rose 7% at CER. Globally, masks and other sales rose 7% on a reported basis and 11% at CER.

ResMed, during the fiscal fourth quarter, recorded an 11% year-over-year increase in device sales in the United States, Canada and Latin-America region, benefiting from incremental revenues from a competitor's recall. Furthermore, device sales increased 2% year over year and 6% at CER on a global basis. In the reported quarter, the company introduced the AirSense 10 Card-to-Cloud solution to address the needs of an industry crisis in PAP supply. The company expects the new device, along with the AirSense 11 and its legacy AirSense 10 device to support solid growth throughout fiscal 2023.

On the flip side, ResMed did not derive any incremental revenues from COVID-related demand in the fiscal fourth quarter compared with the year-ago period. During the quarter, ResMed’s selling, general and administrative expenses rose 7.4% year over year (up 12% at CER) predominantly on increases in employee-related expenses, professional service fees and travel expenses.

Meanwhile, research and development expenses increased 7.4% (up 11% at CER). These mounting expenses led to an adjusted operating margin contraction of 24 bps year over year to 29.5%, weighing on the company’s bottom line. The persistent supply-chain challenges related to securing sufficient components hamper its ability to meet the growing device demand. The volatility surrounding COVID restrictions across the globe also continue to pose challenges.

ResMed's ability to sell its products largely depends on the extent to which coverage and reimbursement will be available from government health administration authorities, private health insurers and other organizations. These third-party payers are increasingly challenging the prices charged for medical products and services and can deny coverage for treatments that may include the use of its products.

In some markets, such as Spain, France and Germany, government coverage and reimbursement are currently available for the purchase or rental of products but are subject to constraints such as price controls or unit sales limitations. In other markets, such as Australia, there is currently limited or no reimbursement for devices that treat SDB conditions.

Key Picks

A few better-ranked stocks in the broader medical space are AMN Healthcare Services, Inc. AMN, ShockWave Medical, Inc. SWAV and McKesson Corp. MCK.

AMN Healthcare has a long-term earnings growth rate of 3.2%. The company surpassed earnings estimates in the trailing four quarters, delivering a surprise of 15.7%, on average. It currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

AMN Healthcare has outperformed its industry in the past year. AMN has lost 9.7% compared with the industry’s 38.8% fall.

ShockWave Medical, sporting a Zacks Rank #1 at present, has an estimated growth rate of 33.1% for 2023. The company surpassed earnings estimates in all the trailing four quarters, the average beat being 180.1%.

ShockWave Medical has outperformed its industry in the past year. SWAV has gained 16.3% against the industry’s 35.9% fall in the past year.

McKesson has an estimated long-term growth rate of 9.9%. The company surpassed earnings estimates in the trailing three quarters and missed in one, delivering a surprise of 13%, on average. It currently carries a Zacks Rank #2 (Buy).

McKesson has outperformed its industry in the past year. MCK has surged 71.9% against the industry’s 17.5% fall.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

McKesson Corporation (MCK) : Free Stock Analysis Report

ResMed Inc. (RMD) : Free Stock Analysis Report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

ShockWave Medical, Inc. (SWAV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance