Recent Lows A Chance To Snap KREIT? Maybe Not…

Keppel REIT (KREIT) recently experienced a major selldown as it fell from a 52 week high of 1.63 in May 2013 to about $1.20. To some, it may represent some value for investing.

KREIT still has a worrying amount of debt that is due for refinancing in 2015 and 2016. This sits right smack in the middle of possible interest rate hikes in the US.

The potential purchase of MBFC Tower 3 from its sponsor could mean that KREIT will need to tap on financing again. Neither debt nor equity financing appears to be a positive for the trust.

The share price performance of Keppel REIT (KREIT) has been worrying in recent months. The price of the trust fell from the 52 weeks high of $1.63 in May last year to $1.20 (as at closing of 21/4/2014). This marks a 26.4 percent loss in value for KREIT within a year.

Last week, KREIT announced its first quarter results for FY2014 which have attracted attention from analysts. Market watchers were eager to find out if the drop in prices has brought value to the trust.

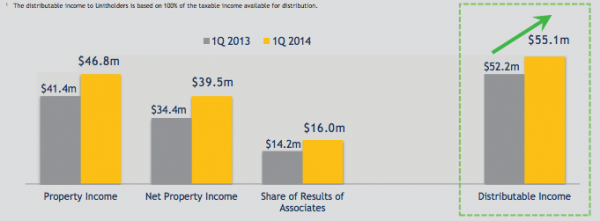

Net property income for 1Q14 increased by 14.7 percent to $39.5 million (1Q13: $34.4 million). This led to a higher distributable income of $55.1 million which is 5.5 percent higher than a year ago.

However, the distribution per unit (DPU) of KREIT remains at $0.0197 as the share capital was enlarged due to several placements of shares last year.

Based on the closing price of $1.20, the distribution yield stands at 6.6 percent which is significantly higher than the 5.9 percent distributed for 1Q13. KREIT began trading on “Ex” basis on 21 April while the distribution is expected to be paid on 28 May.

Source: Financial Performance, Keppel REIT, 1Q14 Presentation

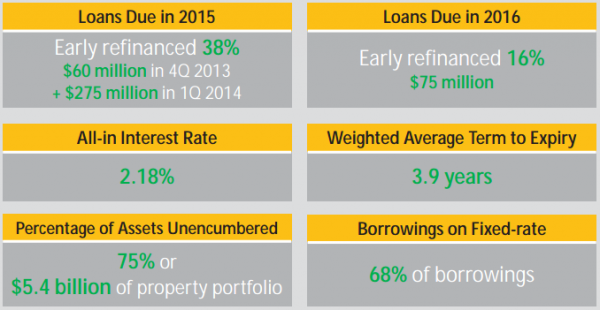

In capital management, KREIT made some progress in comparison with the previous quarter. The average maturity of its debt was increased from 3.6 years to 3.9 years due to early refinancing of loans due in 2015 and 2016. Cost of debts for the trust is low as the all-in interest rate for KREIT stands at 2.18 percent.

Despite these efforts, the debt profile of KREIT is still worrying as a high amount of debt is due for refinancing in 2016. Interest rates are expected to rise by 2015 based on the indications from the US Federal Reserve.

Yield of the trust will likely face compression as 32 percent of its borrowings are based on floating rates (that is, the interest rates on these debt facilities will increase if and when the Fed increases its benchmarks).

At the same time, KREIT will have to issue new debts to meet its obligations and will be affected by the rising interest rates. A “safety net” will also be removed as the income support (minimum 5.2% yield) from its sponsor (Keppel Land) expires this year.

Occupancy of the REIT remains high with its Singapore property being fully committed while the overall occupancy stands at 99.8 percent. Upward rental reversion of the Singapore properties is expected for the leases that are expiring this year.

However, there is a possible lower contribution from the Australian properties due to a weaker Australian Dollar.

KREIT may reshuffle its portfolio by selling Prudential Tower as a way to fund its purchase of MBFC Tower 3 from its sponsor. Market watchers expect the purchase of the property to be a catalyst to the trust.

However, we worry that KREIT may raise additional funds through placement of new shares to fund the hefty acquisition as it will result in further dilution of current shareholdings (as seen in the past year).

Investors are reminded to consider carefully even at the current low price as the outlook for KREIT remains mixed. Analysts from various research houses hold the same view as they unanimously gave the REIT “Hold” calls.

More From Shares Investment:

Yahoo Finance

Yahoo Finance