Here's how your tax bracket will change in 2018

Jonathan Ernst/Reuters

President Donald Trump signed the Republican tax bill into law at the end of December.

2018 tax brackets have been changed under the new law, and are in effect starting this year.

There are still seven income tax brackets, but the ranges have been adjusted.

The personal exemption has been eliminated, and the standard deduction has been increased.

President Donald Trump signed the Republican tax bill into law at the end of December.

The new legislation makes sweeping changes to the tax code for businesses and, on average, American taxpayers.

The tax bill went into effect on January 1, and applies to income earned this year. However, the new tax brackets will not affect taxes paid on tax day 2018 — which falls on April 17 this year — as Americans file tax returns for income earned in 2017, under the previous income tax brackets and law.

Here's how the new tax plan will change federal income tax brackets in 2018 compared with those in 2017.

First, for single filers:

Skye Gould/Business Insider

10%: $0 to $9,525 of taxable income for an individual

12%: $9,526 to $38,700

22%: $38,701 to $82,500

24%: $82,501 to $157,500

32%: $157,501 to $200,000

35%: $200,001 to $500,000

37%: over $500,001

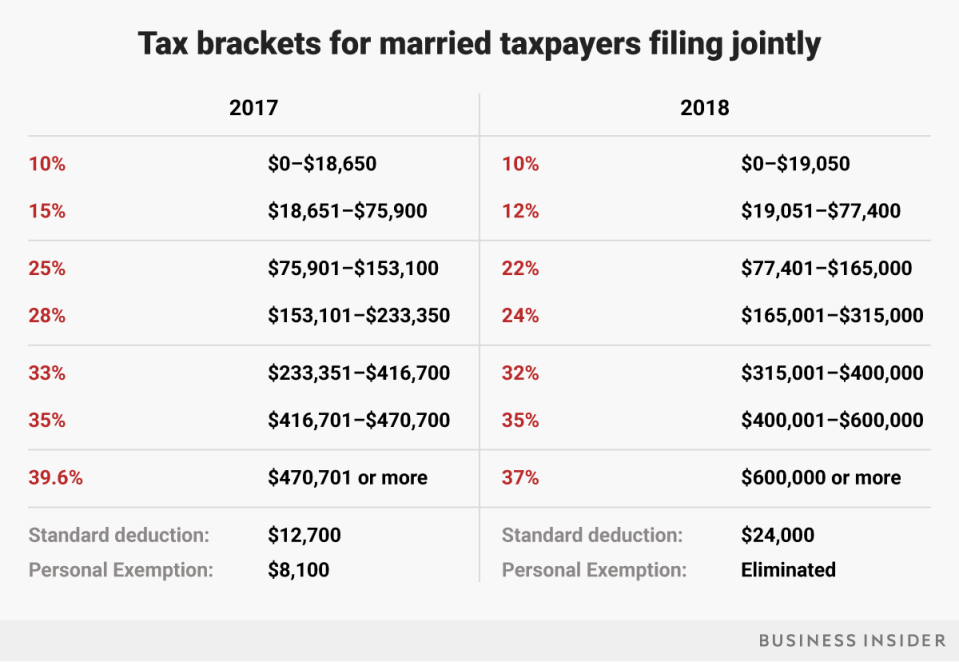

And second, for joint filers:

Skye Gould/Business Insider

10%: $0 to $19,050 for married joint filers

12%: $19,051 to $77,400

22%: $77,401 to $165,000

24%: $165,001 to $315,000

32%: $315,001 to $400,000

35%: $400,001 to $600,000

37%: Over $600,000

There are still seven federal income tax brackets — but at slightly lower rates and adjusted income ranges.

Business Insider also broke down the new 2018 income tax brackets for individual taxpayers who file as head of household or married taxpayers who file separately.

About 70% of Americans claim the standard deduction when filing their taxes, and their paychecks will almost certainly increase — albeit slightly.

In 2017, the standard deduction for a single taxpayer was $6,350, plus one personal exemption of $4,050.

The new law combines those into one larger standard deduction for 2018: $12,000 for single filers and $24,000 for joint filers.

Elena Holodny contributed to an earlier version of this post.

NOW WATCH: Here's what Trump's tax plan means for people at every income level from $20,000 to $269,000 a year

See Also:

Here's a look at what the new income tax brackets mean for every type of taxpayer

The 9 places in the US where Americans don't pay state income taxes

SEE ALSO: Here's a look at what Trump's new income tax brackets mean for every type of taxpayer

DON'T MISS: The IRS begins accepting tax returns Monday — here's what to expect this year

Yahoo Finance

Yahoo Finance