Reasons to Retain ExlService (EXLS) Stock in Your Portfolio

ExlService Holdings, Inc. EXLS had an impressive run over the past year. The stock has gained 17.6% against the 2.6% decline of the industry it belongs to.

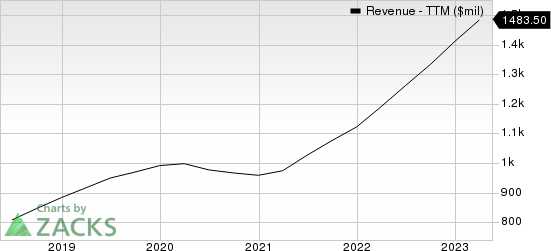

ExlService’s earnings for 2023 and 2024 are expected to increase 14% and 14.1%, respectively. Revenues are anticipated to grow 14.5% and 12.4%, respectively, in 2023 and 2024.

Factors That Augur Well

EXLS has a large addressable market that includes healthcare, banking, insurance, retail, media and technology industries. It remains focused on expanding its presence in both well-established and emerging markets, building its client portfolio in finance and accounting, and consulting services across all its business segments.

ExlService Holdings, Inc. Revenue (TTM)

ExlService Holdings, Inc. revenue-ttm | ExlService Holdings, Inc. Quote

The company continues to maintain long-term relationships with existing clients and attract new ones through its BPaaS and digital offerings. It focuses on increasing the depth and breadth of its services across clients’ value chains and geographies. This, in turn, is helping the company strengthen its presence in spaces characterized by complex and diverse data-led processes.

ExlServicehas a consistent record of share repurchases. It repurchased shares worth $68.5 million, $115.6 million and $77.8 million in 2022, 2021 and 2020, respectively. Such moves help instill investors’ confidence in the stock and positively impact earnings per share.

Some Risk

EXLS’current ratio (a measure of liquidity) at the end of the first quarter of 2023 was 2.02, lower than the prior quarter’s current ratio of 2.21 and the year-ago quarter’s 2.58. A decline in the current ratio is not desirable as it indicates that the company may have problems meeting its short-term debt obligations.

Zacks Rank and Stocks to Consider

ExlService currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader Zacks Business Services sector that investors can consider are Booz Allen Hamilton BAH and Omnicom OMC.

Booz Allen has an expected long-term earnings per share (three to five years) growth rate of 8.9%.

BAH has a trailing four-quarter earnings surprise of 8.7%, on average. BAH carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Omnicom has an expected earnings growth rate of 6.5% for the current year. OMC has a trailing four-quarter earnings surprise of 9.1%, on average.

OMC has a long-term earnings growth of 4.7% and carries a Zacks Rank #2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Omnicom Group Inc. (OMC) : Free Stock Analysis Report

ExlService Holdings, Inc. (EXLS) : Free Stock Analysis Report

Booz Allen Hamilton Holding Corporation (BAH) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance