Refinancing Your Home Loan in Singapore – Guide to Saving On Your Mortgage 2018

If your home loan is currently charging you more than 2% interest, you might be paying more than you need to, and should definitely consider refinancing. Refinancing your home loan in Singapore means reducing your monthly repayment amount by switching to a lower interest rate.

This could mean switching to a new loan package within your current bank, or switching bank altogether. Here’s what you should know about refinancing in Singapore:

Contents

1. What is Refinancing?

Refinancing a home loan is an opportunity for homeowners to switch their home loan to another bank for a lower interest rate. This is because typical home loan packages raise their interest rates after three years. This means that if you do not refinance, you would expect to pay much higher rates than you are currently once you hit the 4th year of your loan and thereafter.

This is the best time to see if another bank is offering you a lower interest rate. Refinancing means saving money in the long run. Another reason homeowners in Singapore look into refinancing your current home loan is due to market related forces that affect interest rates. SIBOR and SOR rates, which factor into your monthly payments could be on their way up due to global economic changes and if an increase is predicted, you’ll want to switch to a lower interest rate loan too. The Monetary Authority of Singapore (MAS) and The Association of Banks Singapore (ABS) monitor these SIBOR and SOR rates and make adjustments to inter bank lending rates daily.

Here’s an example of what we mean:

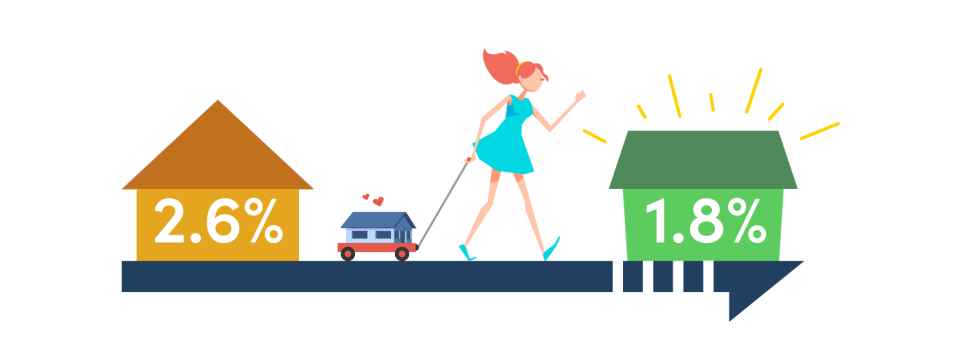

Ms Liana has an outstanding home loan of $300,000 with about 20 years left. Her current interest rate is 2.6%. That means she’s paying about $1,604.36 a month.

For simplicity’s sake, let’s assume a bank is willing to offer her a home loan package of 1.8% for the first 3 years. If she takes it up, she will only need to pay about $1,489.40 a month. That’s a difference of about $115 a month, $1,380 a year and $4,140 after 3 years!

How much can you save by refinancing your home loan?

Current Loan Package | Lower Interest Loan Package | Savings Per Month |

Outstanding Loan of $300,000 | Outstanding Loan of $300, 000 $1,489.40 | Estimated Savings Per Month $115 With a reduction of 0.8% on monthly interest rate. |

But do take note that there are some costs involved in refinancing, such as legal charges and valuation fees. This can set you back by $2,000 to $3,000 depending on your property type. So, while you still save money in the long run, the amount you save may not be as significant as it first appears, which make sure you know all the costs that go into a refinancing package from another bank.

The cost of refinancing also depends on other factors, such as the lock-in period.

2. Lock-in period

While you can technically refinance at any time, you should always wait until your lock-in period is almost over to begin the process. This is because there is a penalty fee charged when you refinance your home loan before your lock-in period ends. The typical fee for this is 1.5% of your outstanding loan amount.

