Red Rock (RRR) Q4 Earnings Beat Estimates, Revenues Miss

Red Rock Resorts, Inc. RRR reported mixed fourth-quarter 2019 financial numbers, wherein earnings surpassed the Zacks Consensus Estimate but revenues missed the same. The bottom line surpassed the consensus mark for the second straight quarter, while revenues missed the same for second consecutive quarter.

Th company reported adjusted earnings of 18 cents per share, which beat the Zacks Consensus Estimate of 11 cents. However, the reported figure declined from the year-ago quarter’s earnings of 30 cents by 40%.

Revenues during the quarter totaled $460.8 million, which missed the consensus mark of $463 million. However, the top line improved 6.8% year over year. The uptick can primarily be attributed to a year-over-year rise in Las Vegas operations.

Casino revenues in the quarter amounted to $255.8 million, up 6.2% year over year. Food and beverage revenues increased 9.8% year over year to $110.8 million. Other revenues declined 3.4% on a year-over-year basis to $26.1 million. Room revenues increased 10.9% year over year to $46.8 million. Management fees revenues rose 3.9% to $21.3 million.

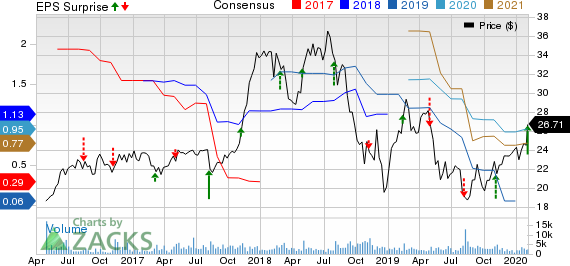

Red Rock Resorts, Inc. Price, Consensus and EPS Surprise

Red Rock Resorts, Inc. price-consensus-eps-surprise-chart | Red Rock Resorts, Inc. Quote

Segmental Details

Las Vegas Operations: Revenues in this segment totaled $437.9 million, up 6.9% year over year. This uptick can be attributed to higher revenues from the Palms Casino Resort. However, Adjusted EBITDA increased to $125.5 million by 3.7% on a year-over-year basis. The segment’s adjusted EBITDA margin contracted 89 basis points to 28.6%.

Native American Management: Revenues in the segment increased 3.9% to $21.2 million. Meanwhile, adjusted EBITDA increased to $19.9 million from $19.1 million owing to rise in management fees generated under the Graton Resort management agreement.

Other Financial Details

As of Dec 31, 2019, Red Rock had cash and cash equivalent of $128.8 million. Outstanding debt at the end of the reported quarter was $3.076 billion. The company declared a quarterly cash dividend of 10 cents payable on Mar 27, 2020 to shareholders of record as of Mar 13, 2020.

Zacks Rank & Other Key Picks

Currently, Red Rock, which shares space with Boyd Gaming Corporation BYD, carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other stocks, which warrant a look in the same space include Churchill Downs Incorporated CHDN and Caesars Entertainment Corporation CZR. Both the stocks carry the same rank as Red Rock.

Churchill Downs and Caesars Entertainment has an impressive long-term earnings growth rate of 20% and 10%, respectively.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Caesars Entertainment Corporation (CZR) : Free Stock Analysis Report

Churchill Downs, Incorporated (CHDN) : Free Stock Analysis Report

Red Rock Resorts, Inc. (RRR) : Free Stock Analysis Report

Boyd Gaming Corporation (BYD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance