Residential outlook for 2018

Most property consultants are expecting new-home sales to ring in at roughly 11,000 units for 2017. This is a 38% increase from the 7,972 units registered in 2016, says Tricia Song, Colliers International head of research for Singapore.

This year, 18 private residential projects with an estimated 6,000 units were launched for sale, says Ong Teck Hui, JLL national director of research. He foresees about 20 projects being launched next year, yielding 8,000 to 9,000 units. Ong’s forecast for new home sales in 2018 is 11,000 to 12,000 units.

The last major launch of 2017 was Parc Botannia. Analysts expect the year to end with 11,000 new homes sold. (Credit: Sing Holdings)

Colliers’ Song forecasts that new-home sales in 2018 will hit 12,600 units. “We expect new-home sales to remain healthy next year amid the more positive economic outlook, rising market confidence and pent-up demand,” she says. Given the spate of collective sales since 2016, Song expects a “bumper crop of new launches” in late 2018 to 2019.

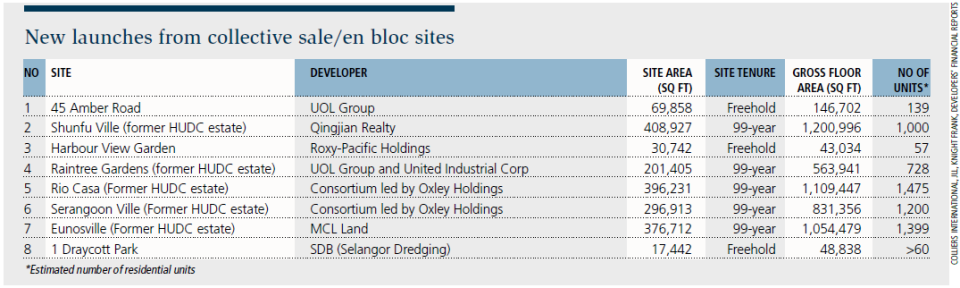

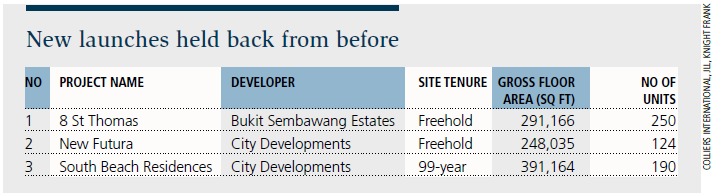

Taking into account both collective sale sites and land sold via public tenders, including projects waiting on the sidelines such as the New Futura, South Beach Residences and 8 St Thomas, Song estimates there will be 25 new private residential project launches next year, yielding a total of 15,000 to 16,000 new units. Her assumption is that only collective sales transacted before August 2017 will be in time for launch in 2018 (see tables).

Resales to exceed new-home sales

Both Colliers and JLL have similar projections for resale volume: 13,000 to 13,500 units in 2017, a jump of 55% to 71% compared with the range of 7,901 to 8,406 units in 2016. Resales include developers’ sale of balance units in completed projects such as Amber Skye, Gramercy Park, Leedon Residence and Marine Blue.

“The projects launched a few years ago will benefit, as the unsold stock is likely to be compressed further,” notes Desmond Sim, head of research for CBRE Singapore and Southeast Asia.

In a typical year, the transaction volume of new home sales tends to be on a par with that of resales, observes Alan Cheong, head of research for Savills Singapore. The fact that resales far exceed new home sales in 2017 is a reflection of a dearth of new launches as a result of a moderation in the supply of new sites under the government land sales (GLS) programme in recent years, he says.

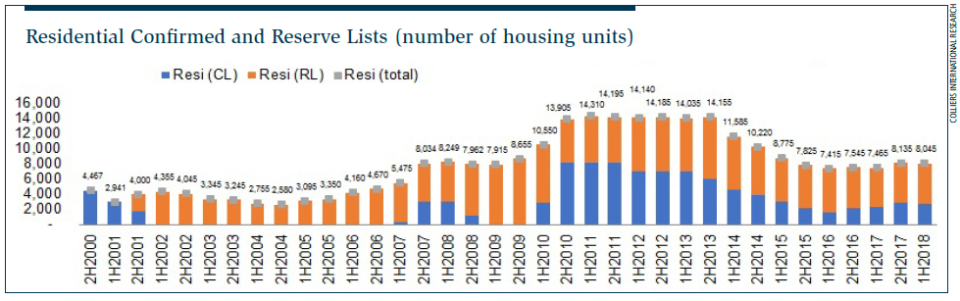

The government releases sites for public tender every six months through the GLS programme, offering sites for sale on both the Confirmed and Reserve Lists. From 2H2010 to 2H2013, the government released 23 to 30 sites with the potential to yield 14,000 to 14,300 housing units. From 2H2015 to 2H2017, the number of new sites released through the GLS programme was reduced to 12 to 15, with the capacity to produce 7,420 to 8,125 units (see charts). The tapering of supply was in reaction to the slowdown in housing demand, owing to the seven rounds of property cooling measures and the impact of the total debt servicing ratio (TDSR) loan framework.

“Developers that purchased sites from 1H2010 to 2H2013 have already launched and sold their projects and received their sales proceeds,” says Savills’ Cheong. With the emergence of new developers and the fewer number of sites released under the GLS programme, Cheong notes that there has been aggressive bidding for land sites and, because fewer GLS sites were launched, some developers turned to collective sale sites as an alternative. This was seen in 2016.

‘Bank of mum and dad’

Even as prices of land are being pushed up, the real test will come when developers launch the projects off-plan, says Cheong. With demand mainly fuelled by domestic buyers, and the TDSR and other property cooling measures still in place, young people will be depending on “the bank of mum and dad” to fund their new-home purchases, he reckons. “But how deep are the reserves of that bank? That remains to be seen.”

Sales momentum is likely to build up in the first three quarters of 2018, Cheong adds. “If the new sale prices are deemed to be high, demand will spill over to the resale market. He therefore foresees resale transactions once again overtaking new-home sales in 2018.

Riding on the sales momentum, Bukit Sembawang is expected to launch 8 St Thomas next year (Credit: Bukit Sembawang Estates)

This year, overall sentiment in the residential market has improved. “Some homebuyers have entered the market out of fear of missing out, while others want to lock in interest rates before they rise further,” notes CBRE’s Sim. The new units that have moved have been those priced reasonably at $2 million, which is still “the sweet spot”, he adds.

Prices projected to increase 8% to 10%

Sim forecasts an 8% to 10% rise next year on a psf basis. He sees higher land prices starting to come into play next year as developers try to keep the majority of units in their new projects at the sweet spot, which means smaller units and higher price psf.

City Developments is expected to launch the 190-unit South Beach Residences next year (Credit: Samuel Isaac Chua/The Edge Singapore)

Tempering the market, the Ministry of National Development noted in its release on Dec 13 that, while demand for sites by property developers is still strong and home transactions have picked up, “there is a large potential supply of around 20,000 units from awarded en bloc sale and GLS sites that have not yet been granted planning approval, on top of the [roughly] 18,000 unsold units that already have planning approval”. In addition, more than 30,000 private housing units remain vacant, according to MND.

This article appeared in EdgeProp Pullout, Issue 811 (Dec 25, 2017).

Related Articles From EdgeProp.sg

Sengkang Central and Hillview sites launched for sale based on concept and price

Collective sale momentum to continue in 2018

URA launches tender for West Coast Vale residential site

Singapore home property prices to rise faster over next 2 years, says Goldman Sachs

Yahoo Finance

Yahoo Finance