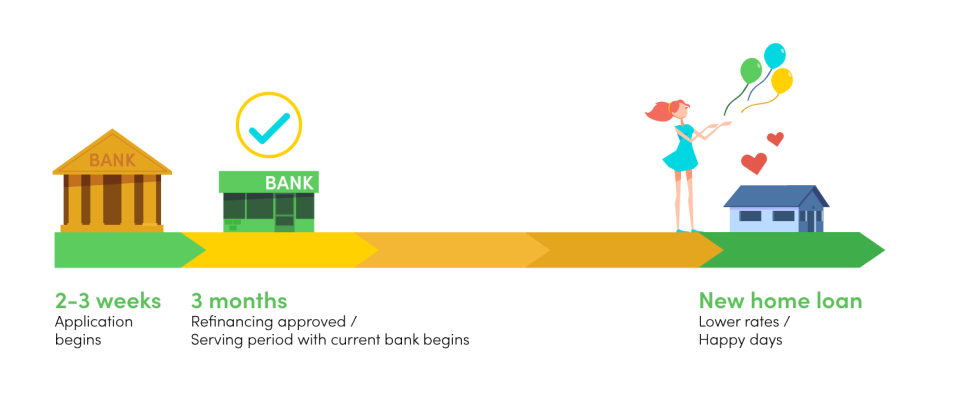

There’s no need to wait until the lock-in period is over before you begin to process of refinancing, though. Newly-signed refinancing contracts are valid for 6 months, so in a rising interest rate environment, you’ll want to obtain a good home loan package as early as possible. You would also need to give at least 3 months’ notice before you can refinance. Here’s how early you should be refinancing in order to make sure you don’t pay a higher interest rate:

You will want to take note of the date on which your current bank will increase your home loan interest rates, and work backwards from there. Based on the timeline above, starting your process of refinancing applications should begin about 4 months or so before the date of the increase. This factors in the 3 month notice period you need to serve with the current bank and also application time with the new bank you wish to move to.

If you’re lucky, the home loan package you’re on has no lock-in period. This can happen if you signed your home loan during a price war between the banks. Typically, a lock-in period is 2 or 3 years.

MoneySmart’s Refinancing Calculator helps you to view all the home loan packages offered by banks in Singapore, so that you can see how much the interest rate charges will be and decide if it is worth your time to refinance your home loan.

3. What is the cost of refinancing?

We have already mentioned the various costs of refinancing – legal fees, valuation fees, prepayment penalties during the lock-in period.

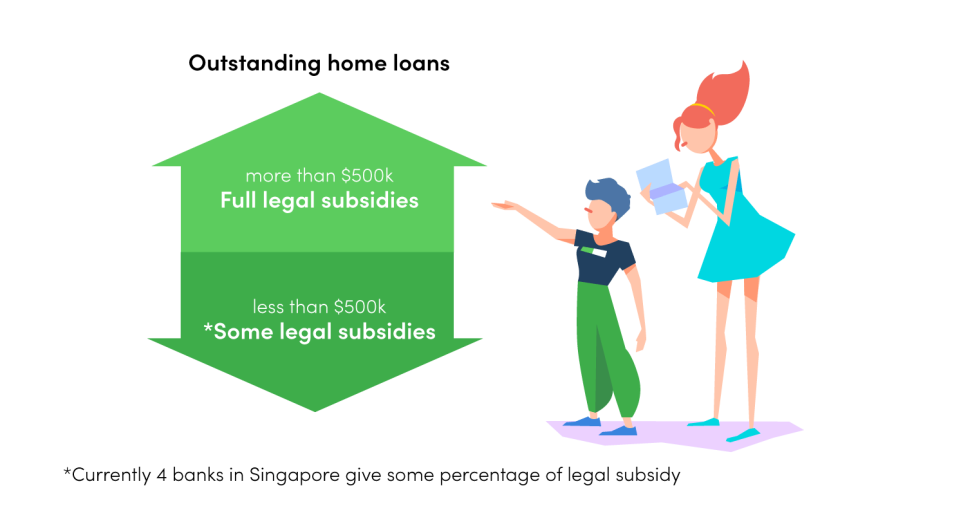

However, some of these costs can be subsidised by the bank under some circumstances. For example, if your loan amount is big enough, banks will be willing to defray the legal fees with subsidies.

Do think carefully about taking on such legal subsidies as they will often come with terms and conditions – which means more costs. If you take the legal subsidies and then try to refinance over the next 3 years, the bank might have the right to clawback the amount. The terms and conditions will state what is the duration of the Clawback period, which is the time you need to stay with the bank before you can refinance to another bank without a penalty fee. It is called a Clawback period as if you don’t fulfil this, they will “clawback” the freebies they gave you.

One other cost of refinancing is known as the cancellation fee. This is incurred if you refinance a home loan package when the property is still uncompleted. For buildings under construction, the home loan amount is disbursed in stages. The cancellation fee amount is between 0.75% to 1.5% of the loan amount that hasn’t been disbursed yet.

4. Repricing vs refinancing

Repricing a home loan is similar to refinancing except that you stay with the same bank and switch to a new loan package that they offer you. Repricing does not require legal fees and a new valuation of the property does not need to be conducted. However, it is not necessarily cheaper than refinancing especially when you sign up for loans that come with legal fee subsidies.

With subsidies – Refinancing to a different bank may cost $300 – $500, or nothing at all

Repricing administrative fees amount to $500 to $800

The time it takes to reprice is shorter compared to refinancing, which means you can switch to a lower interest rate package sooner.

When it comes to home loans, banks will always try harder to get new customers than retain existing customers. You are more likely to find a more competitive interest rate when you refinance than when you reprice.

A savvy homeowner will want to find out what the refinancing options are in the market, and then check back with their bank if they can offer a competitive repricing package.

In most cases, repricing is usually ideal only for homeowners who have a small outstanding loan amount of $200,000 or less, since the cost of refinancing will probably be significant compared to the amount you save.

Ultimately, there is only one factor you should consider when choosing whether to refinance or reprice – cost. Make your decision based on which saves you more over the next two or three years.

Interest rates should be lower than your existing loan

The cost involved in switching to a new bank is less than the amount you save in monthly payments over the course of the loan.

Here’s the easiest way to understand how banks tier their home loan rates:

Loans amounts above $500,000 (Usually comes with full legal fee subsidies)

Loan amounts below $500,000 (4 banks in Singapore give some percentage of legal subsidy)

Best home loan rates for loans above $500,000

Bank | Home Loan Package | Notes |

Standard Chartered (FD-linked) | Year 1: 9M FD + 1.35% Thereafter: 9M FD + 1.35% 9M FD currently @ 0.30% | 2 year lock in 1.5% penalty for full/partial repayment Cancellation fee applies for undisbursed loan Legal subsidy $1,800 Comes with a 3 years legal subsidy clawback period Documents to be submitted by 13 Apr 2018 |

Citibank (SIBOR) | Year 1: 1-mth SIBOR + 0.50% Year 2: 1-mth SIBOR + 0.50% Year 3: 1-mth SIBOR + 0.55% Thereafter: 1-mth SIBOR + 0.90% | 2 years lock in 1.5% penalty for full/partial repayment Savings account will earn interest of 50% of housing loan rates to offset home loan interest Legal subsidy 0.20% capped at $2,500 |

BOC (Fixed) | Year 1: 1.75% Fixed Year 2: 1.75% Fixed Year 3 & thereafter: 3-mth SIBOR + 0.70% | 2-year lock-in 1.75% penalty on full/partial redemption during lock in Legal subsidy $1,800 Legal subsidy clawback 3 years |

Best home loan rates for loans below $500,000 that come with legal subsidy

Bank | Home Loan Package | Notes |

OCBC (OHR) | Year 1: OHR + 0.65% Year 2: OHR + 0.65% Year 3: OHR + 0.75% Year 4: OHR + 0.80% Year 5 & thereafter: OHR + 0.90% | 2 year lock in 1.5% penalty for full/partial repayment 1 time free conversion in the event OHR increases Legal subsidy 0.40% of loan amount capped at $2,000 for private property For HDB, legal subsidy of $1,800 for loan amount above $300,000 Comes with a 3 years legal subsidy clawback period |

Citibank (SIBOR) | Year 1: 1-mth SIBOR + 0.50% Year 2: 1-mth SIBOR + 0.50% Year 3: 1-mth SIBOR + 0.55% Thereafter: 1-mth SIBOR + 1.10% | 2 years lock in 1.5% penalty for full/partial repayment Savings account will earn interest of 50% of housing loan rates to offset home loan interest Legal subsidy 0.20% capped at $2500 Comes with a 3 years legal subsidy clawback period |

UOB (Fixed) | Year 1: 1.70% Year 2: 1.80% Year 3 & thereafter: 14M FD + 1.60% 14M FD currently @ 0.25% | 2 years lock in 1.5% penalty for full/partial repayment Legal subsidy 0.40% of loan amount capped at $1,800 for private property & $1,500 for HDB Legal subsidy clawback of 3 years |

Assessing whether you should or should not apply for refinancing of your home loan in Singapore comes with several factors to consider. Contacting a

Mortgage Specialist at MoneySmart for a free consultation can also help you make sense of it all.

The post Refinancing Your Home Loan in Singapore - Guide to Saving On Your Mortgage 2018 appeared first on the MoneySmart blog.

MoneySmart.sg helps you maximize your money. Like us on Facebook to keep up to date with our latest news and articles.

Compare and shop for the best deals on Loans, Insurance and Credit Cards on our site now!

More From MoneySmart

Yahoo Finance

Yahoo Finance